Are you curious about the vehicles that qualify for Section 179 deductions? The IRS list of vehicles over 6000 lbs holds the key. In this quick guide, we provide a clear and concise breakdown of eligibility, helping businesses maximize tax savings through available deductions.

Get ready to navigate the IRS list and make informed decisions for your heavy-duty business vehicles.

List of Vehicles 6000 lbs or More That Qualify for IRS Tax Benefit in 2024 (PDF)

Table of Contents

- What vehicles qualify for the Section 179 deduction?

- List of vehicles 6,000 pounds or more that qualify for tax incentives in 2023

- What is Section 179 Tax Deduction?

- Is It Possible to Claim a Section 179 Deduction on a Used Vehicle?

- How to Claim the Section 179 Vehicle Tax Deduction

- Vehicle Valuation Experts and the IRS Section 179 Deduction

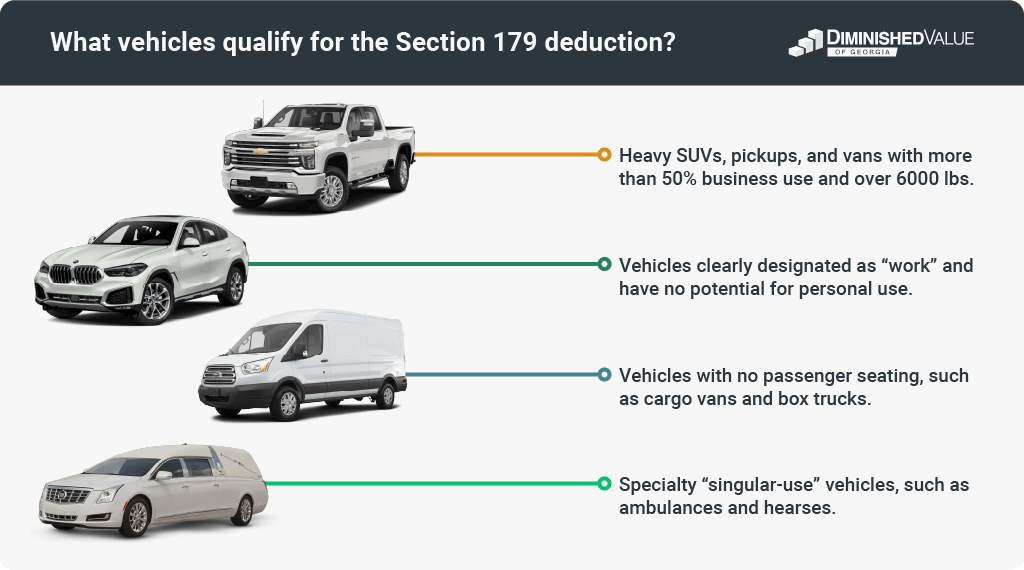

What vehicles qualify for the Section 179 deduction?

Vehicles that qualify for a Section 179 tax write-off include:

- Heavy SUVs, pickups, and vans with more than 50% business use and over 6000 lbs. Gross vehicle weight qualifies for a partial Section 179 deduction plus bonus depreciation.

- Vehicles clearly designated as “work” and have no potential for personal use are typically considered work vehicles.

- Vehicles with no passenger seating, such as cargo vans and box trucks, can qualify.

- Specialty “singular-use” vehicles, such as ambulances and hearses, usually qualify.

Up to $28,900 in 2024 ($27,000 in 2022) of the cost of vehicles rated between 6,000 lbs GVWR and 14,000 lbs, GVWR can be deducted using a section 179 deduction. This limitation on sport utility vehicles does not impact larger commercial vehicles, commuter vans, or buses.

List of vehicles 6,000 pounds or more that qualify for tax incentives in 2024:

| Make | Model | Approx GVW (Lbs) |

|

Audi

| Q7 | 6,900 |

| SQ7 | 6,900 | |

| Q8 | 6,900 | |

| SQ8 | 6,900 | |

|

BMW

| X5 xDrive45e | 7,165 |

| X6 M50i | 6,063 | |

| X7 xDrive40i | 7,143 | |

| X7 M50i | 7,143 | |

| X7 M50d | 7,143 | |

|

Bentley

| Bentayga | 7,275 |

| Bentayga Hybrid | 7,165 | |

| Bentayga Speed | 7,275 | |

| Flying Spur | 6,724 | |

| Flying Spur V8 | 6,724 | |

| Flying Spur W12 | 6,724 | |

| Mulsanne | 6,173 | |

| Mulsanne Speed | 6,173 | |

| Mulsanne Extended | 6,617 | |

|

Buick

| Enclave Avenir AWD | 6,160 |

| Enclave Avenir FWD | 6,055 | |

| Enclave Essence AWD | 6,160 | |

| Enclave Essence FWD | 6,055 | |

|

Cadillac

| Escalade | 7,100 |

| Escalade ESV | 7,300 | |

| Escalade Platinum | 7,100 | |

| Escalade ESV Platinum | 7,300 | |

|

Chevrolet

| Silverado 2500HD | 10,000 |

| Silverado 3500HD | 14,000 | |

| Silverado 4500HD | 16,500 | |

| Silverado 5500HD | 19,500 | |

| Silverado 6500HD | 23,500 | |

| Express Cargo Van 2500 | 8,600 | |

| Express Cargo Van 3500 | 9,900 | |

| Express Passenger Van | 9,600 | |

| Suburban | 7,800 | |

| Tahoe | 7,400 | |

| Traverse | 6,160 | |

| Chrysler | Pacifica | 6,055 |

|

Dodge

| Durango | 6,500 |

| Durango SRT | 6,500 | |

| Durango Citadel | 6,500 | |

| Durango R/T | 6,500 | |

| Durango GT | 6,500 | |

| Durango SXT | 6,500 | |

| Grand Caravan | 6,055 | |

|

Ford

| Expedition | 7,450 |

| Expedition MAX | 7,700 | |

| F-250 Super Duty | 10,000 | |

| F-350 Super Duty | 14,000 | |

| F-450 Super Duty | 16,500 | |

| F-550 Super Duty | 19,500 | |

| Transit Cargo Van T-250 HD | 9,070 | |

| Transit Cargo Van T-350 HD | 10,360 | |

| Transit Passenger Wagon | 10,360 | |

|

GMC

| Sierra 2500HD | 10,000 |

| Sierra 3500HD | 14,000 | |

| Sierra 3500HD Denali | 14,000 | |

| Sierra 4500HD | 16,500 | |

| Sierra 5500HD | 19,500 | |

| Sierra 6500HD | 22,900 | |

| Yukon | 7,300 | |

| Yukon XL | 7,800 | |

| Honda | Odyssey | 6,019 |

| Infiniti | QX80 | 7,385 |

|

Jeep

| Grand Cherokee | 6,500 |

| Grand Cherokee SRT | 6,500 | |

| Grand Cherokee L | 6,500 | |

| Wrangler Unlimited | 6,500 | |

| Gladiator Rubicon | 6,250 | |

|

Land Rover

| Defender 110 | 7,165 |

| Defender 90 | 7,055 | |

| Discovery | 7,165 | |

| Discovery Sport | 6,724 | |

| Range Rover | 7,165 | |

| Range Rover Sport | 7,165 | |

| Range Rover Velar | 6,724 | |

| Range Rover Evoque | 6,724 | |

| Range Rover Evoque R-Dynamic | 6,724 | |

| Lexus | LX 570 | 7,000 |

|

Lincoln

| Aviator | 6,001 |

| Aviator | 6,001 | |

| Navigator | 7,200 | |

|

Mercedes-Benz

| GLS 580 4MATIC | 6,768 |

| GLS 600 4MATIC | 6,768 | |

| G 550 4×4 Squared | 7,057 | |

| GLS 580 4MATIC | 6,768 | |

| GLS 600 4MATIC | 6,768 | |

| AMG G 63 4MATIC SUV | 6,724 | |

|

Nissan

| Armada 2WD/4WD | 7,300 |

| NV 1500 S V6 | 8,550 | |

| NVP 3500 S V6 | 9,100 | |

| Titan 2WD S | 7,300 | |

|

Porsche

| Cayenne Turbo Coupe | 6,173 |

| Cayenne Turbo S E-Hybrid Coupe | 6,173 | |

| Cayenne Turbo S E-Hybrid | 6,173 | |

| Panamera Turbo S E-Hybrid | 6,244 | |

| Tesla | Model X | 6,000 |

|

Toyota

| Tundra 2WD/4WD | 6,800 |

| 4Runner 2WD/4WD LTD | 6,300 | |

| Tundra 2WD/4WD | 6,800 |

What is Section 179 Tax Deduction?

Businesses can claim the full equipment purchase price (software, machinery, etc.) rather than depreciating it over time using the 179 tax deduction.

If you claim the deduction the year you purchase and put the equipment to use, your taxable income will be reduced by the amount you spent, which means you’ll have a lower tax liability.

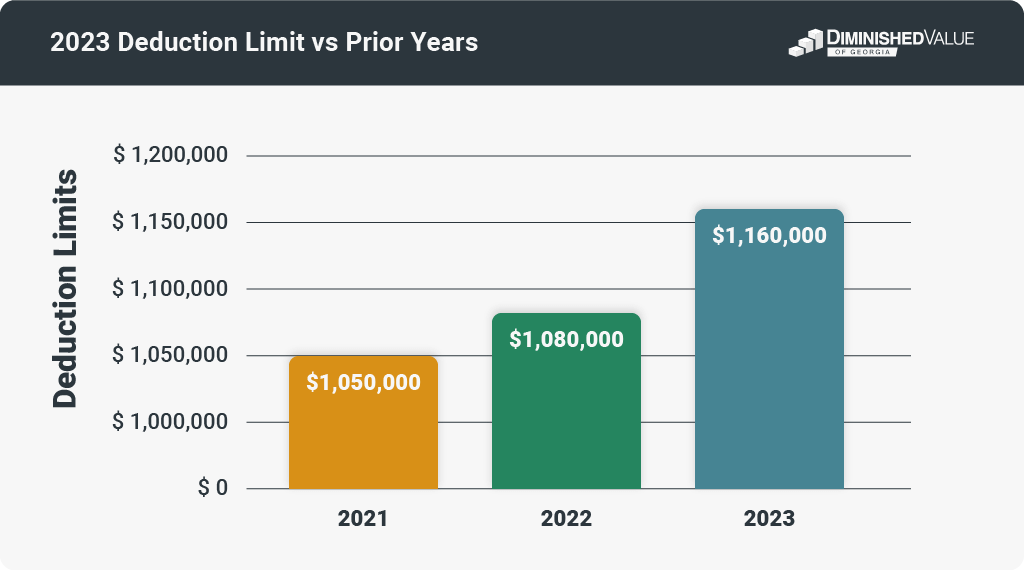

In 2022, you can deduct as much as your business’s net income or $1,080,000 for qualifying equipment, whichever is less. In 2024, the cap rises to $1,160,000.

This also means that small businesses can deduct a portion of the cost of qualifying business vehicles under Section 179.

Is It Possible to Claim a Section 179 Deduction on a Used Vehicle?

Yes, you can claim a Section 179 deduction on used vehicles if they are new to both you and your business.

The critical criterion is that the vehicle must be used for business purposes for more than 50% of its operational time.

How to Claim the Section 179 Vehicle Tax Deduction

Unlocking the Section 179 deduction for heavy vehicles involves a crucial step: the completion of IRS Form 4562. This form serves as the cornerstone, not only for calculating depreciation but also for solidifying the vehicle’s eligibility.

To ensure precision and compliance with tax regulations, seeking the guidance of a professional vehicle appraiser is not just recommended but integral. Their expertise ensures a seamless process, maximizing your chances of a successful Section 179 deduction claim.

Vehicle Valuation Experts and the IRS Section 179 Deduction

Optimal Section 179 deduction calls for consultation with a vehicle valuation expert. Their expertise ensures an accurate assessment of the vehicle’s value, aligning with IRS guidelines. They play a vital role in determining depreciable value and furnishing robust documentation for your deduction claim.

Ready to streamline your deduction process? The Diminished Value of Georgia experts are here to help. Contact us today for tailored assistance that ensures your Section 179 deduction journey is not just smooth but maximally rewarding.