Dealing with the aftermath of a car accident can be stressful, especially when your vehicle is declared a total loss. Progressive total loss claims can feel complex, but understanding how the process works is essential to securing the compensation you deserve.

Did you know that 90% of the time, the insurance company’s initial offer is a lowball? In this guide, we’ll break down everything you need to know about total loss claims with Progressive, from how vehicles are evaluated to tips for negotiating a fair settlement.

Whether you’re dealing with your first claim or seeking to maximize your payout, this article will provide practical insights to help you navigate the process with confidence.

Ready to learn how to ensure a fair outcome for your claim? Let’s dive in.

How Does Progressive Determine if Your Vehicle is Totaled

A vehicle is considered a total loss when the cost of repairs plus the salvage value exceeds its Actual Cash Value (ACV), making repairs impractical.

The process begins with an insurance adjuster, who evaluates the extent of the damage, repair estimates, and your car’s value. If the repair costs surpass the ACV + salvage value, the vehicle is deemed totaled. This decision is influenced by state-specific total loss thresholds, which set a damage-to-value percentage that determines whether a car qualifies as a total loss. Most states adopt a 75% threshold, meaning if repair costs equal or exceed 75% of the vehicle’s value, it is declared a total loss.

In 2023, over 29% of collision claims were classified as total losses, driven by soaring repair costs that continue to outpace inflation. Progressive typically offers settlement based on the ACV or, in some cases, a replacement vehicle. However, unless you have additional endorsements like new car replacement coverage, the payout will usually reflect the car’s depreciated value.

If you choose to keep the totaled car, the salvage value is deducted from the settlement amount. This allows you to retain the vehicle, though it may be subject to restrictions like a salvage title.

For more information on state-specific thresholds, you can refer to this Total Loss Threshold by State.

Signs that Your Car is a Total Loss

Determining whether your vehicle might be declared a total loss can save you time and help you prepare for the claims process. Here are some common signs that indicate your car could be totaled:

- Extensive Damage: If the damage affects critical components like the frame, engine, or transmission, repairs may exceed the car’s Actual Cash Value (ACV).

- High Repair Costs: When repair estimates come close to or exceed 75% of the vehicle’s value (based on your state’s total loss threshold), your car is likely to be deemed a total loss.

- Age and Depreciation: Older vehicles or those with significant mileage are more likely to be totaled, as their lower ACV makes it harder to justify repair costs.

- Safety Concerns: If the damage compromises the vehicle’s structural integrity or safety features, insurers may declare it unsafe for the road, leading to a total loss determination.

- Salvage Title History: Cars with a prior salvage title are often written off in subsequent accidents due to their reduced value.

If you notice any of these signs after an accident, be prepared for the possibility that your vehicle could be declared a total loss. Understanding these indicators can help you gather the necessary information to secure a fair settlement.

How Insurance Adjusters Evaluate Vehicle Value

Insurance adjusters play a critical role in determining the settlement amount for a totaled vehicle after an auto accident. Their evaluation process focuses on establishing the Actual Cash Value of your car at the time of the accident. Here’s how they do it:

- Reviewing the Vehicle’s History and Condition:

Adjusters assess your vehicle’s maintenance records, mileage, prior accidents, and overall condition to determine its worth. If your car had any existing damage or wear and tear, it could lower the loss settlement value. - Comparing Similar Vehicles:

Adjusters also use comparable vehicle listings to evaluate market trends. They look at recent sales and dealer prices for cars of the same make, model, and year within your area. This helps them estimate the car’s fair market value (FMV). - Factoring in Depreciation:

They consider the age of your car and its depreciation over time. Older vehicles often have lower values, which can significantly impact your insurance coverage payout. - Assessing Damage from the Collision:

The adjuster reviews repair estimates to determine if fixing the car is a possibility under your collision coverage. If repair costs exceed the state’s total loss threshold or the ACV, they’ll proceed with a total loss claim. - Deducting Salvage Value:

If you choose to keep the vehicle, the adjuster will deduct the car’s salvage value from the insurance claim payout. This is common for owners who wish to repair or sell the vehicle independently.

Adjusters must adhere to the terms outlined in your insurance policy, so understanding your policy details can help you anticipate their decisions. It’s essential to review their findings thoroughly to ensure the valuation is fair and accurate.

Understanding Fair Market Value

The fair market value (FMV) of your car is the cornerstone of any total loss claim, as it determines how much your insurance coverage will pay out. FMV reflects the price your vehicle would sell for in its current condition in an open market, factoring in comparable sales, regional demand, and depreciation. It’s the benchmark that Progressive Insurance adjusters use to calculate your settlement offer.

When determining FMV, adjusters analyze sales of similar vehicles in your area, considering make, model, year, mileage, and condition. They also account for market trends, such as supply and demand, which can significantly impact a car’s value. For instance, a vehicle with high demand and limited availability may fetch a higher value, while older cars or those with previous damage may be worth less.

Navigating the Total Loss Claims Process

Filing a total loss claim with Progressive Insurance can be challenging, especially if it’s your first experience with this process.

Whether you’re reviewing the initial settlement offer, gathering evidence, or disputing a valuation, understanding how the process works will help you make informed decisions.

In the next section, we’ll break down the essential steps to file your claim and secure the settlement you deserve.

Steps to File a Total Loss Claim

- Review the Initial Offer: Carefully examine the settlement offer provided by Progressive. Pay close attention to how they calculated the Actual Cash Value and the comparable vehicle listings they used as references.

- Provide Additional Evidence: Gather supporting documents, such as repair estimates, maintenance records, and recent market listings of similar vehicles. These can serve as evidence to challenge their valuation if it seems low.

- Request a Free Claim Review: Submit your case for a free claim review by a licensed appraiser. These experts specialize in determining whether an insurance company’s offer accurately reflects your vehicle’s value. They will analyze your claim and provide feedback on whether the offer is fair or needs to be disputed—all at no cost to you.

- Hire a Licensed Appraiser: If the claim review shows the offer undervalues your car, consider hiring a licensed appraiser. They will create a certified report that provides an unbiased, accurate valuation of your vehicle’s fair market value.

- Submit the Appraiser’s Report to Progressive: Share the appraiser’s report along with all supporting documents with Progressive. The insurer is obligated to review the evidence thoroughly and reassess your settlement offer based on the updated valuation.

Taking these steps can significantly improve the chances of receiving a fair payout for your insurance claim, ensuring that the compensation reflects the true value of your vehicle.

Do you need a second opinion? Get a Free Total Loss claim review from our experts!

When do I Need to Hire an Auto Appraiser?

Hiring an auto appraiser is often necessary when you believe the insurance company’s settlement offer doesn’t reflect the true value of your vehicle. This can happen for several reasons, such as discrepancies in the fair market value, undervaluation of your car’s condition, or inaccurate repair estimates provided by the insurance company.

If you’ve submitted a total loss claim with Progressive Insurance and their initial offer seems unfair, an appraiser can provide an unbiased, professional valuation. Beyond providing a certified report as critical evidence to dispute a lowball offer, appraisers also know the ins and outs of how to negotiate with the insurer effectively, leveraging their expertise to advocate for a higher loss settlement.

Appraisers are particularly helpful when the claims process becomes contentious, or when you lack the time or expertise to gather documentation and negotiate with the insurer. By involving an appraiser early, you increase your chances of achieving a settlement that truly reflects your vehicle’s worth.

Negotiating a Fair Settlement

Securing a fair loss settlement often comes down to how well you negotiate with Progressive Insurance. With the right preparation, you can turn their initial offer into a payout that truly reflects your vehicle’s value. Knowing when to push back, how to present evidence, and what strategies to use can make all the difference in the outcome of your claim.

Tips for Effective Negotiation with Insurers

Here are some tips to guide you:

- Stay Polite but Firm: Maintain a professional tone during discussions, but don’t hesitate to stand your ground if the initial offer seems unfair. Clearly explain why their valuation doesn’t reflect your vehicle’s true worth.

- Know Your Policy: Familiarize yourself with your insurance policy, including coverage limits, exclusions, and any additional endorsements. This knowledge ensures you’re aware of what you’re entitled to under the terms of your insurance claim.

- Leverage an Appraisal Report: If the offer remains low after negotiations, present a certified report from a licensed appraiser.

- Don’t Settle Too Quickly: Insurers may pressure you to accept their initial offer, but you have the right to request additional time to review or contest it. Take the time needed to gather evidence and explore your options.

Remember, the insurance company is not your friend. Their primary goal is to minimize payouts, so advocating for yourself with clear evidence and persistence is essential.

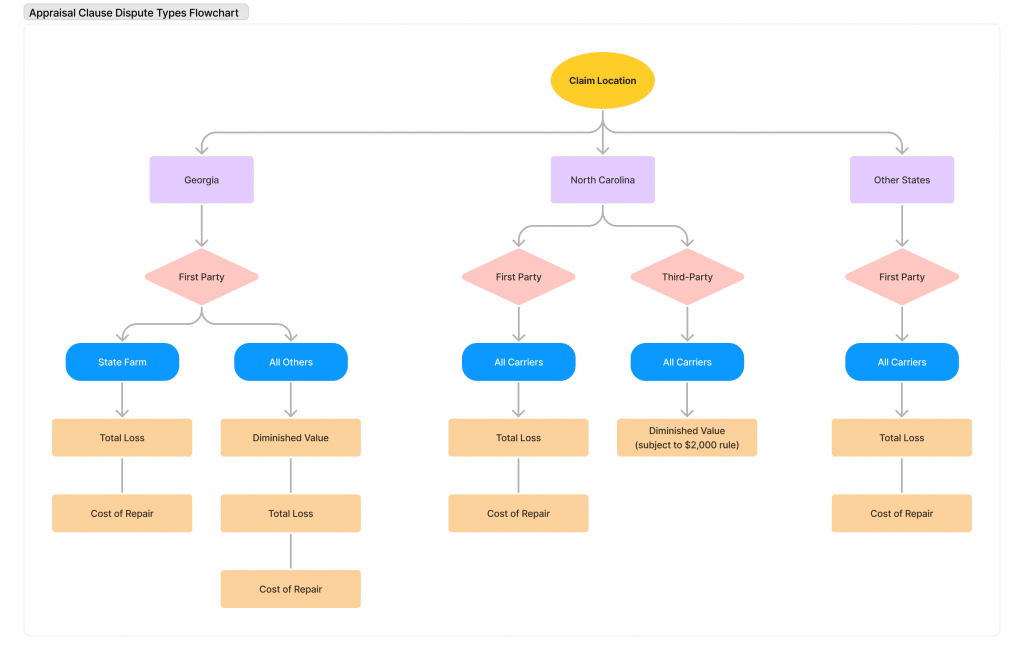

Understanding the Appraisal Clause

The appraisal clause is a key feature in many insurance policies that can help you resolve disputes over the value of your totaled vehicle.

If you and Progressive Insurance can’t agree on a fair loss settlement, this clause provides a way to challenge their valuation and seek a more accurate payout.

In the following sections, we’ll explain what an appraisal clause is and how to use it effectively to protect your rights.

What is an Appraisal Clause?

An appraisal clause is a provision in your insurance policy that provides a formal process for resolving disputes about the value of your vehicle in a total loss claim. This clause is designed to protect policyholders when they disagree with the insurer’s valuation and believe their vehicle’s fair market value has been undervalued.

Here’s how it works: Both you and the insurer appoint independent appraisers to evaluate your vehicle’s value. These appraisers compare evidence, such as comparable sales data and repair estimates, to determine the most accurate valuation. If the two appraisers cannot agree on a figure, a neutral umpire is brought in to make the final decision, ensuring a balanced resolution.

The appraisal clause can be a powerful tool for securing a fair loss settlement when traditional negotiations fail. However, it’s essential to understand the process fully and be prepared with evidence to support your claim.

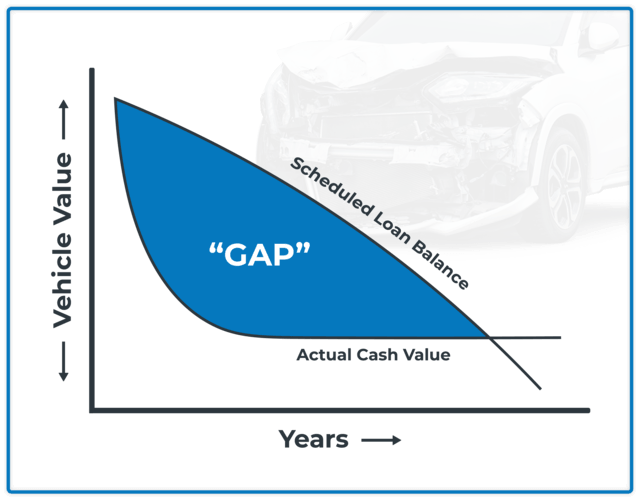

Implications for Financed Vehicles

If your vehicle is financed, a total loss claim can become even more complicated. In addition to dealing with the insurance company, you’ll need to navigate the financial obligations tied to your loan.

When a financed car is declared a total loss, the insurance settlement typically goes toward paying off the outstanding loan balance. However, if the settlement amount is less than what you owe, you may still be responsible for covering the remaining balance. This is where gap insurance becomes invaluable, as it can cover the difference between the loan amount and the fair market value of the car.

In the next sections, we’ll explore what happens to your loan after a total loss and discuss your options for handling any remaining balance.

What Happens to Your Loan After a Total Loss?

When your financed vehicle is declared a total loss, the insurance company typically pays the loss settlement directly to the lender. This amount is meant to cover the remaining balance of your auto loan. However, if the insurance settlement is less than what you owe, you’re still responsible for paying the difference.

This situation, often referred to as being “upside-down” on a loan, is common when the fair market value of the car has depreciated faster than the loan balance. For example, if you owe $20,000 on your vehicle but its value is only $17,000, you’d need to pay the $3,000 shortfall out of pocket.

Options for Handling a Loan Balance

If your total loss settlement doesn’t fully cover your auto loan, there are several options to manage the remaining balance:

- Use Gap Insurance:

If you have gap insurance, it will cover the difference between your loan balance and the vehicle’s fair market value. This additional coverage ensures you aren’t left paying out of pocket for the shortfall. Gap insurance is particularly beneficial for newer vehicles or loans with little equity. - Negotiate with the Lender:

Some lenders may be willing to work with you to adjust payment terms or settle the remaining balance at a reduced amount. Open communication with your lender can help you find a manageable solution. - Refinance the Balance:

If you don’t have gap insurance and the remaining balance is significant, refinancing the loan may be an option. This allows you to spread the repayment over a longer period with potentially lower monthly payments. - Pay the Shortfall Out of Pocket:

If the remaining balance is small, paying it off directly may be the simplest solution. While this can be an unexpected expense, it avoids ongoing interest or complications with your credit.

Understanding how GAP insurance works for leased vehicles can help you avoid unexpected costs.

Frequently Asked Questions

What Happens After Your Vehicle is Declared a Progressive Total Loss?

Once your vehicle is declared a total loss, Progressive Insurance will determine its Actual Cash Value (ACV) based on factors like the car’s condition, mileage, and fair market value. They will then issue a loss settlement offer to cover the value of your vehicle.

If you accept the offer, the settlement amount will be used to pay off any outstanding loans on the car first. Any remaining balance will be paid directly to you. If you decide to retain the vehicle, the salvage value will be deducted from the settlement. Progressive may also handle paperwork like transferring the title or issuing a salvage title if required.

Can I Keep My Totaled Vehicle?

Yes, you can choose to keep your totaled vehicle after a total loss claim, but there are a few important considerations. If you decide to retain the car, Progressive Insurance will deduct the vehicle’s salvage value from your settlement amount. This allows you to keep the car while receiving a reduced payout.

However, keeping the vehicle may mean it is issued a salvage title, which can limit its resale value and make it more challenging to insure or register in the future. Before deciding, weigh the repair costs and long-term implications of retaining the car.

How Long Does the Claim Process Take?

The timeline for a total loss claim can vary depending on the complexity of the case and how quickly you provide the necessary documentation. Generally, Progressive Insurance aims to process claims within a few weeks. However, delays can occur if there are disputes over the vehicle’s value or if additional evidence is needed.

To expedite the process, ensure all forms, repair estimates, and supporting documents are submitted promptly. Staying in regular contact with your claims adjuster can also help resolve any issues and move the process along faster.

How Much Will I Get for My Vehicle?

The amount you’ll receive for your vehicle depends on its fair market value and how Progressive Insurance calculates the Actual Cash Value (ACV). Generally, this includes considerations like the vehicle’s age, mileage, condition, and features.

While the final figure varies for every claim, most payouts align with what the car would sell for in the current market.