If you’ve been involved in a car accident, you’ve likely heard the term “claimant.” But what does it really mean? Understanding who the claimant is—and how that role affects your insurance claim—is crucial.

In this article, you’ll learn what a claimant is in a car accident, how to tell if you’re a first party or third party claimant, and why that distinction matters.

By the end, you’ll know exactly how your role as a claimant shapes your legal rights, insurance responsibilities, and potential compensation.

Understanding the Claimant in a Car Accident

In auto insurance, a claimant is anyone who files a claim after a car accident. This could be the person responsible for the crash, the person affected by it, or even a bystander who suffered damages.

There are two main types of claimants: first party and third party. Your classification depends on your relationship to the insurance policy and whether you are at fault.

Knowing which one you are is important because it impacts how you file your claim and what legal rules apply.

The claimant plays a key role in the claims process. They initiate the insurance claim, negotiate settlements, and may need to prove damages or liability.

Understanding your role helps protect your rights and ensures you follow the correct procedures.

First Party vs. Third Party Claimants

Understanding whether you are a first party or third party claimant is essential. This classification determines how you file your claim, who pays for damages, and what laws apply to your situation.

Who Is a First-Party Claimant?

A first party claimant is the insured person who files a claim under their own insurance policy. This happens when you seek coverage from your insurer for your own damages.

For example, if you rear-end another car, you are considered the first party. You may file a claim with your insurer to cover the repairs to your vehicle.

Who Is a Third-Party Claimant?

A third party claimant is someone who files a claim against another person’s insurance company. This typically happens when you are not at fault for the accident but suffered damages.

Using the same example, the driver you rear-ended would be the third party. They would file a claim with your insurance for their vehicle damage and any related costs.

For a more detailed comparison, visit this First Party vs. Third Party Claims guide.

First Party Diminished Value Claims

When you file a diminished value claim under your own insurance policy, it’s considered a first party claim. This is based on a contractual relationship between you and your insurer.

How First Party Claims Work

As a first party claimant, your recovery is governed by contract law. That means the terms of your insurance policy dictate what you can claim and how disputes are resolved.

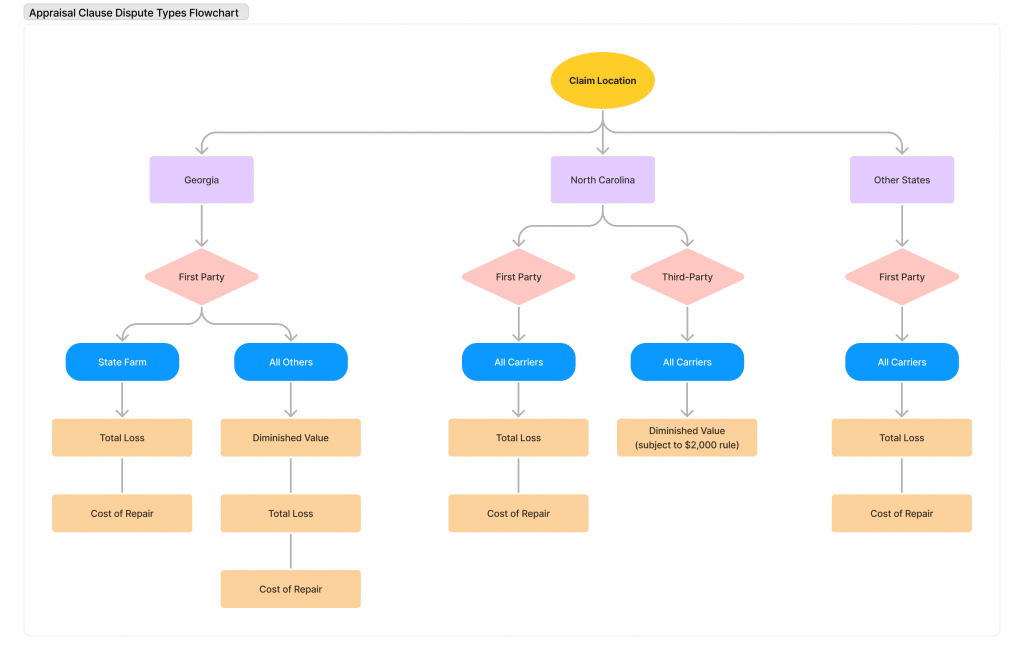

Currently, Georgia is the only state that requires insurance companies to compensate their own insured for the loss in value of their vehicle after an accident. This makes first party diminished value claims rare in most other states.

The Appraisal Clause Explained

If you and your insurance company disagree on the amount of diminished value, your policy likely includes an appraisal clause. This clause outlines how disputes over the value of your claim can be resolved without going to court.

Typically, both you and the insurer select independent appraisers. If they can’t agree, an umpire is chosen to make the final decision. This process ensures that both sides have a fair opportunity to present their valuations.

For more details about claim deadlines in your state, visit this state-by-state guide to diminished value statutes of limitations.

Third Party Diminished Value Claims

When you file a diminished value claim against someone else’s insurance policy, it is considered a third party claim. These claims are based on tort law, not contract law.

How Third-Party Claims Work

Since there is no contract between you and the other driver’s insurance company, your right to recover depends on proving that their insured was negligent.

If successful, you can claim compensation for both the physical damage and the loss in value of your vehicle.

Unlike first party claims, third party claims often involve negotiation. Without a binding contract, both parties typically work out a settlement to avoid going to court.

Direct vs. Indirect Losses

Third party claims can cover both direct and indirect losses:

- Direct Loss: This includes physical damage, like dents, broken parts, or frame damage to your vehicle.

- Indirect Loss: These are additional damages such as diminished value, loss of use, or even pain and suffering.

Understanding these categories helps you know what to request when filing a third party claim.

Special Case: Uninsured and Underinsured Motorist Coverage

Sometimes, the driver at fault doesn’t have insurance or doesn’t have enough coverage to pay for your damages. In these situations, your own insurance policy may include Uninsured Motorist (UM) or Underinsured Motorist (UIM) coverage.

When you use this coverage, your insurance company steps in as if it were the other party’s insurer. Even though you’re filing a claim for someone else’s negligence, it is still treated as a first party claim.

This distinction is important because it affects how the claim is handled and the procedures you must follow. Always review your policy to understand what UM and UIM coverage you have and how it applies.

Final Thoughts

Understanding whether you are a first party or third party claimant is essential to protecting your rights.

Your role affects how you file your claim, who you negotiate with, and what compensation you can recover.

Always be aware of the statute of limitations that applies to your claim. Missing these deadlines can prevent you from receiving the compensation you deserve.

If your claim is complex or if negotiations stall, consider seeking professional assistance. An experienced appraiser or attorney can help ensure that your rights are protected and that you get the fair settlement you’re entitled to.