Gap Insurance Appraisals

Why Hiring a Professional

Appraiser is Essential

If you’ve bought a car and got gap insurance, knowing the appraiser’s role in case of an accident is crucial. They ensure a fair vehicle value assessment for your gap insurance claim.

- based on 500+ reviews on

- s

What is GAP Insurance?

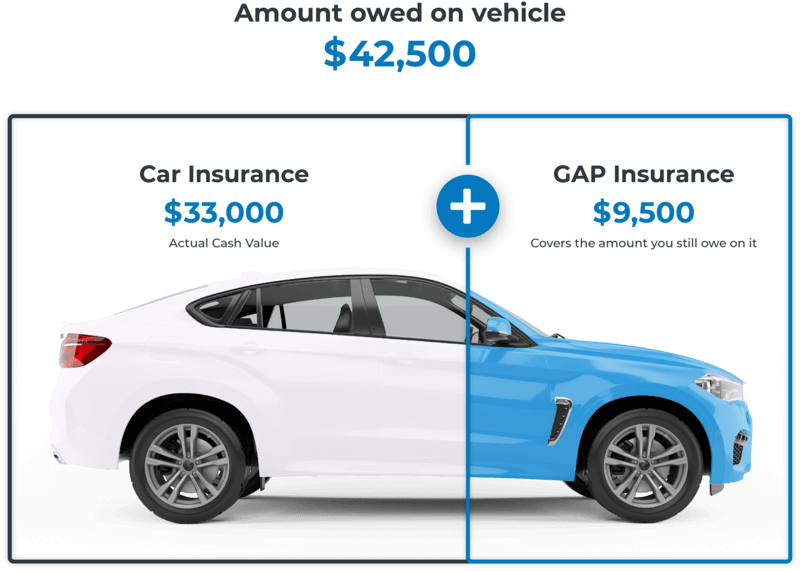

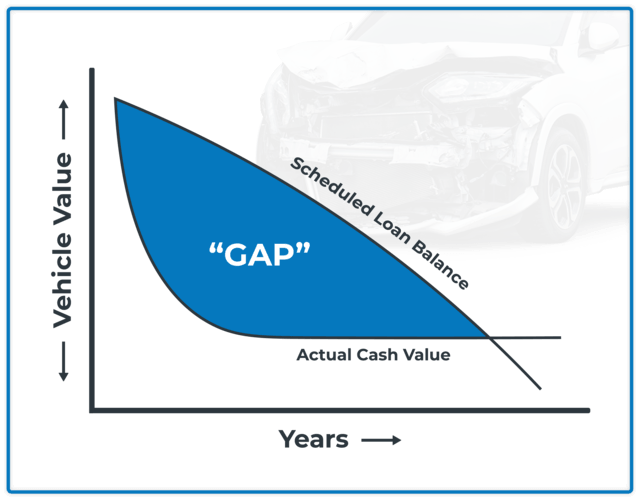

Gap insurance is an optional form of auto insurance coverage that can help protect you in the event of a total loss of your vehicle. If your vehicle is totaled in an accident, stolen, or damaged beyond repair, your regular auto insurance policy will typically pay the actual cash value of the vehicle at the time of the loss. However, if you owe more on your car loan or lease than the actual cash value of your vehicle, you could end up owing money on a car that you no longer own. This is where gap insurance comes in.

Gap insurance is designed to cover the difference, or "gap," between the actual cash value of your vehicle and the amount you owe on your loan. For example, if your car is worth $20,000 but you still owe $25,000 on your loan, gap insurance would cover the $5,000 difference. This can help protect you from unexpected expenses and ensure that you are not left with a large debt after a total loss.

Why You Need an Appraiser

In the event of a total loss, the value of your vehicle will be used to determine the amount of your insurance settlement. If the amount of your settlement is less than the amount owed on your vehicle, gap insurance can help cover the difference. However, to receive the full amount of coverage, you need to demonstrate that the cost of repairing your vehicle exceeds the total loss threshold.

This is where a professional appraiser comes in. An experienced appraiser can provide an accurate assessment of your vehicle's value, taking into account various factors such as the make, model, year, condition, and upgrades or modifications. They can also help you navigate the process of submitting the necessary documentation to your gap insurance provider, ensuring that your claim is processed quickly and efficiently.

Hire a Professional Appraiser

When it comes to gap insurance appraisals, it’s important to work with a professional appraiser who is qualified, experienced, and reputable. Look for an appraiser who has a solid track record of providing accurate and fair appraisals, and who is knowledgeable about the specific requirements of your gap insurance provider.

As an experienced appraiser, I can provide you with the expertise and guidance you need to obtain a fair and accurate appraisal of your vehicle’s value. I understand the complexities of gap insurance claims and can help you navigate the process from start to finish. By working with me, you can be confident that your claim will be handled efficiently and that you will receive the full amount of coverage you are owed.

How to Obtain a Gap Insurance Appraisal

You will typically need to provide the appraiser with the following information:

- Your vehicle make, model, and year

- The current condition of your vehicle

- Any upgrades or modifications that you have made to your vehicle

- The mileage on your vehicle

Diminished Value of Georgia

Diminished Value of Georgia is a professional car appraisal company located in Atlanta and serving the entire State of Georgia. We specializes in vehicle valuation reports for loss in value insurance claims as well as other assessments including Total Loss, Actual Cash Value, Classic Cars, GAP insurance appraisals, salvage value appraisal, flood damage appraisals and stated value insurance appraisals. Our team of experts will handle all aspects of a claim including umpire and mediation. We are licensed, independent, court approved and unbiased.

Gap Insurance Coverage

It's also worth noting that if you have canceled your regular insurance and are relying solely on gap insurance coverage, you may be able to receive the entire cash value of your vehicle. This is because gap insurance is designed to cover the difference between the cash value of your vehicle and the amount owed on your loan or lease, up to the policy limit. However, the specifics of your coverage may vary, so it's important to read your policy carefully and consult with your gap insurance provider to understand your options.

In conclusion, if you have purchased gap insurance coverage for your vehicle, hiring a professional appraiser is essential in the event of an accident or total loss. A professional appraiser can help you obtain an accurate assessment of your vehicle's value, which is essential for demonstrating that the cost of repairing your vehicle exceeds the total loss threshold. This, in turn, can help you receive the full amount of coverage you are owed from your gap insurance provider.

When choosing a professional appraiser, it's important to look for someone who is experienced, qualified, and reputable. By working with an appraiser who has a solid track record of providing accurate and fair appraisals, you can have confidence that your claim will be handled efficiently and that you will receive the full amount of coverage you are entitled to.

Remember that if you have canceled your regular insurance and are relying solely on gap insurance coverage, you may be able to receive the entire cash value of your vehicle, up to the policy limit. However, it's important to read your policy carefully and consult with your gap insurance provider to understand your options.

In summary, hiring a professional appraiser is an important step in ensuring that you receive the full amount of coverage you are owed from your gap insurance provider. With their expertise and guidance, you can navigate the claims process with confidence and peace of mind.

Order a GAP Insurance Appraisal

To order your appraisal report, please fill out the form below. You can also text or call us at (678) 404-0455 if you have any questions.

GAP desk appraisal

Flat rate

$225

- USPAP Compliant Valuation Report

- Demand Letter Tailored to Your Claim

- Supporting Documents

- Follow-Up Letters

- Email Support

- Phone Support

GAP Field appraisal

flat rate

$425

- USPAP Compliant Valuation Report

- Demand Letter Tailored to Your Claim

- Supporting Documents

- Follow-Up Letters

- Email Support

- Phone Support

- Vehicle Inspection Report

- Repair Quality Checkup

Order a GAP Field Appraisal

Order a GAP Desk Appraisal

Diminished Value Claim Review

Wondering how much your vehicle lost in Value? We can help!

-

1372 Peachtree St NE

Ste S10

Atlanta, GA 30309 - Phone | (678) 404-0455

- Whatsapp | (678) 666-2575

- Fax | (678) 868-1832

Diminished Value of Georgia is powered by Appraisal Engine Inc™ | All Rights Reserved.