Once upon a time, in the bustling city of Atlanta, a car owner named Alex faced a dilemma that many of us might find all too familiar. After purchasing his dream car, a sleek, modern sedan that gleamed under the Georgia sun, disaster struck.

A careless driver ran a red light, colliding with Alex’s new pride and joy. Though grateful for walking away unscathed, the financial aftermath was a nightmare. His car, now a tangled mess of metal, was deemed a total loss by the insurance company.

To add insult to injury, Alex discovered the payout from his standard auto insurance policy wouldn’t cover the full amount he owed on his car loan. It was a financial gap wider than the Grand Canyon, leaving Alex wishing he had considered something he had previously scrolled past: GAP insurance.

Is GAP Insurance Worth the Investment? A Complete Guide (PDF)

The Underrated Safety Net

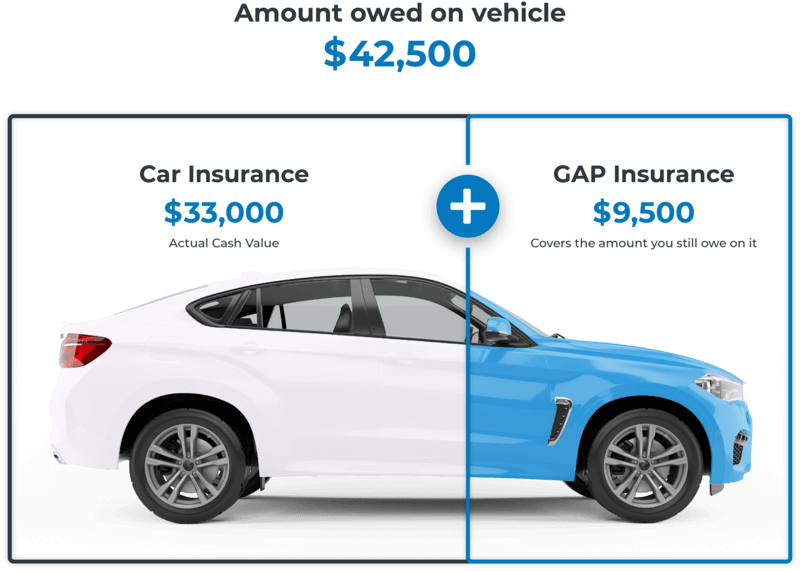

GAP insurance, or Guaranteed Asset Protection insurance, is the unsung hero of the automotive insurance world. It’s designed to cover the ‘gap’ between what your standard insurance pays out and the amount you still owe on your vehicle in the event of a total loss. But is it worth the extra pennies?

The Numbers Speak Volumes

Statistics reveal a startling reality: new cars can depreciate by 20% to 30% in the first year of ownership and up to 50% or more over three years. With car loans extending to six, seven, or even eight years, the risk of finding oneself underwater on a car loan is higher than ever.

A 2020 report by the Insurance Information Institute highlighted that one in seven drivers could face a financial gap in the event of their car being totaled. Yet, despite these glaring figures, GAP insurance remains an overlooked safeguard.

Understanding GAP Insurance Costs

When you think about getting GAP insurance, how much you’ll pay for it can vary. If you decide to get this insurance through the place where you got your car loan, it might cost you a one-time fee between $500 and $700. But, if you go through a credit union, you might find it’s a bit cheaper. The catch with credit unions is that you’ll end up paying a little bit of interest on that cost.

Research by Experian shows that if you choose to add GAP insurance to your regular car insurance policy, it could cost you an extra $20 to $40 every month.

So, what affects how much you’ll pay for GAP insurance? Here are the main things:

- The value of your car when you buy the insurance.

- How old you are.

- The place you live.

- Your history of insurance claims.

These details help figure out your exact cost for GAP insurance, making sure it fits just right for your situation.

Beyond the Obvious

What most websites won’t tell you is that GAP insurance isn’t just about covering a financial shortfall. It’s a peace of mind purchase, a guardian angel for your wallet in times of unexpected disaster. It’s particularly invaluable for:

- Leased vehicles: Often mandatory, but always a wise choice.

- High-depreciation models: Some cars lose value faster than others.

- Long-term loans: Extended payment plans increase the duration of potential negative equity.

- Low down payments: Less upfront means more owed as the car depreciates.

Where We Come In

In the complex world of GAP insurance, understanding and proving your vehicle’s value is key, especially after a total loss. This is where the expertise of Diminished Value of Georgia becomes invaluable. Our professional appraisers excel in accurately assessing the value of your vehicle, taking into account its make, model, year, condition, and any modifications or upgrades.

This precise valuation is critical because, in the unfortunate event of a total loss, your insurance settlement is determined by your car’s current market value. If this settlement doesn’t cover what you still owe, GAP insurance should cover the difference. However, to ensure you’re fully compensated, it’s essential to demonstrate that the cost of repairs would surpass the total loss threshold.

Our team not only provides a meticulous evaluation of your vehicle but also assists in navigating the submission process for your GAP insurance claim, ensuring that all necessary documentation is in order for a swift and efficient claim resolution.

With us by your side, you’re not just protecting your financial investment with GAP insurance—you’re securing peace of mind, knowing that every aspect of your claim is handled with precision and expertise.

Click here to learn more about GAP Insurance appraisals

The Verdict

In the end, whether GAP insurance is worth it boils down to your personal situation – the type of vehicle you own, your financial arrangement, and how much risk you’re willing to bear. For many, the modest investment in GAP insurance brings a sense of security that’s priceless, transforming a potential financial disaster into a manageable inconvenience.

As you navigate the roads of car ownership and insurance, consider this: if disaster struck your vehicle tomorrow, where would you stand? Is the peace of mind offered by GAP insurance worth it to you?