As winter’s chilly curtain draws to a close and the vibrant palette of spring begins to unfold, the realms of powersports and classic cars are igniting with a flurry of activity, prepping for a season brimming with promise and potential.

March, with its blend of farewell to frost and a welcome to warmth, serves as a pivotal juncture in the calendar, heralding a period rich in evolution and excitement. So, why not pour yourself a comforting beverage and settle in?

We’re about to embark on a journey through the latest narratives and nuances that are shaping the industry at this very moment. Ready to delve into the heart of these developments with us?

March 2024 Powersports and Classic Car Market Highlights (PDF)

Powersports Market Update: A Mix of Shadows and Sunlight

Scott Yarbrough, the principal analyst at Motorcycle & Powersports, captures the current sentiment perfectly: “February is where we traditionally start to see Powersports prices take a turn upwards as dealers begin to prepare for the Spring selling season.” Yet, this year, it’s a mixed bag.

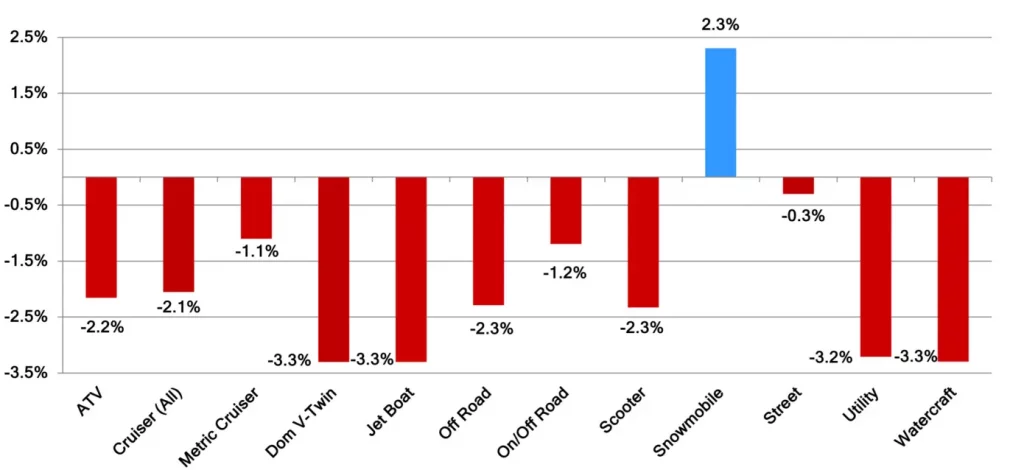

While street bikes are showing resilience, barely dipping in value by 0.8%, their cousins – cruisers, scooters, and dual sports – are facing steeper declines. It’s a post-pandemic market “correction” that’s proving to be a stubborn guest, overstaying its welcome.

The silver lining? There’s a hint that one segment might soon show positive movement. As we’ve navigated the bumpy roads since last summer, all segments, except snowmobiles, continued their downward trend in value this March.

The industry buzz at this month’s AIME show was palpable, with everyone asking: “How long until we hit a normal market?” The consensus? The consistent drops in value might soon come to an end, and by fall, we could be welcoming back “normalcy.”

Cruisers and Off-Roads: A Tale of Two Segments

Cruisers have been on a consistent decline in value since late summer, a trend mirrored across most segments. The increase in inventory levels on both new and used fronts has not helped.

On the flip side, the Off-Road segment has faced severe price declines, a remnant of the pandemic’s early days when their values spiked. But hope springs eternal, and there’s an expectation of a bounce back, especially as we head into fall, traditionally their strongest season.

The Classic Car Segment: Auctions Galore and Record Breakers

The classic car market is buzzing with excitement, thanks in part to the January auctions in Florida and Arizona. “This coming year is shaping up to be a good one,” notes Eric Lawrence, Principal Analyst, Specialty Markets.

Auction week in Scottsdale was a spectacle, with Barrett-Jackson’s event being the largest ever – a testament to the hobby’s robust health. RM Sotheby’s and Mecum’s events weren’t far behind, with record-breaking sales and an enthusiastic turnout that hints at a prosperous year ahead.

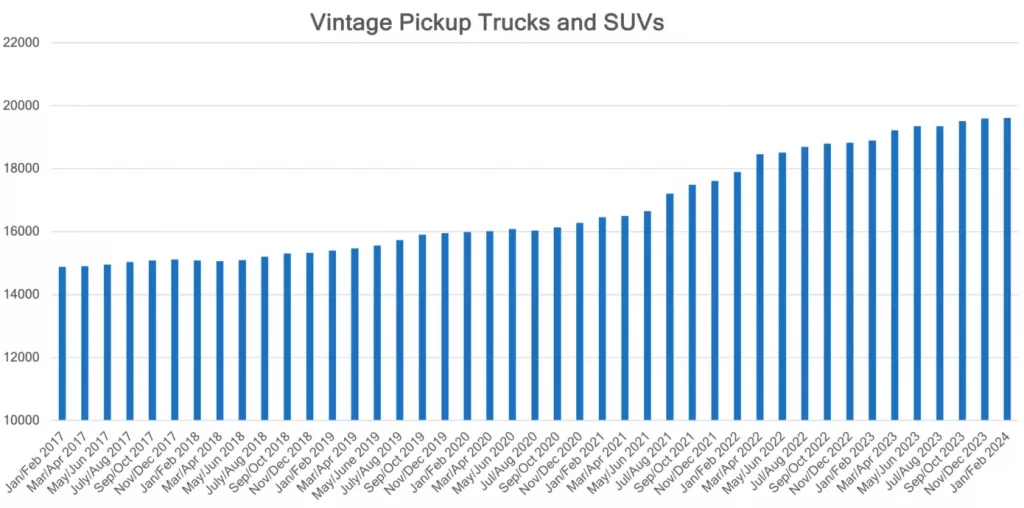

Vintage Pickups and SUVs: Riding the Wave of Popularity

The vintage pickup truck and SUV segments are on fire, with values doubling or sometimes tripling in the past few years. This enthusiasm is not limited to domestic models, as collectible SUVs built on modified truck chassis are also seeing a surge in interest.

The trend towards restomods, where classic muscle cars are fitted with modern drivetrains and amenities, continues to grow, reflecting a blend of nostalgia and contemporary convenience.

Looking Ahead: RVs, Motorhomes, and the Commercial Sector

The RV market presents a mixed picture, with motorhomes seeing a decrease in value while towables are on the rise. The overall sentiment in the commercial truck and trailer market remains cautious, with inventory levels rising and putting pressure on values. However, there’s a sense of optimism as we head into the spring selling season, with hopes pinned on stabilization and a gradual return to pre-pandemic normalcy.