Interest Rates Test Dealerships in Favorable Market (PDF)

The U.S. automotive market continues to thrive, bringing optimism to franchised dealerships across the country. According to the latest quarterly index survey conducted by Cox Automotive, dealers expressed satisfaction with the current market conditions and anticipate further growth in the coming months. However, this positive outlook is somewhat restrained by economic uncertainties and the looming issue of interest rates. In this blog post, we will delve into the survey findings and explore how dealerships are navigating the challenges they face while maintaining a buoyant attitude.

Optimism Abounds Despite Economic Uncertainty

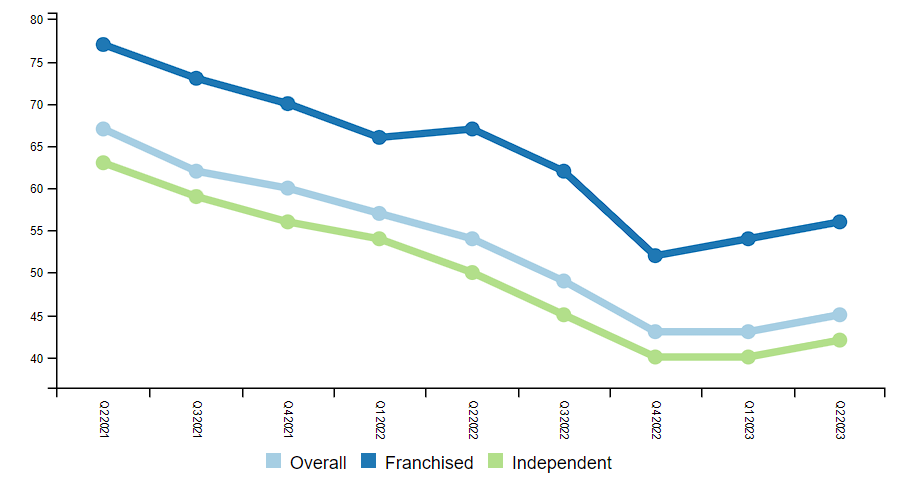

Cox Automotive’s Dealer Sentiment Index survey, which gathered insights from 568 franchised dealer representatives and 492 independent dealer personnel between April 24 and May 7, reveals a score of 56 for the current market conditions. This figure represents a two-point increase from the previous quarter, indicating dealers’ positive view of the market’s present state. Moreover, dealers expressed confidence in the market’s trajectory over the next three months, giving it a rating of 57, up by one point.

How would you describe the current market for vehicles in the areas where you operate?

Scores above 50 signify strength, while scores below 50 signify weakness.

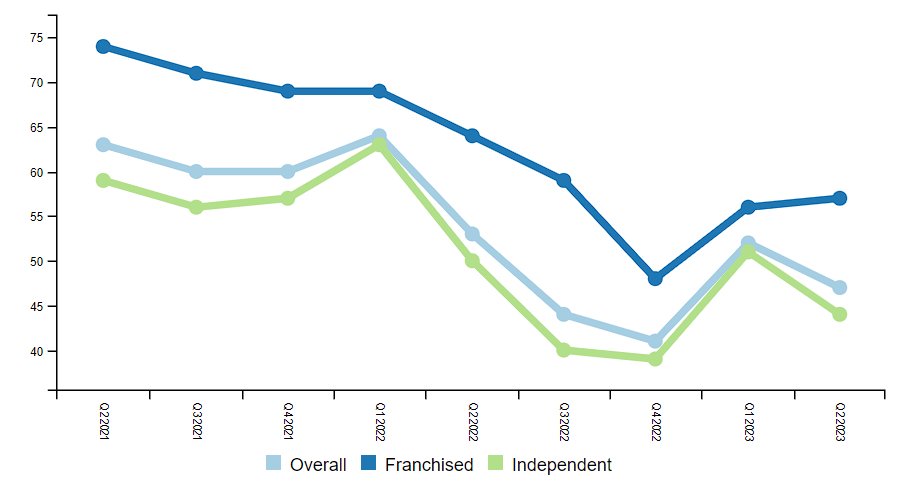

What do you expect the market for vehicles in your area to look like 3 months from now?

Scores above 50 signify strength, while scores below 50 signify weakness.

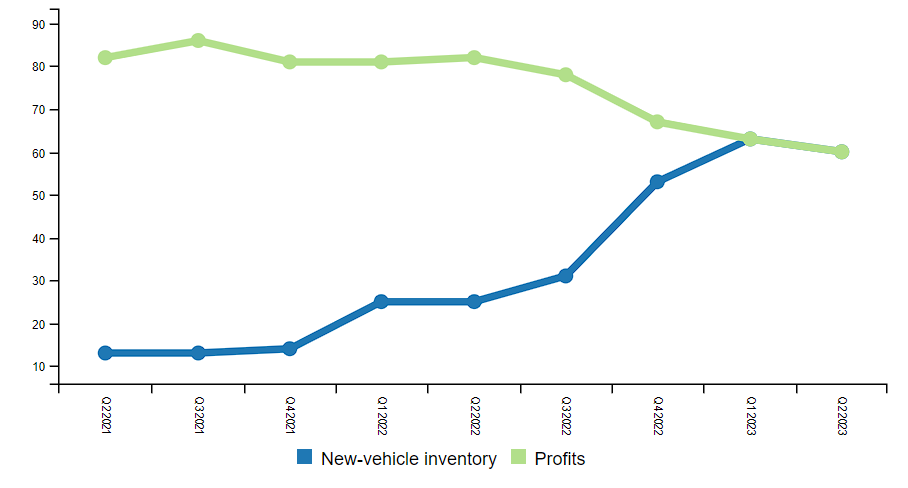

How would you describe the current new-vehicle inventory levels?

Scores above 50 signify strength, while scores below 50 signify weakness.

Interest Rates Cast a Shadow

Although dealerships remain generally positive, their optimism for the future is slightly tempered due to concerns about interest rates and economic uncertainties. Interest rates emerged as the top concern for franchised dealers, with 61% of respondents highlighting it as a hindrance. This represents a slight increase from the first quarter of 2023 and a significant jump from the first quarter of 2022 when inventory shortages were the primary concern. Cox Automotive Chief Economist Jonathan Smoke explains that dealers’ worry about economic issues has prevented them from being more optimistic about the next three months.

| Q2 2023 | Q1 2023 | Q2 2022 | |

|---|---|---|---|

| Interest rates | 61% | 60% | 16% |

| Economy | 49% | 50% | 38% |

| Limited inventory | 42% | 42% | 67% |

| Market conditions | 33% | 38% | 32% |

| Political climate | 26% | 24% | 25% |

Economic Factors and Inventory Shortages

In addition to interest rates, the overall economic climate and limited inventory pose challenges to dealerships. The survey reveals that 49% of franchise dealers identified the state of the economy as a hindrance to their business, albeit a slightly lower percentage compared to the previous quarter. Limited inventory availability remains a concern for 42% of dealerships, indicating ongoing challenges in sourcing vehicles for their customers.

Navigating Profitability and Market Conditions

Despite the hurdles, dealerships continue to adapt and find opportunities for growth. The sentiment regarding new-vehicle inventory remains positive, with dealers rating it at 60 on the Cox index. Although slightly lower than the previous quarter, this score surpasses any other period since the onset of the COVID-19 pandemic in the second quarter of 2020. Additionally, dealers’ perception of new-vehicle inventory mix improved from a score of 50 in the first quarter of 2023 to 53 in the second quarter.

Profitability, however, has experienced a decline for the second consecutive quarter, dropping from a score of 63 to 60. While this downward trend raises concerns, it is important to note that the current score still exceeds pre-pandemic levels. Dealers are facing increased pressure to lower prices, leading original equipment manufacturers (OEMs) to offer more incentives to drive sales and fill dealer lots.

Adaptation Strategies

Overall, franchised dealerships in the United States are optimistic about the automotive market’s performance, buoyed by positive current conditions and the anticipation of further growth. However, concerns about interest rates and economic uncertainties cast a shadow over dealers’ long-term optimism. As they navigate these challenges, dealerships are adjusting their strategies to maintain profitability and provide customers with the vehicles they desire. With the automotive industry evolving rapidly, dealerships will continue to adapt to changing market dynamics, ensuring a vibrant and customer-focused automotive experience for years to come.