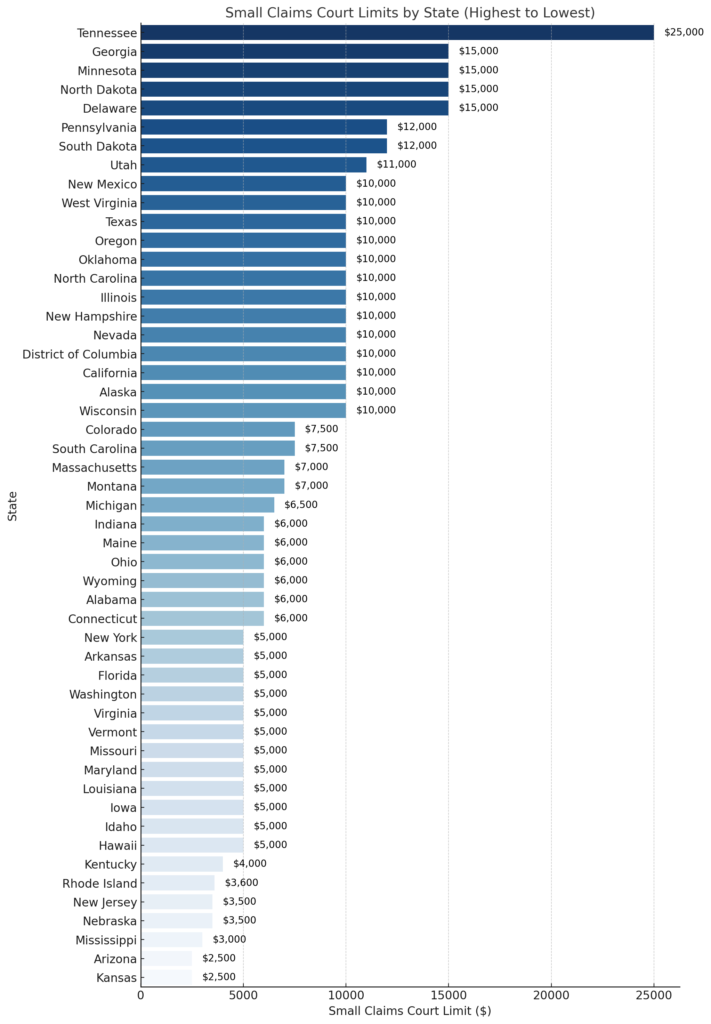

If you’re considering taking legal action, small claims court is often the easiest and most affordable way to resolve a dispute. Each state has a maximum lawsuit limit, which determines how much money you can sue for in small claims court.

Some states allow claims as high as $25,000, while others cap cases at just $2,500. If your claim exceeds the limit, you may need to explore other legal options.

By the end of this article, you’ll find:

- A state-by-state list of small claims court limits

- A downloadable guide for quick reference

- What to do if your claim is too large for small claims court

State-by-State Small Claims Court Limits

Want a quick reference? Click here and download our free small claims limit guide.

Below is a breakdown of maximum lawsuit amounts in small claims court for all 50 states.

| State | Small Claims Court Limit | Exceptions |

|---|---|---|

| Alabama | $6,000 | |

| Alaska | $10,000 | |

| Arizona | $3,500 | |

| Arkansas | $5,000 | |

| California | $10,000 | Plaintiffs can only file claims for over $2,500 twice a year. Businesses are limited to $5,000. |

| Colorado | $7,500 | |

| Connecticut | $5,000 | Security deposit claims have different rules. |

| Delaware | $15,000 | |

| District of Columbia | $10,000 | |

| Florida | $5,000 | |

| Georgia | $15,000 | No small claims limit for eviction cases. |

| Hawaii | $5,000 | No limit on landlord-tenant security deposit cases. |

| Idaho | $5,000 | |

| Illinois | $10,000 | |

| Indiana | $6,000 | $8,000 in Marion County. |

| Iowa | $5,000 | |

| Kansas | $4,000 | |

| Kentucky | $2,500 | |

| Louisiana | $5,000 | No limit on eviction cases. |

| Maine | $6,000 | |

| Maryland | $5,000 | |

| Massachusetts | $7,000 | No limit on vehicle damage claims. |

| Michigan | $6,500 | |

| Minnesota | $15,000 | $4,000 for consumer credit cases. |

| Mississippi | $3,500 | |

| Missouri | $5,000 | |

| Montana | $7,000 | |

| Nebraska | $3,600 | Adjusted every five years based on inflation. |

| Nevada | $10,000 | |

| New Hampshire | $10,000 | |

| New Jersey | $3,000 | $5,000 for security deposit disputes. |

| New Mexico | $10,000 | |

| New York | $5,000 | $3,000 in town and village courts. |

| North Carolina | $10,000 | |

| North Dakota | $15,000 | |

| Ohio | $6,000 | |

| Oklahoma | $10,000 | |

| Oregon | $10,000 | |

| Pennsylvania | $12,000 | |

| Rhode Island | $2,500 | |

| South Carolina | $7,500 | |

| South Dakota | $12,000 | |

| Tennessee | $25,000 | No limit for eviction cases. |

| Texas | $10,000 | |

| Utah | $11,000 | |

| Vermont | $5,000 | |

| Virginia | $5,000 | |

| Washington | $5,000 | |

| West Virginia | $10,000 | |

| Wisconsin | $10,000 | No limit for eviction cases. |

| Wyoming | $6,000 |

What If Your Claim Exceeds the Small Claims Limit?

If your claim is too large for small claims court, you still have options.

Other Legal Options for Higher-Value Claims

- File your lawsuit in civil court, where there is no maximum limit.

- Work with an attorney to explore alternative legal avenues.

- Negotiate a settlement before going to court.

When to Consider Mediation or Civil Court

- Mediation is faster and cheaper than court.

- Civil court allows for higher-value claims but may take longer.

- Some disputes, like auto insurance claims, may be resolved outside of court.

Small Claims Court and Auto Insurance Disputes

Auto insurance claims often turn into frustrating disputes, especially when an insurer refuses to pay a fair settlement. While small claims court provides a legal avenue to recover damages, not every case qualifies.

Can You Sue an Insurance Company in Small Claims Court?

Yes, you can sue an insurance company in small claims court. Many policyholders use small claims court when their insurer:

- Refuses to pay for diminished value after an accident

- Delays or denies a valid claim without reason

- Underpays a settlement, leaving you with out-of-pocket expenses

If you were in an accident, the at-fault driver’s insurance is responsible for paying your car’s lost value—this is called a third-party diminished value claim. However, even if you were at fault, some states, like Georgia, allow you to file a diminished value claim against your own insurance carrier.

In 90% of cases, you won’t need a lawyer or a lawsuit against your insurer or the at-fault party. Most claims settle fairly when handled correctly. However, a lawsuit may be necessary if you have a strong claim and have exhausted all negotiation attempts.

Follow this step-by-step guide on how to file a diminished value claim to ensure you take the right steps.

Learn more about suing for diminished value after selling your car and see if you still have a case.

Even if you’ve already sold your car, you may still qualify for a diminished value claim, as long as you file within your state’s legal time frame.

Don’t wait too long to file! Each state has a strict statute of limitations for diminished value claims. If you’re unsure how much time you have, check the diminished value statute of limitations by state to avoid missing your deadline.