Open Lending Expands Eligibility to Older Cars (PDF)

As the average age of cars on American roads increases, more and more people are lowering their credit scores by seeking out financing for older vehicles. Data from S&P Global indicates that in 2022, these consumers financed cars for an average of 6.4 years. In response, Open Lending has expanded its eligible pool of vehicles to include models that are up to 11 years old.

However, Open Lending maintained its limit of 150,000 miles on mileage. This decision was made based on a study, which identified that a 9-year-old car and an 11-year-old model with similar mileage posed the same level of risk to the lender. Banks’ biggest concern is that a customer with an older vehicle could experience severe mechanical problems and not be able to afford to fix it, resulting in a loan default.

According to revenue director Matt Roe, the risk is not determined by the age of the vehicle, but by its mileage. Open Lending has decided to expand the eligibility age ranges to a wider range of borrowers. However, some creditors still have not adhered to the changes due to the need to update their internal policies, and not because of doubts about the advantages of the measure.

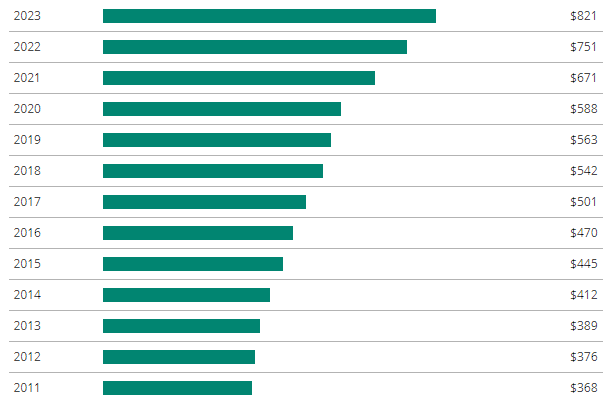

Used-vehicle loan payment by model year

Financing Older Vehicles: The Changing Landscape

Financing for older cars is on the rise, due to affordability limitations and limited supply chain issues from manufacturers. Experian data shows that 9-year-old vehicles accounted for 5.2% of loans in 2022, up from 3.9% in 2020. Additionally, 11-year-old vehicles accounted for 3% of loans, up from 1.9% in 2020 and down from 3.2% in 2019. However, 18% of used vehicle loans in 2022 were for vehicles aged 9 years or older, one point lower than the number recorded in 2019.

S&P Global Mobility pointed out that in January 2022 the average age of light vehicles on American roads was 12.2 years, about 2 months more than the previous year. This trend has caused dealership lots to contain more vehicles between 10 and 11 years old, requiring dealers to have a lender to finance older models.