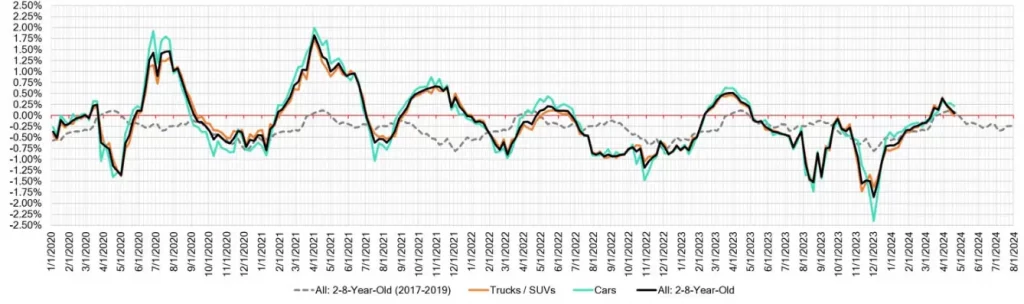

In the second week of April 2024, the auto market showed signs of a spring slowdown, reflecting a cautious approach from buyers and a nuanced shift in market dynamics. The overall market inched up slightly by +0.05%, while Trucks and SUVs experienced a minor decline of -0.02%. This week paints a picture of an industry pausing to gauge its next move.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.21% | +0.27% | +0.17% |

| Truck & SUV segments | -0.02% | +0.09% | +0.02% |

| Market | +0.05% | +0.14% | +0.08% |

Auto Market Update Week Ending April 13, 2024 (PDF)

Market Overview

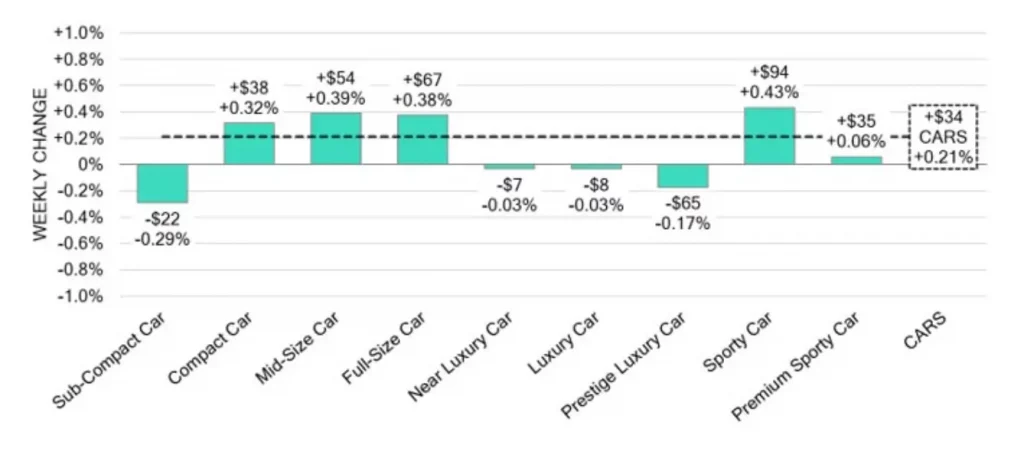

Car Segments

The car segments showed some resilience despite the broader slowdown. Overall, car values increased by +0.21%. Notably:

- The 0-to-2-year-old cars rose by +0.06%.

- Cars aged 8-to-16 years saw a growth of +0.21%.

- The Sporty Car segment led with a +0.43% increase, demonstrating consistent strength over the past month with a similar weekly growth rate.

The Compact Car segment continues its upward trend for the 15th consecutive week, with a significant +0.32% rise, suggesting sustained buyer interest in more economical, efficient vehicles.

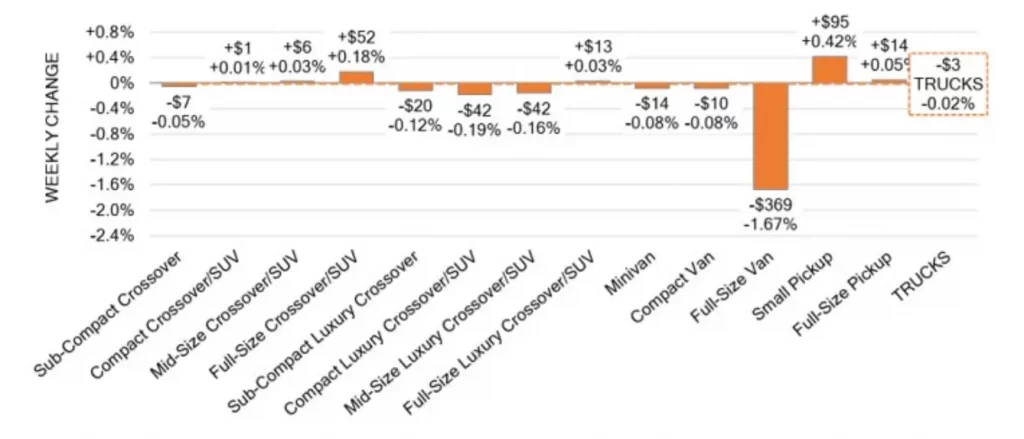

Truck & SUV Segments

Trucks and SUVs didn’t fare as well, with an overall dip of -0.02%:

- The 0-to-2-year-old models managed a slight gain of +0.03%.

- Older models, 8-to-16 years old, decreased by -0.09%.

Full-size Vans faced the most significant drop at -1.67%, influenced by increased fleet remarketing and a higher supply entering the market. Meanwhile, the Small Pickup segment showed robust growth, up +0.42%, marking its ninth week of consistent gains.

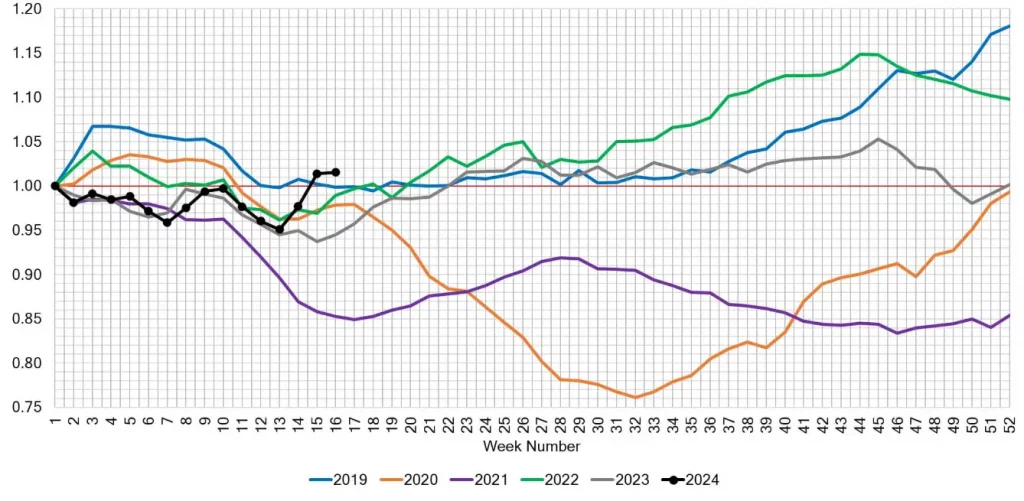

Retail Insights

The Used Retail Active Listing Volume Index, normalized to the start of the year, provides insight into the inventory levels at dealerships. The Days-to-Turn, now at 37 days, suggests a stable but cautious market environment, reflecting a slight extension in the time cars are held before sale.

Conclusion: A Market in Reflection

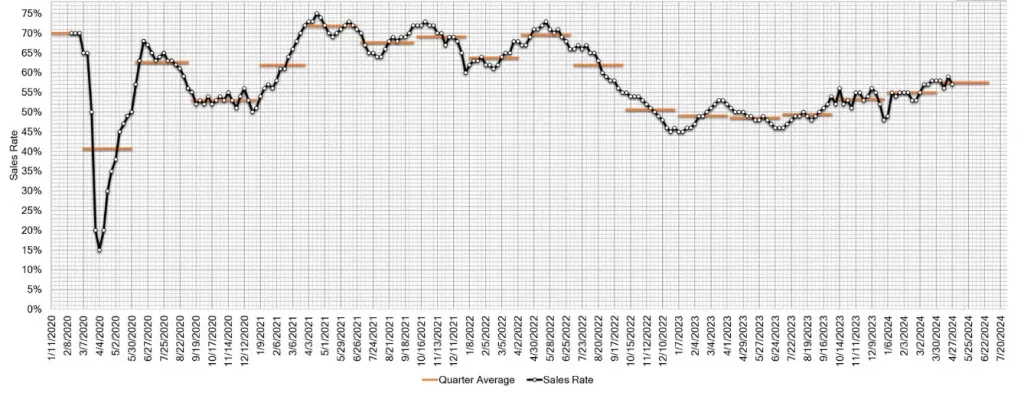

As we witness subtle yet telling shifts in the auto market this April, it’s clear that the industry is in a phase of reflection and recalibration. With a slight decline in auction conversion rates and cautious behavior from buyers, the market appears to be bracing for potential changes. Will this cautious trend continue, or are we on the cusp of a market rebound?