In 2023, car dealerships across the country faced a tough reality. Despite working hard to sell cars and keep their businesses running, their pretax profits dropped almost 20% in just nine months.

This was a big change from the past, especially after dealing with all the ups and downs in the economy. Let’s dive into what’s really happening behind these numbers and see how dealerships are dealing with these new challenges.

Understanding Auto Dealership Profit Decline in 2023 (PDF)

The Unveiling of Startling Figures

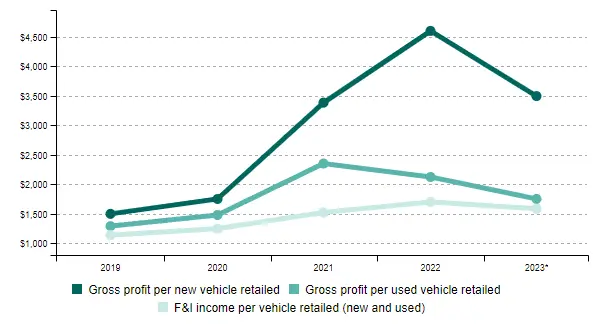

According to an inaugural report by the Presidio Group and NCM Associates, the average dealership witnessed a significant dip in profitability. Pretax profits fell by 19.5%, while the gross profit per new vehicle sold plummeted by 26% compared to the previous year. This data, harvested from about 4,400 franchised dealerships, paints a picture of the sector grappling with “The Great Normalization” post-COVID-19.

A Historical Perspective

The journey hasn’t always been so tumultuous. In 2019, dealership profits surged by 11%, followed by an impressive 43.2% increase in 2020. 2021 was a golden year with a 111.8% jump, symbolizing peak profitability during the pandemic. However, the tide began to turn in 2022, with a 5.1% decline, setting the stage for the current downturn.

Underlying Factors

Several dynamics have influenced this shift. Increasing inventory levels have reduced per-vehicle sales profitability while rising interest rates have escalated operational costs. Despite these challenges, average dealership revenues saw a marginal increase to $62.8 million through Q3 of 2023, suggesting a complex economic environment.

| Slight Increase in Average Car Dealership Revenue | |

|---|---|

| 2019 | $73🔺 |

| 2020 | $70.2🔺 |

| 2021 | $82.8🔺 |

| 2022 | $82.3🔺 |

| 2022* | $62🔺 |

| 2023* | $62.8🔺 |

The Role of Data and Insight

With the National Automobile Dealers Association ceasing the release of average dealership financial profiles in 2021, the Presidio Group and NCM have stepped in to fill this knowledge gap. Their partnership aims to provide valuable insights to dealers navigating these uncertain times.

The Evolving Automotive Business

Paul Faletti, CEO of NCM Associates, emphasizes the importance of this data in helping dealers manage their businesses amidst rapid industry evolution. Despite the decline in pretax profits, the average dealership’s income from 2018 through 2022 was still 219% higher than in 2018, showcasing the sector’s resilience.

As we conclude this journey through the ups and downs of dealership profitability in 2023, it’s clear that the automotive industry is in a state of transformation. Dealerships are navigating a landscape marked by economic fluctuations and changing consumer behaviors.

The data from Presidio and NCM not only provides a snapshot of the current scenario but also serves as a guiding light for future strategies. In this ever-evolving market, one question remains: How will dealerships adapt and thrive in the face of these new challenges?