Arizona Insurance Commissioner Complaint Information

The Arizona Department of Insurance helps consumers address insurance-related issues and concerns. If you need to file an Arizona Insurance Commissioner Complaint or are unsure whether the department is the right place for your question or problem, contact the Consumer Affairs Division for guidance.

Contact Information for Consumer Affairs Division

- Phone: (602) 364-2499 or (800) 325-2548 (in Arizona but outside Phoenix)

- Phone Hours: 8:00 a.m. to 4:00 p.m., Monday through Friday (except state holidays)

- Email: consumers@azinsurance.gov

How to File an Arizona Insurance Commissioner Complaint

If you are unable to resolve your insurance issue with your agent or company, or if you believe there has been illegal activity, you can file a complaint with the Arizona Department of Insurance. Please note that under Arizona law, complaint-related facts become public records.

Steps to File a Complaint

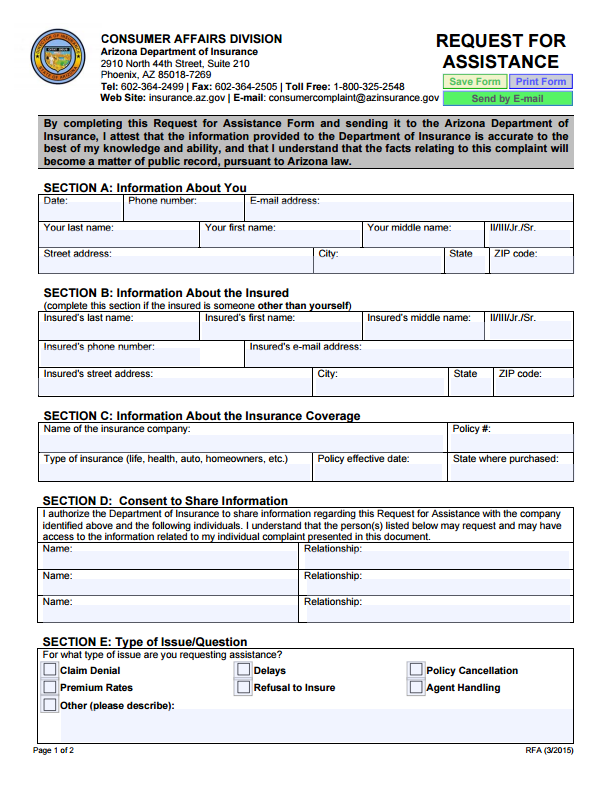

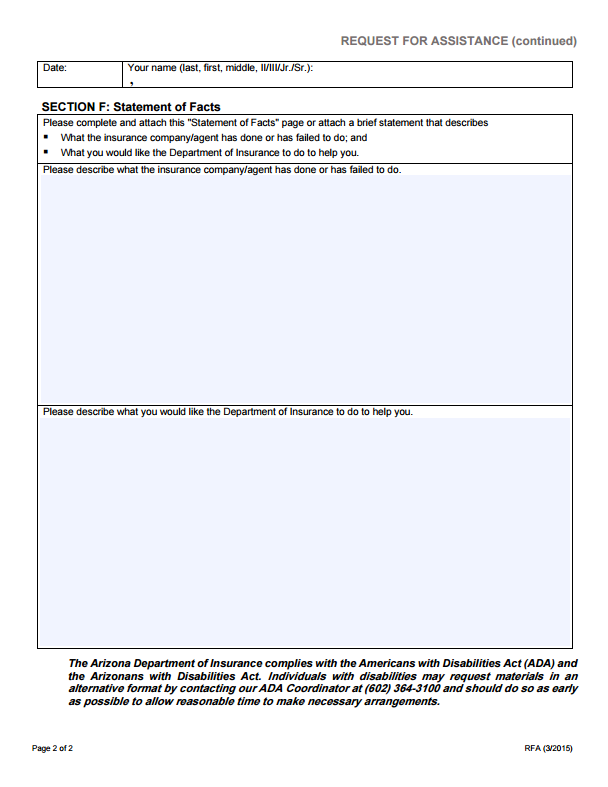

- Complete and print the Request for Assistance Form.

- Provide the completed form along with any supporting documents (e.g., letters, receipts, or notices).

- Submit the complaint using one of the following methods:

- By Email: Scan and email the documents to consumercomplaint@azinsurance.gov.com

(Note: Email may not protect confidential information.) - By Fax: Send documents to (602) 364-2505.

- By Mail or Delivery: Consumer Affairs Division

Arizona Department of Insurance

2910 N. 44th Street, Suite 210

Phoenix, AZ 85018-7269

- By Email: Scan and email the documents to consumercomplaint@azinsurance.gov.com

Reporting Insurance Fraud

The Arizona Department of Insurance also investigates insurance fraud, which occurs when false or misleading information is provided during an insurance transaction or claim.

Types of Insurance Fraud:

- Hard Fraud: Deliberately faking accidents, injuries, thefts, arson, or other losses to collect money illegally.

- Soft Fraud: “Little white lies” on insurance applications or claims, such as inflating claim amounts.

Insurance fraud impacts everyone by raising costs. The department’s Insurance Fraud Unit has successfully prosecuted individuals from all professions, including doctors, lawyers, and agents.

If you suspect fraud, download and complete the Arizona Fraud Referral Form (PDF) and submit it to the department.

Contact Information for Filing Complaints

Mailing Address:

Consumer Affairs Division

Arizona Department of Insurance

2910 N. 44th Street, Suite 210

Phoenix, AZ 85018-7269

Fax: (602) 364-2505

Email: consumercomplaint@azinsurance.gov

For additional assistance, visit the Arizona Department of Insurance website.

For links to other state insurance complaint processes, visit our Insurance Commissioner Complaints by State page.