Was Your Vehicle Declared a Total Loss After a Collision, Accident, Theft, or Flood?

Was your vehicle declared a total loss after an accident, theft, or flood? Don’t settle for the insurer’s valuation without a second opinion. Our total loss appraisal services are designed to ensure you receive the full cash value your vehicle deserves.

With affordable options and expert evaluations, we help clients across Atlanta and all 50 states maximize their insurance payouts. Let us help you navigate the claims process with confidence!

Collect Your Vehicle’s Actual Cash Value by Ordering an Independent Appraisal Report.

Real Solutions that Will Help You Maximize Your Total Loss Payout From an Insurance Claim.

Total Loss Claims in Georgia

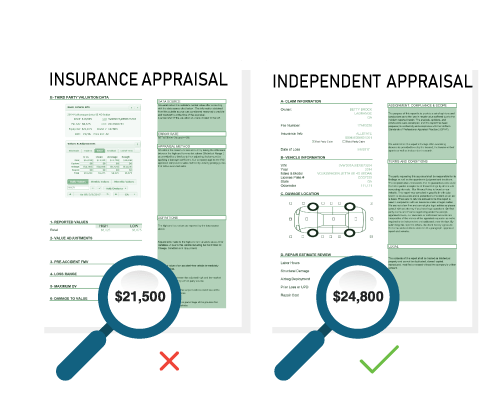

Once a vehicle has been declared a total loss, questions of valuation can become particularly thorny and the subject of significant disagreement between claimants and their carriers.

Insurance companies will commission an appraisal of the vehicle in question and inform the policyholder of their valuation assessment.

Georgia law provides for multiple claims valuation methods, including the cash equivalent method or the replacement vehicle method.

It is important for car owners to keep in mind that they have the right to refuse that determination and begin a dispute process by hiring an appraiser of their choosing.

When concerns arise about the fairness of the value assessment provided by the insurer, this option should indeed be exercised.

1 – Review The Insurer’s Valuation Report

It is critical that a vehicle owner scrutinize the details of the insurance carrier’s valuation report following a serious accident.

Some of the most important elements to review for accuracy include:

- Make, model, and year description of the vehicle

- Odometer reading

- Trim level

- Optional equipment

- Assessment of condition

- Comparable vehicle valuations (number used/location)

- Adjustments for condition and mileage

- Recent repair work and/or upgrades

- Tax amount

It is often the case that the insurer’s appraisal report will be inaccurate, potentially depriving you of the monetary value to which you are rightly entitled. Keeping a close eye on the criteria the carrier’s appraiser used to assess the vehicle can prevent unnecessary loss.

2- Hire Your Own Total Loss Car Appraiser

As is almost always the case, an auto insurance carrier will make every attempt to reduce the value of a policyholder’s claim. For this reason, an unfairly low appraisal value may be provided in the aftermath of a total loss event.

The difference between an insurer’s appraisal amount and that reached by an independent appraiser can sometimes be substantial, and it is in the vehicle owner’s best interest to secure a second opinion, so to speak.

Georgia auto insurance policies typically contain a so-called “appraisal clause” articulating the holder’s right to seek his or her own valuation assessment for the purposes of dispute resolution and claim settlement negotiations.

As one of Atlanta’s leading car appraisal companies, we look forward to helping you obtain the full value you are owed for your vehicle.

Affordable Total Loss Appraisal Services

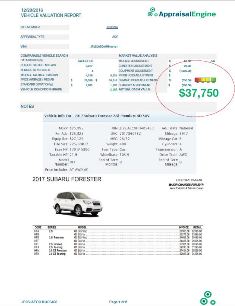

We offer vehicle valuation reports to clients involved in car accidents who want to challenge the insurance company’s unfair settlement offer.

Our team of valuation professionals stands ready to provide owners with either a desk review or a field inspection of their totaled vehicle.

1- Total Loss Desk Appraisal: $275

This report is normally ordered when the condition assessment contained in the insurer’s appraisal is not in dispute.

This appraisal includes a USPAP compliant report, settlement negotiations directly with the carrier for first-party claims is an additional $250 fee.

2- Total Loss Field Appraisal: $425

For cases in which the insurer’s appraisal incorrectly characterizes the condition and other elements of the vehicle’s value, we will need to conduct a physical inspection in order to provide an accurate determination.

Field inspections include all aspects of a desk review as well as the added detail of an on-site examination.

To schedule a field appraisal, please call (678) 404-0455.

Order a Total Loss Appraisal

Total Loss Free Quote

Total Loss Free Quote

Total Loss Desk Appraisal

Total Loss Desk Appraisal

Additional Total Loss Appraisal Resources

Our team of professionals is ready to provide unrivaled customer service and the most accurate total loss car valuations available in Greater Atlanta.

- Atlanta Car Appraisal Services

- Why Hire Diminished Value of Georgia for your Total Loss Claim

- Car Appraisal Information Center

- I Disagree with the Insurers Total Loss Value on my Vehicle, What’s Next?