When your car is damaged in an accident, it’s not just the repair costs that matter. Your vehicle also loses value—even after it’s fixed. That’s where an independent appraisal comes in.

But here’s the big question:

Will the insurance company accept the amount shown in your appraisal?

This article gives you a clear answer. You’ll learn:

- When and why insurance companies accept appraised values

- Why some appraisals are rejected outright

- How the commonly used 17C formula works—and why it’s often unfair

- What makes a car appraisal legally strong and credible

- Why choosing the right licensed appraiser can make all the difference

By the end of this article, you’ll know exactly what to expect when submitting your appraisal—and how to do it the right way.

Will the Insurance Company Really Accept My Appraisal?

Yes—if it’s credible, compliant, and well-documented. Insurance companies aren’t required to accept every appraisal. But they must consider a valid proof of loss. And that’s exactly what a properly documented appraisal is.

What the Law Says in Georgia

Under Georgia law, insurers are required to accept and evaluate any legitimate proof of loss submitted by the policyholder. This includes a professionally prepared appraisal report. As outlined in the Georgia Insurance Commissioner’s directives, insurers must not dismiss reasonable documentation submitted in support of a claim, especially in diminished value cases.

This legal framework empowers you to present your own evidence of your vehicle’s actual market loss. Insurance companies are obligated to give it fair consideration.

Legal Basis:

According to O.C.G.A. § 33-4-6, failure to evaluate a valid proof of loss in good faith can expose insurers to penalties, interest, and attorney fees.

What Insurance Adjusters Look For

When reviewing an appraisal, insurers check for:

- Licensing and Credentials Is the appraiser state-licensed? Do they have industry certifications?

- USPAP Compliance Does the appraisal follow the Uniform Standards of Professional Appraisal Practice (USPAP)?

- Neutrality Is the appraisal realistic and fact-based—or inflated to pressure the insurer?

Insurance companies are more likely to accept appraisals from professionals they recognize as ethical and accurate.

In Georgia, you’re allowed to submit your own appraisal even if you were at fault. It’s your legal right to claim diminished value.

What Happens If You Use the Wrong Appraiser?

Hiring the wrong appraiser can do more harm than good. Instead of helping your claim, a bad appraisal can cause delays, denials, or even damage your credibility with the insurance company.

Here’s what to watch out for—and why it matters.

⚠️ Your Claim Could Be Rejected

Insurance companies are quick to spot red flags. They often reject appraisals that:

- Come from unlicensed or unknown individuals

- Include inflated values with no supporting data

- Can’t be defended in a legal setting

Once an appraisal is rejected, your claim becomes harder to support, even with a new one.

⚠️ You Could Lose Money and Time

A weak appraisal wastes more than your money. It can delay your claim by weeks or months, forcing you to:

- Go back and hire another appraiser

- Resubmit paperwork

- Re-explain your case from scratch

And if the first appraiser damages your credibility, the second one may not have a chance to fix it.

⚠️ You Risk Legal Trouble

Some appraisers intentionally inflate values, hoping to “leave room to negotiate.” But this is a dangerous game.

Presenting false or exaggerated information to an insurer can be considered bad faith or misrepresentation. That’s a legal risk—one you don’t want to take.

How to Spot a Bad Appraiser

Avoid appraisers who:

- Only offer instant, online-only reports

- Charge based on a percentage of your claim

- Can’t show licensing credentials

- Have no reviews or verified business presence

- Refuse to appear in court or back up their report if challenged

Red Flags:

No physical office, vague pricing, no refund policy, or inflated promises like “guaranteed highest payout.”

Hiring a qualified, licensed professional isn’t just smart—it’s essential. It’s the difference between being taken seriously and being dismissed.

Check out Seven things to look for when choosing an appraisal company.

Why Diminished Value of Georgia Reports Get Accepted

Insurance companies are familiar with us—and they know we don’t cut corners. At Diminished Value of Georgia, our appraisals are built to be accepted, whether by an adjuster or in court.

Here’s why our reports carry weight.

1. Trusted by Insurers, Respected in Court

Led by Tony Rached, our team has completed over 10,000 appraisals. Our reports have helped settle thousands of claims—without court involvement in most cases.

- 90% of our claims are resolved amicably after submitting our report

- Our appraisers are licensed, insured, and recognized by legal and insurance professionals alike

- We’ve been featured by WSB-TV, CBC, and 640 WGST Radio

We don’t just meet the standard—we raise it.

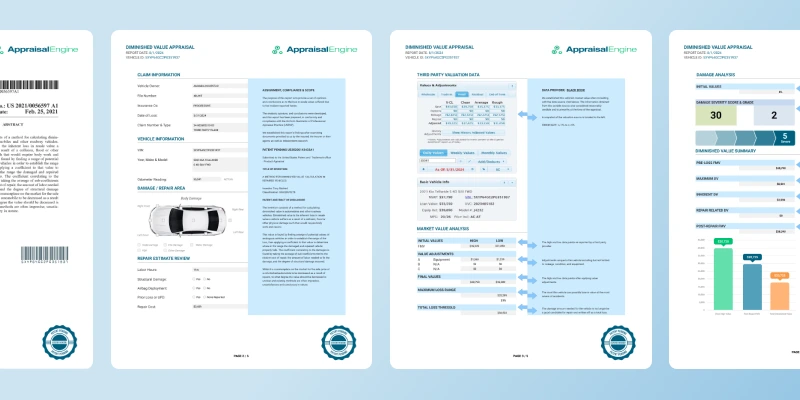

2. We Use a Patent-Pending Appraisal Method

Unlike many appraisers who rely on outdated formulas or gut guesses, we’ve developed a patent-pending methodology for vehicle appraisal that ensures accuracy, consistency, and defensibility.

This proprietary system:

- Calculates real-world loss using current market data

- Applies consistent logic across every case

- Stands up under scrutiny from both insurers and courts

It’s one of the reasons our reports get taken seriously—because the methodology behind them is solid, tested, and unique.

Unlike our method, insurance companies often use the outdated 17C Formula, which undervalues claims in 90% of cases and minimizes payouts. Our appraisal process is built to reflect true market value, not insurance shortcuts.

3. Designed to Be Accepted

Every report we produce is:

- USPAP-compliant and backed by licensed professionals

- Detailed with comparable vehicle data and repair analysis

- Built to support diminished value or total loss claims with real evidence

We also operate under a clear refund policy and pricing structure—no guesswork, no commissions, no inflated values.

Want to see what sets us apart? Learn more about why drivers across Georgia choose Diminished Value of Georgia to handle their claims with integrity and results.

4. Transparent Pricing and a Real Refund Policy

We believe in doing things the right way—not just the easy way. That’s why we offer a clear, upfront pricing model with no percentage-based fees and no surprises.

And if your appraisal doesn’t result in a meaningful increase, you may qualify for a refund. In fact, if your final increase in settlement is less than the appraisal fee, we will refund 100% of your appraisal cost.

We stand behind our work with confidence, and we back it with a fair, published refund policy that protects you from risk.