When dealing with a State Farm total loss claim, understanding the process is crucial to ensure you receive fair compensation. State Farm uses specific guidelines to evaluate whether a vehicle qualifies as a total loss and how claims are handled.

As experienced appraisers, we specialize in helping policyholders navigate the claims process. 90% of the time, the insurance company’s initial offer is a lowball, and it’s important to have the right information to advocate for a fair settlement.

This guide will walk you through what State Farm considers a total loss, how settlements are calculated, and the steps you need to take.

If you’re looking for a second opinion on your total loss claim, learn more here.

What Is a Total Loss According to State Farm?

State Farm considers a vehicle a total loss when the cost of repairs, combined with its salvage value, exceeds its actual cash value (ACV). This decision is influenced by factors such as repair costs, salvage value, and state-specific total loss regulations.

Factors That Influence the State Farm Total Loss Decision

- Extent of Damage: Even if damage appears minor, hidden issues may increase repair costs significantly.

- Safety Considerations: If the vehicle cannot be repaired to a safe condition, it is declared a total loss.

- State Regulations: Each state has its own total loss threshold that applies to State Farm total loss claims. For detailed information on state-specific thresholds, you can refer to this Total Loss Threshold by State.

If you’re unsure whether your car qualifies as a total loss, having an independent appraisal can clarify whether your case qualifies as a State Farm Total Loss and help you navigate the insurer’s decision-making process.

How Does State Farm Calculate the Actual Cash Value (ACV)?

State Farm determines the Actual Cash Value (ACV) of your vehicle based on its market value at the time of the accident.

To calculate the ACV, State Farm considers factors such as your vehicle’s age, condition, and mileage. They also rely on the cost of two or more comparable replacement vehicles available in the local market.

This method is commonly used in State Farm total loss cases, and intended to reflect the price you’d pay for a similar car, but these valuations often favor the insurer, not the policyholder.

Key Factors in ACV Calculation

- Year, Make, and Model: The age and type of your vehicle heavily influence its value.

- Mileage: Higher mileage reduces the ACV.

- Condition: Pre-accident condition, including wear and tear or prior damages, affect the valuation.

- Options and Features: Upgrades like leather seats, navigation systems, or premium audio can increase the ACV.

- Comparable Vehicles: State Farm reviews local listings of similar vehicles for their pricing, which often forms the basis of their valuation.

If you feel that the ACV provided by State Farm is inaccurate or unfair, you have the right to dispute their calculation. Obtaining an independent appraisal can help you advocate for a more accurate and fair valuation.

What Happens If You Disagree With State Farm Total Loss Settlement Offer?

If you believe your State Farm total loss settlement offer is too low, you have options to challenge their valuation. Disputing the offer requires preparation, persistence, and sometimes third-party assistance to ensure a fair outcome.

Steps to Dispute a State Farm Total Loss Settlement

- Review the Initial Offer: Carefully examine the settlement offer provided by State Farm, paying attention to how they calculated the Actual Cash Value (ACV) and any comparable vehicle listings used.

- Provide Additional Evidence: Collect supporting documentation such as repair estimates, recent market listings of similar vehicles, and maintenance records to challenge their valuation.

- Request a Free Claim Review: Before committing to further action, you can submit your information for a free claim review. This step allows a licensed appraiser to evaluate your case and determine if State Farm’s offer is fair. The appraiser will analyze your claim and provide feedback on whether you have grounds to dispute the offer.

- Hire a Licensed Appraiser: If the claim review reveals that the insurance company’s offer undervalues your vehicle, hiring a licensed appraiser is the next step. A professional appraiser will issue a certified report that provides an unbiased, accurate valuation of your vehicle’s Actual Cash Value (ACV). This report is a critical piece of evidence that proves the true value of your car.

- Submit the Appraiser’s Report to the Insurance Company: Once the appraisal report is complete, send it to the insurance company. They are obligated to consider this certified report when reassessing your settlement.

By following these steps, you can build a strong case to challenge an unfair offer and secure the compensation you deserve. If these steps don’t lead to an agreement, the next option is to invoke the appraisal clause in your policy.

Do you need a second opinion? Get a Free Total Loss claim review from our experts!

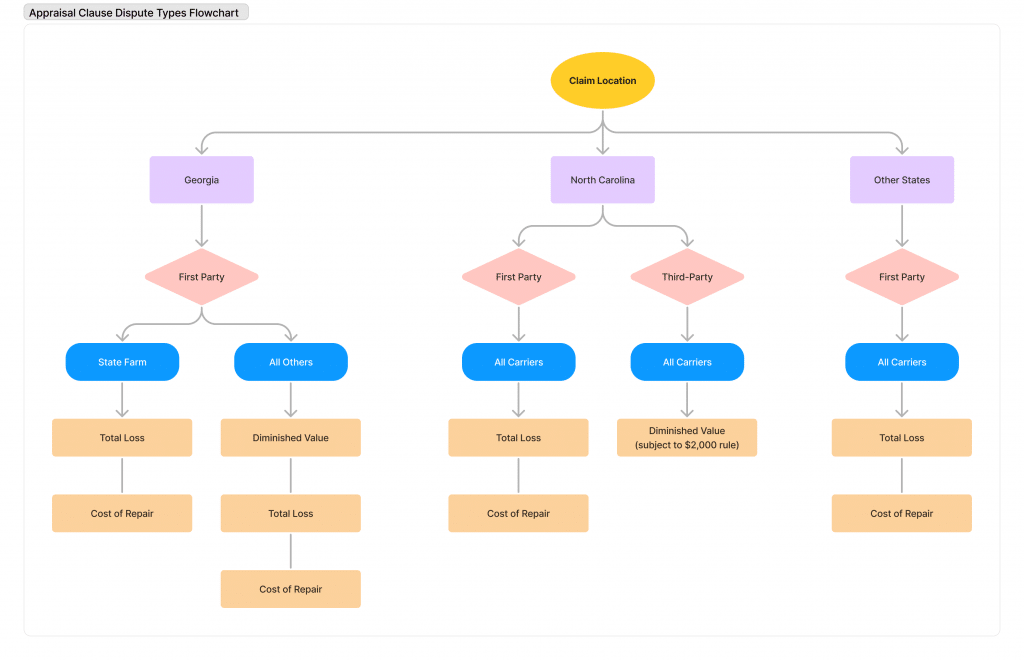

Understanding the Appraisal Clause in Your Policy

When negotiations with your insurance company fail to result in a fair settlement, the appraisal clause can be a valuable tool. This clause, found in many auto insurance policies, offers a structured way to resolve disputes about the value of your vehicle.

By invoking the appraisal clause, you can ensure that the process remains professional and unbiased, with a focus on determining the true market value of your car. Below, we’ll explain how this clause works and when it might be the right option for your claim.

What Is the Appraisal Clause?

The appraisal clause is a dispute resolution tool included in many auto insurance policies. It serves as a mechanism to resolve disagreements between policyholders and their insurance companies over the value of a claim.

When there’s a dispute about how much the insurer should pay for a total loss, either party can invoke the appraisal clause. This process involves both sides selecting independent appraisers to determine the fair market value of the vehicle. If the appraisers disagree, an impartial umpire is appointed to make the final decision.

The appraisal clause provides a formal, binding resolution and ensures that you have an opportunity to obtain a fair settlement based on the evidence.

When Should You Invoke the Appraisal Clause in a State Farm Total Loss Claim?

The appraisal clause should be invoked only after you’ve exhausted other negotiation options with your insurance company. It’s designed to be a last-resort mechanism when disputes over the value of your vehicle cannot be resolved through standard discussions or evidence submissions.

To learn more, check out State Farm Removes Appraisal Clause from Alabama Auto Policies Harming their Policyholders.

What Happens If You Owe Money on a Totaled Car?

When your car is declared a total loss, but you still owe money on your loan or lease, the situation can become more complex. The insurance payout might not always cover the remaining balance, leaving you responsible for the difference.

State Farm’s Role in Loan and Lease Payoffs

State Farm typically pays the lienholder directly for the Actual Cash Value (ACV) of your vehicle. If the insurance payout is less than the amount you owe, you’re responsible for covering the remaining balance.

This shortfall often occurs when the loan balance exceeds the car’s market value due to depreciation.

If you’re leasing a vehicle, this situation can be even more complicated due to negative equity. Understanding how GAP insurance works for leased vehicles can help you avoid unexpected costs.

The Role of GAP Insurance in State Farm Total Loss Claims

Guaranteed Asset Protection (GAP) insurance is designed to cover the difference between what you owe on the loan or lease and the vehicle’s ACV. This additional coverage ensures you won’t be left with an unpaid balance after your car is totaled.

For instance, if your car is worth $33,000 but you still owe $42,500 on your loan, GAP insurance would cover the $9,500 difference.

If you’re unsure about the specifics of your policy, a GAP insurance appraisal can help clarify whether you’re adequately covered. This service ensures that you’re equipped with the right information to avoid financial surprises.

Understanding and utilizing GAP insurance effectively can save you thousands of dollars, especially in total loss situations.

Can You Keep Your Car After It’s Declared a Total Loss?

When a vehicle is declared a total loss, you may wonder if it’s possible to keep the car instead of surrendering it to the insurance company. State Farm, like most insurers, allows policyholders to retain their totaled vehicle under certain conditions, but it’s essential to understand the implications.

State Farm’s Salvage Policy

If you choose to keep your car after it’s been declared a total loss, the insurance company will deduct the salvage value from your settlement. Salvage value represents the estimated worth of the damaged vehicle if it were sold to a scrapyard or salvage auction.

While keeping your car may seem appealing, it’s important to note that:

- Future Repairs Are Your Responsibility: You’ll need to cover repair costs out-of-pocket if you intend to drive the car again.

- A Salvage Title Will Be Issued: Your car will be branded with a salvage title, which can affect its resale value and insurability.

How Retaining a Totaled Car Affects Your Payout

Choosing to keep your car will reduce the settlement amount you receive. For example, if the Actual Cash Value (ACV) of your vehicle is $10,000 and its salvage value is $2,000, your payout will be $8,000.

Before making a decision, weigh the costs of repairing the vehicle against its post-repair value. In many cases, the costs of repairs, coupled with the salvage title, may make retaining the car financially impractical.

If you’re unsure about whether keeping your totaled car is the right choice, consulting an appraiser can provide clarity and help you make an informed decision.

What Do You Need to Do After a State Farm Total Loss?

Once your vehicle is declared a total loss, there are several important steps to take to ensure a smooth claims process. These steps involve transferring ownership, preparing your vehicle for pickup, and updating your insurance policy.

Transferring the Title to State Farm

One of the first tasks after a total loss declaration is transferring the title of your vehicle to State Farm. This process allows them to take possession of the car, whether it’s being salvaged or sold for parts.

To transfer the title:

- Collect all necessary documents, including the car’s title and any lienholder information.

- Work with your lienholder or leasing company, if applicable, to ensure they release their interest in the vehicle.

- Complete any paperwork provided by State Farm to finalize the transfer.

Preparing Your Car for Salvage After a State Farm Total Loss

Before the car is picked up or sent to salvage:

- Remove all personal items, including any paperwork or valuables.

- Delete personal information from navigation systems, Bluetooth, or connected devices.

- Collect all keys and license plates.

Taking these steps ensures a hassle-free transition and protects your personal information.

Updating or Cancelling Your Insurance Policy

Once the title transfer is complete, review your insurance coverage with your State Farm agent. Depending on your situation, you may need to:

- Cancel your existing policy if you’re not replacing the vehicle immediately.

- Transfer coverage to a new vehicle if you’ve already purchased one.

It’s also a good time to review your policy for gaps in coverage or consider additional protections, such as GAP insurance, for future vehicles.

By following these steps, you can close out the total loss claim process efficiently and prepare for the next steps in vehicle ownership.

Frequently Asked Questions (FAQs)

What Is the Statute of Limitations for Filing a Claim?

The statute of limitations varies by state but typically ranges from two to five years for filing an insurance claim after an accident. It’s essential to act quickly to preserve your right to compensation.

What Happens If the Insurance Payout Is Lower Than Expected?

If you believe your State Farm total loss payout is too low, you can dispute the insurer’s valuation. Provide supporting evidence, such as repair estimates or comparable vehicle listings, to challenge their assessment. Hiring a licensed appraiser for a second opinion can also help secure a fair settlement.

Can You Switch Insurance Companies After a State Farm Total Loss Claim?

Yes, you can switch insurance companies even after filing a total loss claim. However, your claims history might influence the premiums offered by your new insurer. Compare quotes and coverage options carefully before making the switch.

Can I Keep My Totaled Car and Still Get a Settlement?

Yes, you can choose to retain your totaled car. However, the insurance company will deduct the vehicle’s salvage value from your payout. Keep in mind that repairs will be your responsibility, and the car will have a salvage title, which may impact its resale value and insurability.

Is GAP Insurance Worth It for a Leased or Financed Vehicle?

Absolutely. GAP insurance covers the difference between the insurance payout and what you owe on your loan or lease. It’s especially valuable for vehicles with rapid depreciation, ensuring you won’t be left with an unpaid balance after a total loss.