Diminished Value of Georgia

Car Appraisals for Insurance Claims

Looks the same. Worth less. Diminished Value!

Are you curious about your vehicle's loss in value after a car wreck?

Complete the form below, and our licensed appraiser will assess the damages and provide a free, no-obligation diminished value quote.

"*" indicates required fields

Diminished Value of Georgia is Atlanta’s #1 Car Appraisal Company

We Offer Insurance Valuations for Diminished Value & Total Loss Claims.

What is Diminished Value?

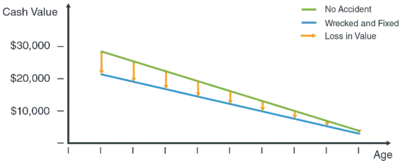

Diminished Value refers to the reduction in a vehicle's resale value following an accident or incident (such as a collision, fire, flood, or hail). While vehicles naturally depreciate over time, accidents can significantly accelerate this depreciation, leading to an immediate drop in market value.

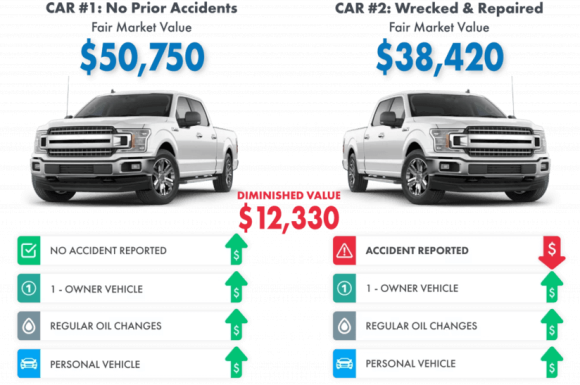

Diminished Value Calculator Case Study

Market data suggests that a vehicle with a prior accident history will bring a much lower cash value at resale. Below is a case study on the effects of collision damage on a vehicle’s price.

Vehicle Information:

- Vehicle: Three-year-old, Honda Accord

- Damage Type: Collision with another vehicle

- Repair Amount: $7,900 (parts and labor)

- Severity: Major rear-end damage, structural repairs performed

- Pre-Accident Cash Value: $18,640

- Post-Repair Cash Value: $14,720

- Loss In Value Amount: $18,640 – $14,720 = $3,920

- The amount owed by the Insurance Company: $3,920

How Does Diminished Value Affect You?

If you are trying to sell your wrecked and repaired vehicle, the buyer will likely refuse to pay the same money for it as they would for an accident-free car, so you are likely to sell it at a discount. In other words, you just lost some money or equity you may have had in your vehicle.

Insurance companies are typically required to reimburse for the reduction in value after repairs, this loss in value is owed in CASH to you, the vehicle owner after the repairs are completed.

In Georgia, insurance carriers are also required to pay their insureds for the loss in value; in other words, if the accident was your fault (collision or comprehensive), you can also get paid for the loss in value suffered due to your negligence. There is no premium penalty associated with requesting diminished value, so if the accident is your fault, you should request proper compensation as this loss will be accrued when you try to sell your car.

How to Recover Your Lost Money?

Insurance companies often undervalue diminished value claims—that's where we step in to assist. Many clients reach out to us after receiving minimal settlements—often $300 or less—which may represent just 10% of their rightful compensation.

As licensed car appraisers, our job is to accurately quantify your loss in value so you can receive the maximum compensation you are entitled to. Our appraisal reports are based on real-time market data that tracks the drop in resale value and are accepted by all major carriers.

Diminished Value of Georgia Services

Diminished Value of Georgia is a local, trusted car appraisal company serving the greater Atlanta area. We offer a full range of car appraisal services to meet the needs of insurance claimants, car buyers and sellers, and classic auto collectors.

Our licensed professional appraisers are committed to meeting the highest ethical standards. With a combined three decades of auto experience, our appraisal reports are accurate, unbiased, and respected in the automotive and insurance industries. Our services include:

Understanding More About Diminished Value

Accelerated Depreciation & The Law

As personal property that undergoes regular use, automobiles naturally decrease in value over time. Car accidents hasten the rate of this normal depreciation and cause an immediate, measurable loss in value.

According to auction data, even after a repair, a vehicle that has been in a wreck will sell for less than a comparable undamaged auto.

Georgia’s Supreme Court decision (Mabry V State Farm) recognized as a matter of law that a vehicle cannot be completely returned to its pre-accident value because the majority of car shoppers will NOT be interested in purchasing a car that has been through an accident or will demand a hefty discount.

An accurate calculation gives a fair impression of the true value of accelerated depreciation and improves the car owner’s chances of being made whole.

The 17C formula

If you are a driver in Georgia who has been in a car accident, you may have heard of the Mabry V State Farm 17C Formula. This refers to an overly simplistic calculation of diminished value that many insurance companies attempt to use to minimize their payout under an auto insurance policy.

By and large, in calculating payments for a vehicle’s diminished value, insurance companies rely on an unfair and inaccurate formula known as the 17C Formula. This method uses a series of overly simplistic factors and a 10% cap to arrive at an unrealistic calculation of an auto’s lost value. Even the Georgia Insurance Commissioner Directive on the Handling of Diminished Value Claims.

While the 17C Formula has been treated as an industry standard by many in the insurance world, it is unfair and inaccurate. Drivers who have had a car damaged in an accident need a USPAP-compliant appraisal report.

The good news is a car owner can present an alternate reliable appraisal and often increase the amount of the insurance company’s payout for diminished value.

Need an Independent Collision

Repair Estimate?

Not sure if the insurance company's collision estimate is correct? Is the body shop being unreasonable and asking you to sign paperwork before they estimate the repair amount?

Diminished Value of Georgia is an independent and unaffiliated company. We will write the repair estimate from the pictures you've taken for a low price.

Order a Diminished Value Car Appraisal Report

Want to overcome the insurance company’s unfair 17c calculation of diminished value? It is your responsibility to submit to the insurance company a USPAP compliant car appraisal report to quantify your loss.

When you choose Diminished Value of Georgia, our field appraisal report will include:

- Multi-Point vehicle inspection

- Vehicle History Report

- Repair Quality Analysis

- Insurance demand letter tailored to your claim

- Market Analysis of comparable automobiles

- The loss in Value Amount

- Automotive industry guide

- Pre-Accident value

- Repair estimate analysis

- Post-Repair Value

Appraisal Engine Inc appraisers offer a complete and comprehensive diminished value solution.

Hire a Licensed Atlanta Car Appraiser

In Georgia, regardless of fault, you are entitled to recover your vehicle’s loss in resale value. But to overcome the insurance company’s standard low offer, you need a reliable report by a competent auto appraiser. Not all car appraisers are created equal and simply choosing the one who provides the highest estimate may not only cost you credibility that jeopardizes your claim but might also constitute fraud.

For the best results, and the highest payout percentage, always hire a reputable licensed auto appraiser. Insurance carriers know who the legitimate appraisers are; they respect the reports produced by Diminished Value of Georgia. Our appraisers and inspectors have 30+ years of combined auto experience and are committed to ethical and reliable service. We are so intimately familiar with Georgia’s diminished value law that our senior appraiser is approved by the Georgia Bar Association to conduct lawyer continued education training.

When you substantiate your claim with a report from the Diminished Value of Georgia, you increase the likelihood that the insurance company will fairly compensate for your diminished value claim. While we cannot guarantee that insurance carriers will act in good faith, our clients report that 90% of claims are amicably settled after submitting our report to the insurance company.

Join forces with one of Atlanta’s leading licensed car appraisers and find out why so many choose to work with us.

Seven things to look for when choosing an appraisal company

What Do Our Customers Say?

See what our satisfied clients say about our exceptional service and accurate estimates.

Any Questions? Contact Us

You are not alone. Most of our clients are hesitant to trust the insurance carrier and usually want a second opinion.

Please fill out the form, and our licensed appraiser will review your damages and provide you with a free, no-obligation Diminished Value quote. Our team will guide you through the entire process and explain what compensation you are entitled to.

- Main Office | (678) 404-0455

- Whatsapp | (678) 666-2575

- Fax | (678) 868-1832

Get a Free Claim Review

Wondering how much your vehicle lost in Value? Click the button to know more.

Diminished Value of Georgia

1372 Peachtree St NE, Ste S10

Atlanta, GA 30309

Call or Text: (678) 404-0455

Fax: (678) 868-1832

Email: info@diminishedvalueofgeorgia.com

Hours: Monday thru Friday 9:00am to 4:00pm

Directions: Map

Connect: Facebook | Twitter | Google Maps | LinkedIn | YouTube | Pinterest

Privacy Policy | Terms of Use

About us

Diminished Value of Georgia is powered by Appraisal Engine Inc™ | All Rights Reserved.