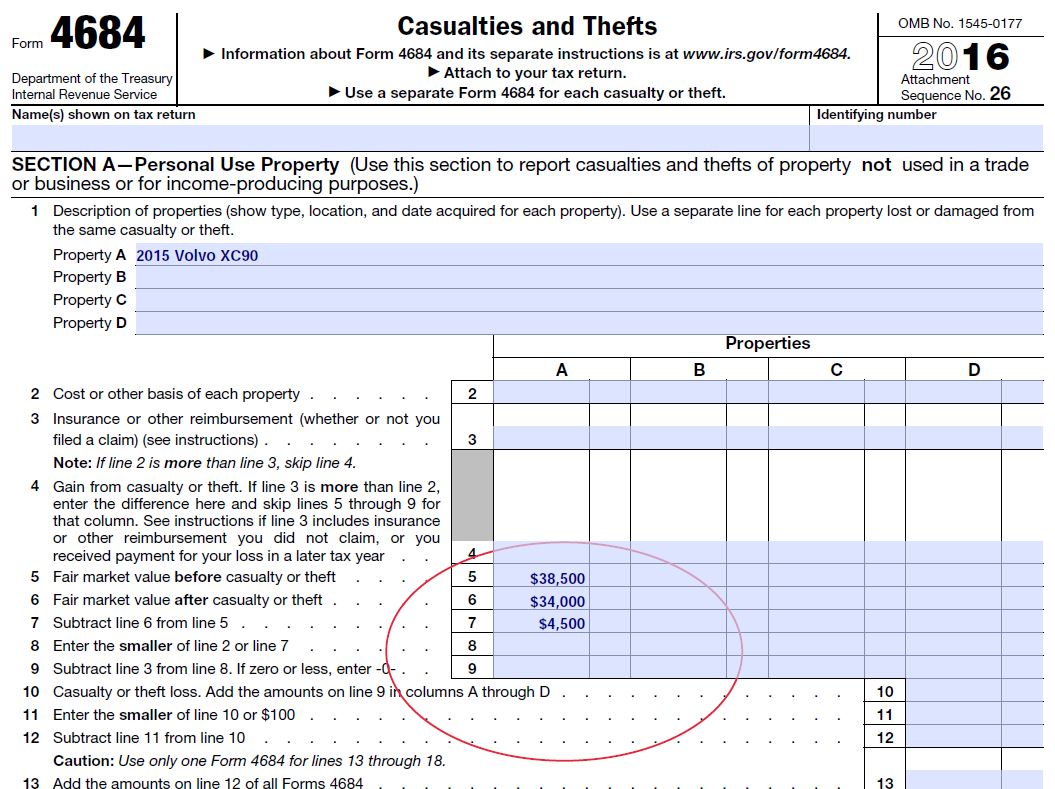

| As tax season approaches and with all the advertising about tax savings one wonders about all the tax forms and deductions available for ordinary citizens. Today, we’re looking at IRS form 4684, casualties and thefts. |

IRS Tax Form 4684 (pdf)IRS Tax Form 4684 Instructions |

The Internal Revenue Service (IRS) recognizes a fact that many insurance companies often ignore, loss in value.

Let’s examine this further; line 5 of the 4684 form asks for the “Fair market value before casualty or theft” whereas line 6 asks for the “Fair market value after casualty or theft “and with a simple calculation in the line below, it is apparent that the IRS allows for a tax deduction for losses in a property’s market value.

For our purposes, today, we’re going to focus on one property in particular: the automobile.

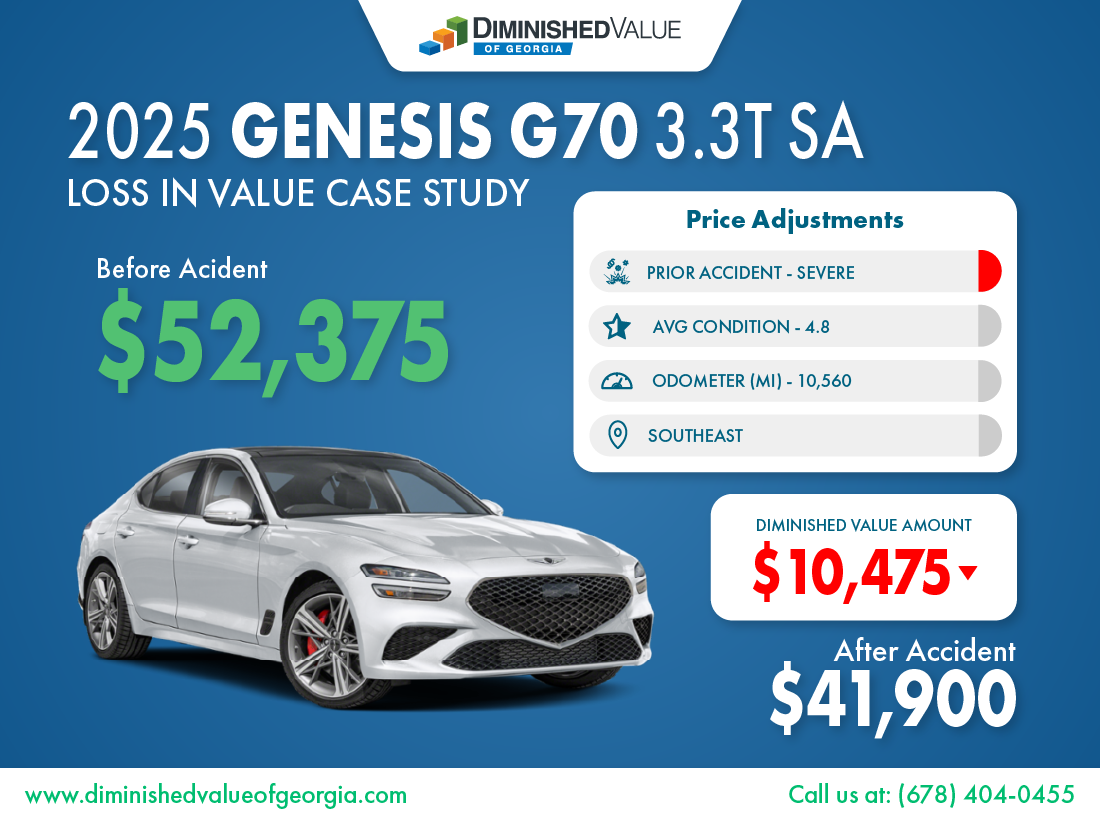

It is often stated that a car is the second most expensive purchase an American will make; so, let’s examine what happens to a vehicle’s value after a collision.

Eric walks on a dealership’s lot and observes two cars that look identical at first sight, he is intrigued. The salesman approaches us and informs him that they are both the same price, which one should I pick he wonders? The night before while looking at cars online he noticed that some dealers state that their cars have a clean Carfax, with that in mind and after having dreams about that pesky Car Fox, he asks the salesman, do you have a history report on these cars? Sure, he goes to the showroom and comes back with two reports.

Looking at the first report he notices, 1 owner, no accidents; but the second car shows a large yellow warning sign, “accident reported” it says, “severe damage reported” it adds.

Decision time, will Eric buy the one with an accident for the same money as the one without? absolutely not! One vehicle is inherently worth less money, who wants damaged goods anyway? As a buyer with unlimited choices, Eric has the power to walk away, the market value of the damaged and repaired car is a lot less in his eyes.

Unfortunately, the previous owner of the wrecked car couldn’t walk away, he got hit by a negligent driver and had to sell his vehicle at a discount. The accident caused the vehicle’s value to diminish.

Georgia’s Supreme Court decision (Mabry V State Farm) recognized as a matter of law that a vehicle cannot be completely returned to its pre-accident value because the majority of car shoppers will be interested in purchasing a car that has been through an accident or will demand a hefty discount.