The Rise of Credit Unions in the Auto Financing Market (PDF)

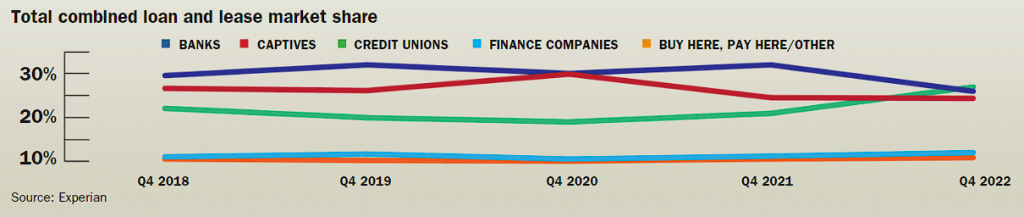

Credit unions are expected to remain strong competitors in the auto financing market in 2023, following their exceptional performance in 2022. During Q4 of 2022, credit unions originated 27% of all auto loans and leases, making them the largest share of the market. Additionally, they financed more used vehicles than any other type of lender, accounting for 31% of used vehicle financing during the fourth quarter.

| Average Interest rates on new-vehicle loans | ||||

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |

| Banks | 4.5% | 5.3% | 6.1% | 6.9% |

| Captives | 3.5% | 4.2% | 4.7% | 5.4% |

| Credit unions | 3.5% | 3.7% | 4.5% | 5.3% |

| Average Interest rates on used-vehicle loans | ||||

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | |

| Banks | 6.8% | 7.7% | 8.4% | 9.3% |

| Captives | 7.3% | 7.9% | 8.8% | 9.1% |

| Credit unions | 5.2% | 5.3% | 6% | 6.9% |

Credit Unions Outperform Competitors in Auto Financing Market

Recent reports suggest that the gap between what credit unions offer and what banks and captive finance companies offer has grown significantly. In the first three months of 2022, credit unions charged a 5.2% interest rate for used-vehicle loans, which was 1.6% less than banks and 2.1% less than captive finance companies. By Q4 of 2022, credit unions had increased their rates to 6.9%, but still maintained a 2.2% advantage over captive finance companies and a 2.4% advantage over banks.

Credit union borrowers with lower credit scores can benefit even more from their lower interest rates. In October, the median deep-subprime customer received an 8.8% interest rate from a credit union on a 72-month loan, which was 2.5 percentage points lower than what banks offered and 9 percentage points lower than what captive finance companies offered.

Despite shrinking interest rate spreads between credit unions and other lenders, Melinda Zabritski, Experian’s senior director of automotive financial solutions, believes credit unions will remain highly competitive in 2023.

Credit unions’ lower interest rates can challenge dealerships in terms of profits from vehicle financing. This is evident in the case of Langdale Ford, which has an indirect lending relationship with four credit unions. Three of these credit unions do not offer competitive rates and do not provide a dealer margin for handling the loan, while the fourth allows for a margin but is often not added by Langdale Ford due to the uncompetitive offering.

Credit unions continue to attract borrowers due to their advantageous features. As non-profits devoted exclusively to their members, credit unions do not have to pay federal corporate income tax and can use deposits to finance loans without incurring expensive capital. The pandemic generated significant deposits in 2022, leaving credit unions with ample lending capital. While savings levels slightly dropped in 2022, they are still expected to rise by 6% in 2023.

Overall, credit unions remain strong competitors in the auto financing market due to their lower interest rates and unique features. While their competitiveness may pose a challenge to dealerships’ profit margins, credit unions’ focus on their members and favorable financing terms are likely to keep them competitive for the foreseeable future.