The Rise of Cash Deals in F&I Offices (PDF)

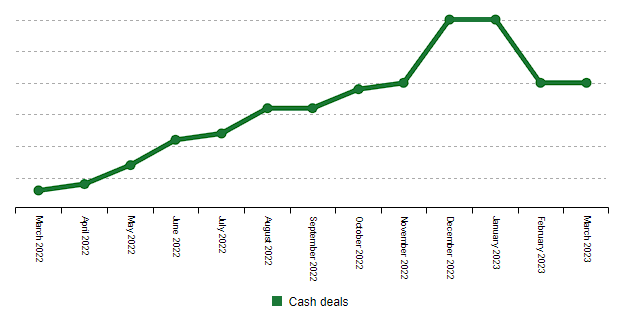

The percentage of “cash deals” in auto dealership finance-and-insurance (F&I) offices have been steadily increasing over the past year. This trend, however, poses a challenge for dealerships as they earn revenue by arranging loans between lenders and consumers. When customers pay in cash or through cashier’s or personal checks, dealerships miss out on this source of income. Furthermore, cash deals can potentially hinder the sale of F&I products, as consumers typically finance these products within their auto loans. Finance managers must then persuade cash buyers to pay for these products separately or take out a loan specifically for coverage.

A Shift in Consumer Behavior

Various statistics indicate a rise in cash deals within the automotive market. StoneEagleMETRICS, an F&I menu, and analytics provider, reported that the percentage of cash deals without outside financing increased from 8.3 percent to 10 percent for new and used-vehicle transactions in March compared to the previous year. Experian’s data also revealed a shift, with the proportion of new vehicles financed decreasing from 85 percent to 81 percent, indicating an increase in cash buyers from 15 percent to 19 percent. Similarly, for used vehicles, cash deals rose from 59 percent to 60 percent of the market.

Managing the Impact

Finance managers are facing new challenges as cash deals become more prevalent. G.P. Anderson, a finance manager at Thielen Motors, highlighted the frustration of not getting paid on cash deals and the impact it can have on the finance team. However, Anderson approaches cash buyers as an opportunity, providing a positive experience that sets his dealership apart from competitors who may have adopted a more adversarial approach.

Exploring the Reasons

The rise in cash deals can be attributed to several factors, one of which is the sticker shock experienced by customers due to increased interest rates. Many customers are unaware of the current interest rates, which can be significantly higher than what they paid for their previous loans. As a result, customers opt to pay in cash instead of financing their purchases.

The Road Ahead

Industry experts believe that the current trend of cash deals will eventually level out. While interest rates continue to fluctuate, the long-term impact on consumer behavior remains uncertain. Finance managers are finding ways to adapt to the changing landscape and provide positive experiences for cash buyers. It remains to be seen how the industry as a whole will respond and whether the prevalence of cash deals will persist in the future.

As cash deals become more common in F&I offices, dealerships are facing new challenges in maintaining their revenue streams. The shift in consumer behavior towards paying in cash has implications for both finance-and-insurance products and overall dealership profitability. Finance managers are adopting different approaches to handle cash buyers and provide a positive experience. While interest rates and market dynamics continue to fluctuate, the industry will need to adapt and find innovative solutions to navigate this changing landscape effectively.