17c Formula. Unfair for Diminished Value Calculations.

If you are a driver in Georgia who has been in a car accident, you may have heard of the Mabry V State Farm 17C Formula. This refers to an overly simplistic calculation of diminished value that many insurance companies attempt to use to minimize their payout under an auto insurance policy.

Diminished value is the market value lost even if repairs are properly completed.

For example, if a vehicle with a resale value of $40,000 sustains $15,000 worth of damage and is fully repaired, the resale value will be less than $40,000 because a customer will prefer a vehicle that has not been involved in an accident over one that has. The drop in market price constitutes diminished value.

While the 17C Formula has been treated as an industry standard by many in the insurance world, it is unfair and inaccurate. Drivers who have had a car damaged in an accident need a USPAP-compliant appraisal report.

The 17C Formula is unfair and inaccurate

The 17c Formula took hold as the result of a 2001 Georgia Supreme Court decision, State Farm Mutual Automobile Insurance Company v. Mabry. The case involved more than 25,000 class action claimants seeking insurance payment for the value of the vehicle that was lost even after repair. The Mabry Court found that the insurance company was required, under the insurance policies’ terms, to pay the claimants for the diminished value.

Because the Mabry lawsuit involved tens of thousands of claims, the Superior Court of Muscogee County, in a 2002 order, used simplistic formula with a 10% cap as a generic estimate of lost value.

The class action in Mabry was a special situation and even the Georgia insurance commissioner has instructed insurance companies not to officially refer to the 17c loss of value as a legal or determinative calculation of diminished value. In actuality, each vehicle is unique and the resale value lost after an accident – even after repairs have been made – is often considerably more than the 10% an insurance company may try to limit you to.

Flaws with 17C calculator

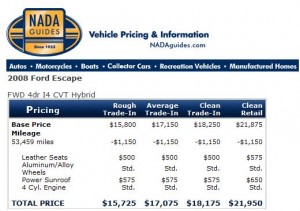

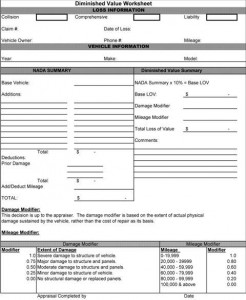

The so-called 17c formula (download the 17c Formula Worksheet in Excel) begins with the pre-accident value of a vehicle often based on the National Automobile Dealers Association’s guide, followed by a series of value adjustments. The formula includes modifiers for the severity of damage and mileage on the vehicle.

Unfortunately, the places where 17c formula components are inaccurate skew the entire calculation dramatically because the elements are compounded – multiplied with the next factor. This exaggerates the effect of a miscalculation of any of the numbers.

Some of the known inaccuracies with the 17C Formula components include:

Geographical data – The resale prices of vehicles vary considerably based on location but the NADA guidelines are not a reliable predictor of the variations

- Arbitrary base loss of value – The starting assumed lost value is 10% but this value is not grounded on any facts and does not take into account the rates at which different types of vehicles lose value

- Simplistic damage modifier – A generic formula intended to account for amount of damage to the vehicle is based on structural damage, leading to underestimate of the loss in value

- Redundant mileage modifier – The base retail value already accounts for the mileage on the vehicle so including it again as a separate multiplier typically artificially lowers the lost value and eliminates any recovery for diminished value for a vehicle with more than 100,000 miles

There are valid ways to calculate the diminished value of a vehicle after an accident and repair but the 17c loss of value formula is riddled with unfair inaccuracies.

17C worksheet and other 17C formula names

As the 17 c formula has been widely adopted, it has come to be known under a number of names including:

The Diminished Value 17c Worksheet (sample 17c Formula worksheet download)

- “Evaluation Guideline Worksheet” (according to USAA Insurance)

- Insurance Company Worksheet for Loss of Value

- Diminished Value Calculator

- Georgia 17C

- Diminished Value Worksheet

- Loss of Value Worksheet

- Worksheet for Loss of Value

In each case, the calculation roughly uses the same 17C Formula components. For more information, download the 17C formula eBook on Diminished Value Claims.

Working with a third-party appraiser on 17C diminished value claims

The insurance companies will almost always present an offer for diminished value that is based on the company’s 17c estimate and appraisal. But this does not mean the vehicle owner must accept the offer. You can fight insurer bad faith (illegal under OCGA 33-4-6 & OCGA 33-4-7) and obtain fair valuation of your vehicle’s loss by demanding a USPA-compliant appraisal report performed by a third-party appraiser.

Some things to keep in mind when working with a vehicle appraiser include:

- Choose an appraiser who is respected by insurance carriers rather than one who has been singled out for fraud or incompetence

- Be sure to receive an in-person inspection by a licensed appraiser with a valid business license

- Be leery if their appraisal is based on a percentage formula

- Select an appraiser who has the experience to be credible in a court of law

- Always ask to be sure that they comply with USPAP reporting standards

- Be on the lookout for illegal practices like an appraiser who works on contingency or artificially inflates or decreases the estimate of value to make the client happy

As strong third-party appraisal can overcome the insurance company’s 17c evaluation and analysis, giving you firm footing to recover the true value of your claim. Why hire us.

Related Article: Read why selecting the right appraiser is critical to your claim.

Be prepared with an alternative to 17c estimate

Obtaining a third-party estimate will help you negotiate your 17c diminished value claims. The key is to be armed with a fair estimate from a reputable and ethical appraiser. A professionally-prepared evaluation that explains its methodology in arriving at the vehicle’s resale value immediately before and immediately after the accident can net you a much fairer diminished value settlement.

Additional 17c Formula Resources & Related Articles

17c Formula Resources & Related Articles

| Safeco Insurance Using the 17c Formula | https://diminishedvalueofgeorgia.com/safeco-insurance-using-17c-formula/ |

|---|---|

| USAA's 17c Evaluation Guideline | https://diminishedvalueofgeorgia.com/auto-loss-appraisal-info-center/usaa-17c-evaluation-guideline-worksheet/ |

| State Farm's 17c Games | https://diminishedvalueofgeorgia.com/state-farms-17c-game/ |

| 17c Formula Excel Sheet | https://diminishedvalueofgeorgia.com/17c-formula-calculator-excel/ |

| 17C Formula Article | https://diminishedvalueofgeorgia.com/17c-formula-and-why-its-not-fair/ |

| State Farm 17c Offer Letter | https://diminishedvalueofgeorgia.com/state-farm-17c-offer-letter/ |

| 17c Worksheet | https://diminishedvalueofgeorgia.com/wp-content/uploads/2010/06/diminished_value_17c_Worksheet.pdf |

| The bottom line is this: 17c is wrong and unfair. Diminished value can ONLY be obtained with an appraisal based on current market data, a detailed analysis, a physical inspection or assessment NOT by using an arbitrary formula written by an insurance executive! | |

This article was written by Tony Rached, commercial reproduction is prohibited without the author’s consent.

Want to learn more about the 17c formula? Download the 17C formula eBook on Diminished Value Claims

Please fill out the questionnaire below to find out what your loss in value should be!

"*" indicates required fields

Geographical data – The resale prices of vehicles vary considerably based on location but the NADA guidelines are not a reliable predictor of the variations

Geographical data – The resale prices of vehicles vary considerably based on location but the NADA guidelines are not a reliable predictor of the variations The Diminished Value 17c Worksheet (sample 17c Formula worksheet download)

The Diminished Value 17c Worksheet (sample 17c Formula worksheet download)