Diminished Value or Total Loss Property Damage Claims: Let Us Help You Settle Efficiently

Navigating through insurance claims can be complex, but we’re here to simplify the process for you. Whether it’s Diminished Value or Total Loss, our expertise in negotiating settlements ensures a fair resolution.

Why do you need our help in settling your claim?

Many insurance policies include an appraisal clause, allowing both parties to reconcile valuation differences through third-party appraisers. H

Here’s what a sample appraisal clause states:

If you (insured, vehicle owner) and we (insurance company or insurer) fail to agree on the amount of loss (total loss or loss in value), either one can demand the loss to be set by appraisal. Either side shall make a written demand for appraisal, each side shall select a competent, independent appraiser. The appraisers shall then set the amount of loss. If the two appraisers fail to agree within a reasonable time, they shall submit their differences to the umpire. Written agreement by any two is binding. The cost of hiring the umpire shall be divided equally between the insurer and the insured.

Appraisal Clause Settlement Services:

-

Efficient Negotiation: We aim to settle claims within a few days, starting with amicable discussions with the adverse appraiser.

-

Umpire Support: In rare cases (5%), an umpire may be required to resolve disputes, ensuring a fair and unbiased outcome.

-

Policy Insights: Not all policies have an appraisal clause; for example, State Farm policies only include it for ACV claims.

-

Scope of Services: We specialize in first-party insurance claims, focusing on property damage. Unfortunately, we cannot negotiate third-party claims.

-

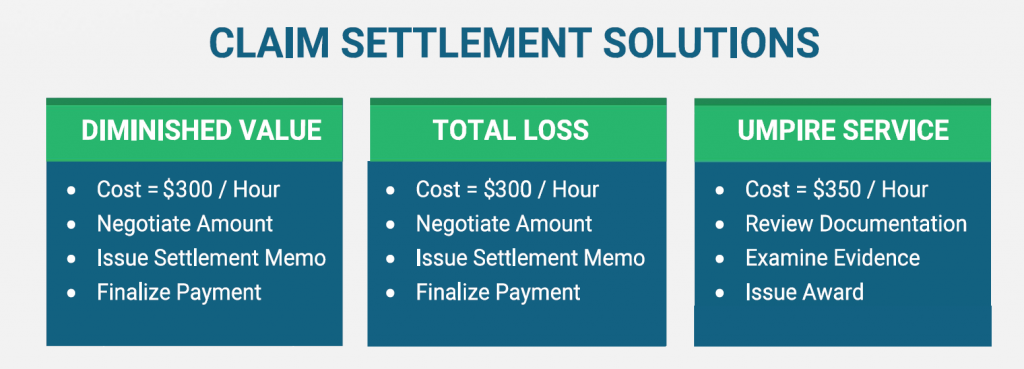

Transparent Billing: Our settlement services operate on a flat hourly rate, ensuring transparency and fairness in all interactions.

-

No Percentage Fees: Unlike attorneys, we don’t take a percentage of your settlement. Our commitment is to efficient service, not a share of your claim.

-

Expert Testimony: Should your case go to trial, expert testimony services are available separately, providing additional support.

As licensed adjusters, we are equipped with the skills to promptly and efficiently handle your insurance claims. Let us guide you through the process and secure the settlement you deserve.