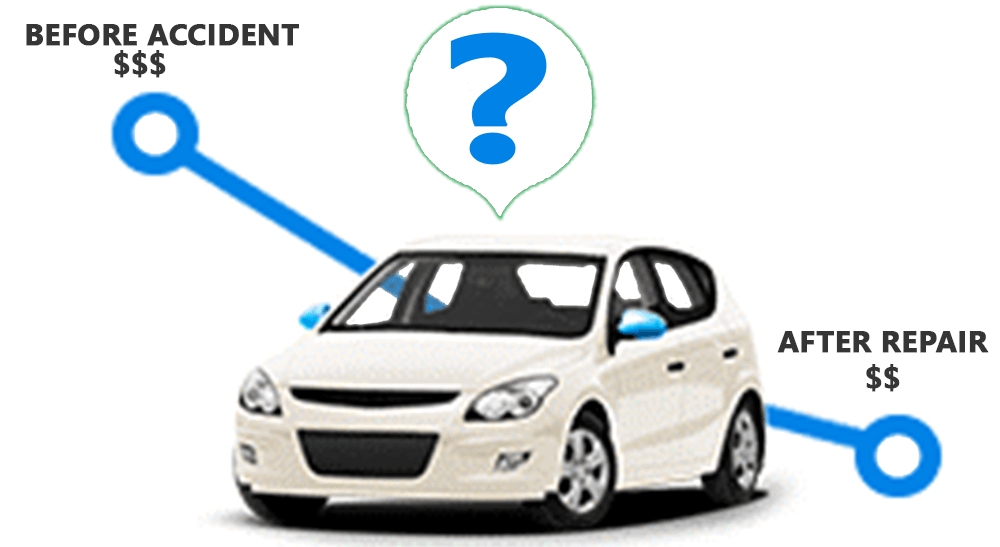

Most vehicles lose between 10 to 20% of their market value after an accident.

Want to know how much your car lost in value after a wreck?

At fault or not, by law, you’re entitled to a cash reimbursement for your vehicle’s loss in value.

- Did you receive a Diminished Value offer from the insurance company and wondering if you should accept it?

- Need a second opinion or a claim analysis?

- Are you wondering if your vehicle lost $500, $1,000 or $5,000 due to the wreck?

- Don’t cash that insurance check until you get a FREE QUOTE from us.

Free Diminished Value Claim Review

Don’t cash that insurance check until you get a FREE QUOTE from us. Call (678) 404-0455 or fill out the questionnaire below.

"*" indicates required fields

Find Out How Much Your Car Lost in Value.

Did you receive an offer from the insurance company and you’re not sure if it’s fair?

Are you wondering if your vehicle lost $500 or $5,000 because of the wreck?

Don’t cash that insurance check until you get a free quote from us. We want you to hire us ONLY if you need to. Please call us at 678-404-0455 or fill out the questionnaire above and we will get back to you with a diminished value quote free of charge.

Who is Diminished Value of Georgia?

Diminished Value of Georgia is a licensed, BBB-accredited company specializing in diminished value appraisals. We perform hundreds of appraisals every month on all types of vehicles, including antiques and specialty cars.

In addition to our affordable, flat rate vehicle appraisals, we also offer online tools, such as a FREE diminished value estimate to help consumers manage expectations, build their insurance claims, and recover the most money allowable.

Most people won’t consider a used vehicle that has been involved in an accident. So what do you do if you’ve been involved in a crash and need money for a down payment on a new vehicle? The landmark 1999 decision in

Mabry vs. State Farm says insurance companies have to pay for your banged-up vehicle’s lost trade-in value.

Consumers believe the purpose of having insurance is to cover a fair portion of their losses in the event of an accident – and yet, insurance claim adjusters are praised for low-balling motorists and saving their companies the most money. A few years ago, WSB-TV Atlanta found that many Georgians were being offered $200 to $300 in diminished value payments when they should have been paid $2,000 to $3,000.

Why Should I Seek a Diminished Value Estimate?

“Diminished value” refers to how much less a car is worth if you were to sell it following an accident. Sometimes the loss in value is not just related to the accident itself, but to improper repairs made after the fact. Seeking a diminished value appraisal gives you an independent third party opinion that can bolster your case for reimbursement. However, you’ll need to pay an expert for this service.

A diminished value estimate is a quick and easy way to see if it’s worth paying for a professional appraisal. Depending on your need, you can expect to pay anywhere between $275 for a desk review of your documents, to $425 for a field appraisal. Before shelling out that kind of cash, it helps to work with a company that is successful in helping people get paid for their diminished value claim.

Do I Qualify for Diminished Value?

All vehicles damaged in an accident and repaired suffer diminished value, but getting your insurance company to reimburse you for the loss is an uphill battle. The best odds for reimbursement are with newer vehicles that are worth more. For instance, you may not qualify if your vehicle is old, rebuilt, or has significant mileage. A vehicle that has been in multiple accidents or those declared a “total loss” isn’t likely to see compensation.

Generally speaking, if your car is worth less than $7,000 at the time of the accident or the damage sustained is worth less than $500, you probably will not have a diminished value claim. In some states, motorists can’t make a claim if they are at fault – although, you’ll be relieved to know it doesn’t matter who is at fault in the state of Georgia.

Why should I choose Diminished Value of Georgia for my Appraisal?

We’re proud to be Atlanta’s leading vehicle appraisal company, as rated by Kudzu reviewers, for the past four years in a row. Our A+ rating with the Better Business Bureau proves our commitment to excellent customer service.

There are plenty of online diminished value calculators, but some of these are run by the insurance companies to either give so low an estimate you give up the pursuit of your claim or so high an estimate that your unrealistic expectations cause a delay in your settlement.

We are a trustworthy team of independent claims adjusters whose best interest is helping you fight for the money you’re rightfully owed!