Diminished Value Calculator: Your Key to Post-Accident Compensation (PDF)

In this article, we are going to guide you through the process of Diminished Value. Its definition and types, the conditions to submit a claim, the unfairness of insurance companies, and a great tool to help you get the right compensation: The Diminished Value Calculator.

Table of Contents

Unlike real estate, vehicles lose their market value from the moment you purchase them, and they keep going down with time. It only gets worse when an accident happens, despite all the repairs that the car received.

This briefly introduces Diminished Value, but one must consider many factors when calculating it. To help you be more confident and make the best decision, we bring the Diminished Value Calculator and the process of evaluating your vehicle’s worth in this article.

How to Calculate Diminished Value

Insurance companies usually use the 17c Formula to calculate diminished value. However, insurance providers use this formula to lower offers without the claimers noticing it. That’s why the experts at Diminished Value of Georgia developed a different and more reliable formula, to get the best deal for our clients.

Our formula follows all USPAP criteria and norms. Before filing a claim, it is crucial to determine if you qualify for Diminished Value.

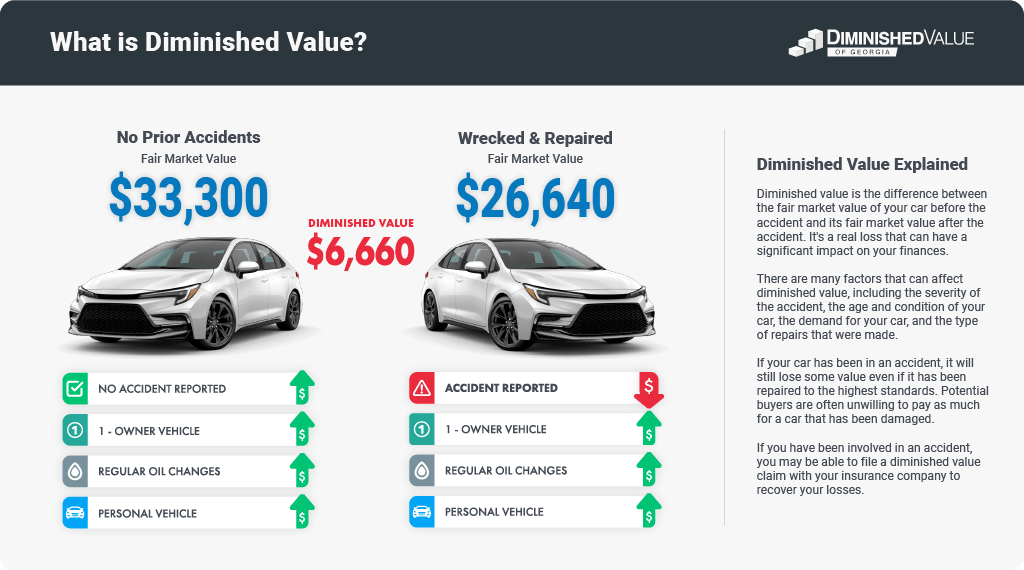

Diminished Value by definition is the loss in resale value a vehicle suffers after an accident.

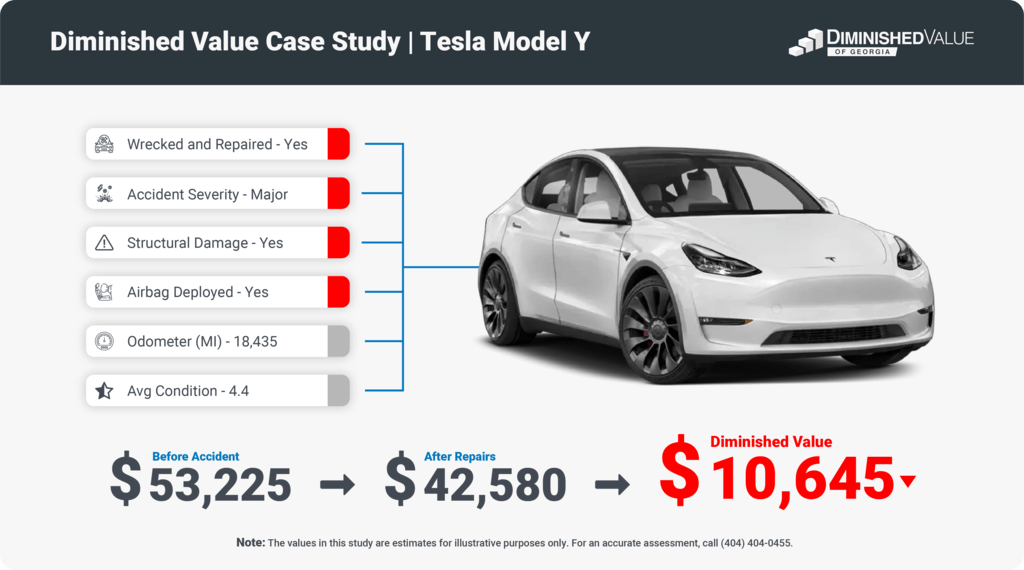

When examining loss in value, we consider three major components:

- Overall Vehicle Value which includes:

- Actual Cash Value

- Mileage

- Vehicle type (4 door, 2 door, minivan pickup truck etc..)

- Class of Vehicle (entry level, upscale, luxury etc.…)

- Vehicle desirability index

- Damage location, type and severity, we check for:

- Structural Damage

- Airbag Deployment

- Damage to Value Ratio

- Parts Ratio

- Vehicle History Report, we’re looking for:

- The Number of owners

- Previous Accidents

- Personal use or commercial

Potential Setbacks to Qualifying

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- The vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- The vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

If your case fits the Diminished Value process, the next thing to do is request a Free Quote to calculate your diminished value. Even though you can’t use the free quote to file a DM claim, it will give you knowledge of the actual value of your vehicle.

What Is Diminished Value?

Diminished Value or Loss in Value is defined as the reduction in the resale value of an automobile caused by a car accident (collision) or an incident (fire, flood, hail). In general, automobiles are depreciating assets, however, an accident will accelerate this depreciation and will cause an immediate and instant drop in market value.

A person may file a Diminished Value Claim, according to each situation, which will lead to the driver at fault’s insurance company paying for the loss of value.

It’s important to note that there are different types of diminished value and the claim must be according to its due category.

Categories

- Inherent Diminished Value: This represents the depreciation in the worth of your vehicle due to its prior involvement in an accident. Even if it undergoes extensive repairs, the vehicle’s historical record will still indicate its accident history, leading to a decrease in its market value. Consequently, claims for inherent diminished value are the most frequently submitted and acknowledged type of diminished value claims.

- Immediate Diminished Value: Immediate diminished value pertains to your vehicle’s value right after an accident, before making any repairs. While the legal system may reference this concept, insurance companies seldom employ it since the majority of vehicles are typically repaired following an accident. Moreover, depending on the specifics of the accident, your insurance provider might cover the cost of repairs.

- Repair-Related Diminished Value: Repair-related diminished value centers on the concern that your vehicle may not return to its original state after repairs. This issue often arises when aftermarket components are used instead of genuine or original equipment manufacturer (OEM) parts, or when subpar repair work diminishes your vehicle’s overall value. The utilization of OEM parts and high-quality repairs is instrumental in mitigating repair-related diminished value.

17c Formula: Unfair Diminished Value Calculator

The 17C Formula is both unjust and flawed. Its origins trace back to a 2001 Georgia Supreme Court ruling in the case of State Farm Mutual Automobile Insurance Company v. Mabry, involving over 25,000 class action claimants seeking insurance compensation for their vehicles’ diminished value post-repair. The court determined that, according to the insurance policies’ terms, claimants were entitled to payment for this diminished value.

Due to the sheer volume of claims in the Mabry case, the Superior Court of Muscogee County issued a simplistic formula with a 10% cap in 2002 as a rough estimate of the lost value, making it a generic calculation.

However, it’s important to note that the 17c loss of value is not considered a legal or determinative diminished value calculator by the Georgia insurance commissioner. In reality, each vehicle’s post-accident resale value loss, even after repairs, often exceeds the 10% limit that insurance companies attempt to enforce.

The 17C Formula, which you can download as an Excel worksheet, begins with the pre-accident vehicle value, often based on the National Automobile Dealers Association’s guide. It then incorporates various adjustments, including factors like damage severity and mileage.

Negative Impacts of the 17c Formula

Regrettably, inaccuracies in the 17C Formula’s components significantly impact the overall calculation because these elements are too complex, magnifying the effects of any miscalculations. Some notable inaccuracies include:

- Geographical data: The resale prices of vehicles vary greatly by location, but the NADA guidelines do not reliably predict these variations.

- Arbitrary base loss of value: The assumed starting loss value of 10% lacks a factual basis and does not consider the varying depreciation rates of different vehicle types.

- Simplistic damage modifier: This generic formula for damage does not adequately account for the extent of damage, resulting in underestimated loss values.

- Redundant mileage modifier: Including mileage as a separate multiplier, when the base retail value already considered it, typically artificially reduces the lost value, especially for vehicles with over 100,000 miles.

There are valid methods for calculating a vehicle’s diminished value after an accident and repair, but the 17C loss of value formula is rife with unfair inaccuracies.

The 17C Formula, widely adopted, goes by various names, including “The Diminished Value 17C Worksheet,” “Evaluation Guideline Worksheet,” “Insurance Company Worksheet for Loss of Value,” “Diminished Value Calculator,” and others. These names are often used interchangeably, and they generally employ the same 17C Formula components.

When dealing with diminished value claims, insurance companies typically offer settlements based on their 17C estimate and appraisal. However, vehicle owners have the option to challenge this offer. They can demand a USPAP-compliant appraisal report performed by an independent appraiser to obtain a fair valuation of their vehicle’s loss.

17c Diminished Value Calculator

Important Considerations Before Hiring an Auto Appraiser:

- Choose a respected appraiser with a good reputation among insurance carriers.

- Ensure an in-person inspection by a licensed appraiser with a valid business license.

- Be cautious of appraisals based solely on a percentage formula.

- Select an appraiser with the experience and credibility to stand up in court.

- Confirm that they adhere to USPAP reporting standards.

- Watch out for unethical practices, such as appraisers working on a contingency or manipulating value estimates.

A strong third-party appraisal can override the insurance company’s 17C evaluation, providing a solid basis to recover the true value of your claim.

Click here to learn more about the 17c Formula and Why it’s Not Fair.

How to File a Diminished Value Claim

Before initiating a diminished value claim, it’s crucial to assess your vehicle’s pre-accident condition and determine liability for the accident. Your claim may face rejection if your vehicle is too old, has high mileage, or has sustained significant structural damage. Additionally, if the accident was your fault, the company might not honor your claim.

As a general rule, it’s typically best to file the claim with the insurer of the at-fault driver. Only resort to filing with your own insurer if the at-fault driver lacks insurance or if you’re a victim of a hit-and-run incident. Remember that your responsibility is to convincingly demonstrate to the insurance company that your vehicle has indeed lost significant value.

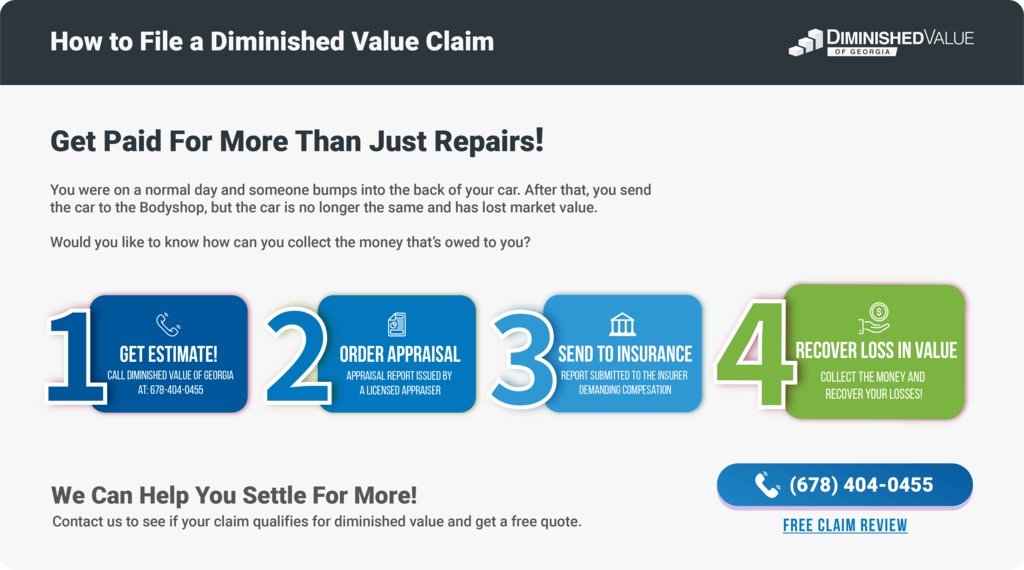

Here are the steps to follow when filing a diminished value claim:

- Contact the insurance company to understand their specific process and requirements for claim submission.

- If your case fits the Diminished Value process, the next thing to do is request a Free Claim Review. Even though the free quote can’t be used to file a DV claim, it will give you knowledge of the actual value of your vehicle.

- Once you receive your estimate, it is necessary to buy an appraisal from a licensed vehicle appraiser, such as Diminished Value of Georgia. This certified document will indicate the car’s actual value based on its condition, history, and current market trends. Learn more.

- The final step is to submit the report to the insurance company and demand compensation.

Diminished Value Calculator FAQ

-

Why choose our diminished value calculator method?

Diminished Value of Georgia is a local, trusted car appraisal company serving the greater Atlanta area. We offer a full range of car appraisal services to meet the needs of insurance claimants, car buyers and sellers, and classic auto collectors.

-

Do I have to pay for a diminished value calculator on your website?

No, you don’t. Our website offers this feature for free.

-

What formula does your diminished value calculator use?

We use our USPAP-compliant method, developed by our Expert Tony Rached, to get the most satisfactory deal.

-

How much can I get?

The average vehicle diminished value settlement is between 10% and 25% of the fair market value of the vehicle. However, the actual amount of a diminished value settlement can vary depending on a number of factors. You can get more information by clicking here.

-

Can I get my own diminished value appraisal report?

Yes. You can hire a licensed appraiser of your choice. The insurance provider must take the independent report into account.

-

Do you provide a 100% Money-Back Guarantee?

Yes, with our diminished value appraisal services, we offer a 100% Money-Back Guarantee. We will gladly refund 100% of the appraisal cost if you use our proven claim process and the insurance company does not pay at least the cost of the appraisal.

-

How long does it take for me to collect my fair settlement?

It all depends on the adjuster handling your claim and the dynamic that exists between both of you, but usually no later than 15 days.

-

My car had an accident before, does it still qualify for Diminished Value?

Yes, you can still file a diminished value claim even if your car had an accident before. However, the amount of compensation you may receive may be reduced.

-

Can the insurance company give me trouble with my claim?

We understand that insurance companies can sometimes be difficult to deal with, especially when it comes to diminished value claims. That’s why we offer our clients continuous guidance and support during the entire claim process, completely free of cost.

Calculate Your Diminished Value Now – Diminished Value Calculator

The process of using the Diminished Value Calculator is simple. We will lead you through an uncomplicated process to gather details about your vehicle and the occurrence. Once you’re finished filling out the form with precise and comprehensive information, our system will generate a quote, putting you on the path to receiving the compensation you rightfully deserve from the at-fault party.

"*" indicates required fields