The Commercial Trucking Market Cooled Down in Q1 2023: An Analysis (PDF)

The commercial truck market experienced a tumultuous ride in 2022, with soaring prices and high activity levels. As the year progressed, a semblance of normalcy emerged, but concerns about economic challenges persisted. However, in the first quarter of 2023, the market reflected worries about a potential recession, slowing demand, and rising interest rates. Despite these challenges, the cooldown in the market may present some positive opportunities for manufacturers, sellers, and buyers alike.

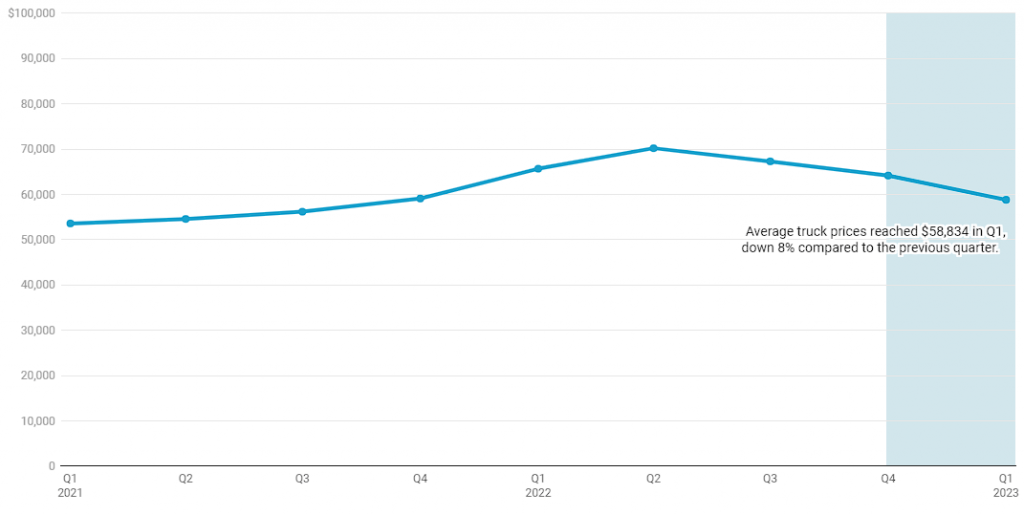

Declining Prices in Q1:

After years of steady price increases, commercial truck values witnessed a decline for the third consecutive quarter. This downward trend brought relief to buyers who had been grappling with high prices. Average truck prices reached $58,834, representing an 8% decrease compared to the previous quarter. The decline was mainly driven by heavy-duty trucks, as illustrated in the accompanying chart.

The Average Price of Heavy and Medium Duty Trucks

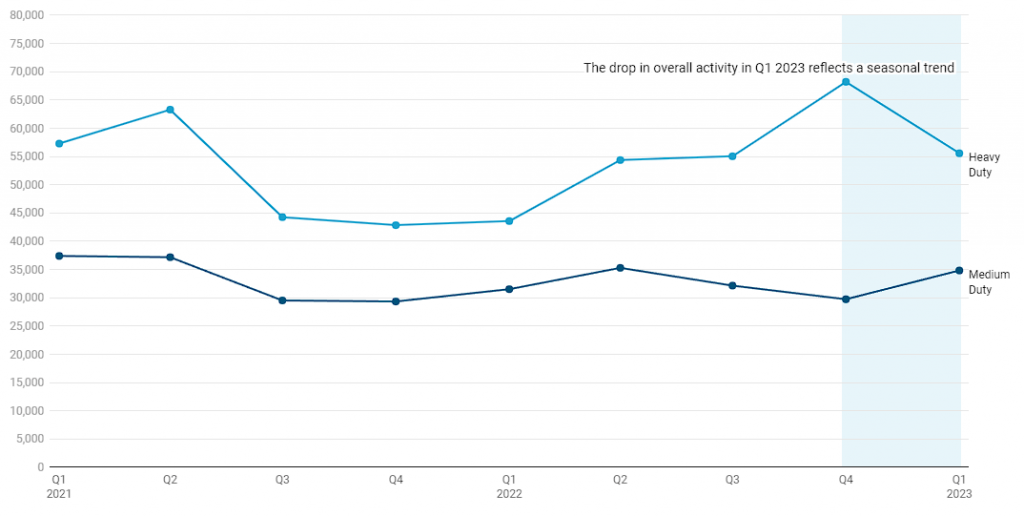

Changes in Average Mileage

During the first quarter, average mileage decreased by 8%. However, a closer analysis revealed that this decline was primarily influenced by heavy-duty trucks. Surprisingly, average mileage for medium-duty trucks actually increased, reaching its highest levels in the past two years. This trend can be attributed to the rise of last-mile logistics and the wider adoption of Class 6 and Class 7 vehicles. Fleet owners opt for these vehicle classes to address labor challenges, as they do not require a Commercial Driver’s License (CDL).

The Average Mileage of Heavy and Medium Duty Trucks

Impact of Age on Market Activity

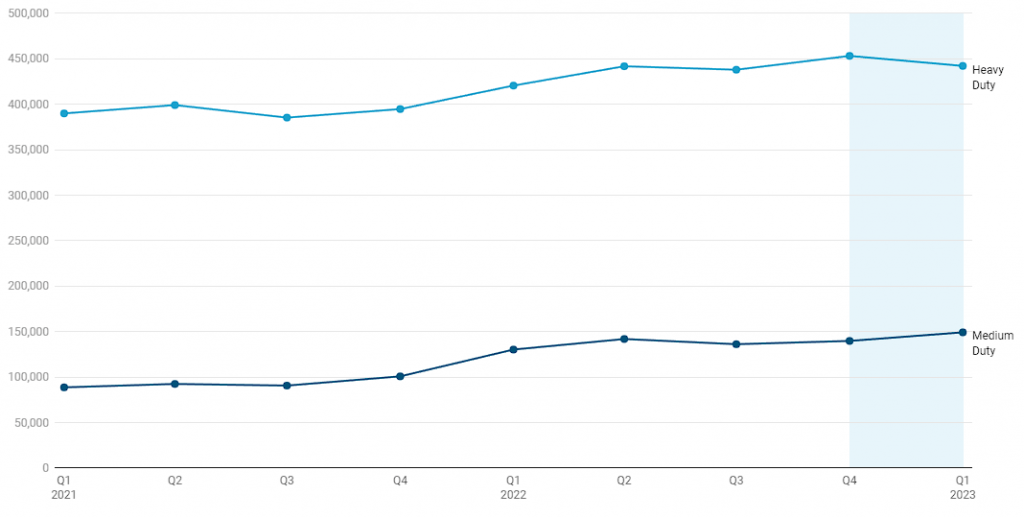

Although the average mileage for heavy-duty trucks decreased, the average age of these vehicles increased. Even when considering the age bump associated with a new year, heavy-duty trucks on the market were older compared to medium-duty trucks. Limited inventories and stagnant supply chains have significantly impacted the market, with the average age of both medium- and heavy-duty trucks increasing by nearly two years since Q1 2021.

Heavy-Duty Trucks and Medium-Duty Trucks Market Activity

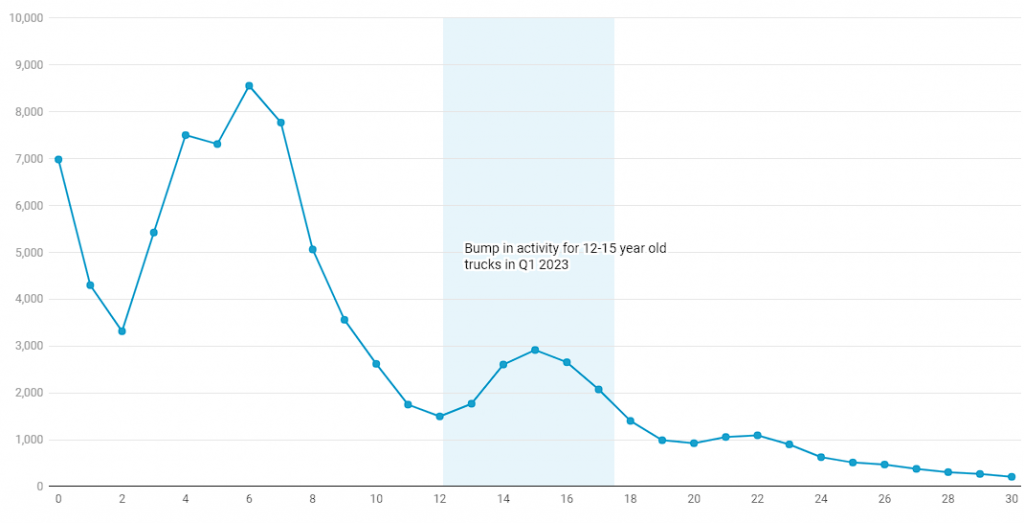

Activity Trends by Age

Total market activity declined in Q1 2023, following the typical seasonal trend. However, medium-duty trucks bucked the trend and experienced a 17% increase in sales. Analyzing activity by age, it was found that trucks that were four to six years old were most commonly sold. At this stage, owners typically sell trucks they had purchased new to refresh their fleets. Additionally, there was a notable increase in activity for trucks aged 12 to 15 years, likely due to buyers selling slightly used vehicles they had acquired.

Market Activity by Age of Vehicles on a Quarterly Basis

Opportunities in the Market Cooldown

The soaring demand for commercial trucks in recent years coupled with limited supply has created challenges for buyers. While the available inventory’s age and mileage may not be ideal for many, the decline in prices offers a welcome respite. This cooldown period presents an opportunity for manufacturers and sellers to address supply chain issues and for buyers to have more flexibility with their budgets.

Overall, the commercial truck market experienced a cooldown in the first quarter of 2023, driven by concerns about a potential recession, slowing demand, and rising interest rates. This cooldown brought about declining prices, primarily in heavy-duty trucks, and changes in average mileage. Additionally, the market experienced fluctuations in activity based on the age of the trucks being sold. While challenges remain, the decrease in prices offers a positive outlook for buyers. Continued monitoring of these trends will provide further insights throughout the year, shedding light on the evolving dynamics of the commercial truck market.