If your car was recently damaged in an accident—and the repairs are done—your car’s value has likely dropped. Even if it looks brand new, buyers and dealers alike will view it differently. That loss in market value is called diminished value, and you may be entitled to recover it through a claim.

In this article, we explain everything you need to know to file a diminished value claim with Erie Insurance. By the end, you’ll be equipped with all the knowledge you need to maximize your claim and avoid lowball offers.

What is a Diminished Value Claim?

A diminished value claim helps you recover the loss in your car’s market value after an accident—even after it’s been fully repaired. Once a vehicle has an accident history, it’s worth less than an identical car that’s never been damaged. That’s because buyers and dealers see it as riskier and less desirable.

This difference in value is what you’re entitled to claim from the at-fault party’s insurance, or from your own insurance carrier, if you’re in a state like Georgia, North Carolina, or Kansas. If Erie Insurance is handling the claim, you have the right to request compensation for that loss—whether they mention it or not.

Do I Qualify for a Diminished Value Claim?

Not every vehicle is eligible for a diminished value claim. Certain conditions can disqualify you or reduce your chances of receiving compensation.

You may not qualify if:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

If you’re not sure, a free claim review from a qualified appraiser can help you confirm whether it’s worth pursuing.

When Should I file a Diminished Value Claim with Eirie Insurance?

You should file your diminished value claim with Erie Insurance as soon as you receive the repair estimate from the body shop. That’s the first moment you have proof of the loss.

In many states, you can file a claim even years after the accident. Some allow up to 10 years to take action—even if you’ve already sold the vehicle. What matters is staying within your state’s statute of limitations.

Check your state’s deadline here.

How does Erie Insurance Calculate Diminished Value?

Erie Insurance often uses what’s known as the “17c Formula” to calculate diminished value. This method was created after a Georgia court case and is now widely used across the industry. But it’s often criticized for producing low and unfair valuations.

Here’s how it works:

- Base Value: Erie starts with 10% of your car’s pre-accident market value. That’s the maximum they’ll consider for diminished value.

- Damage Multiplier: This number reflects how serious the damage was. Minor damage might get a 0.25 multiplier. Major repairs could rate a 1.0.

- Mileage Factor: Then they reduce the amount again based on your car’s mileage. The more miles on your vehicle, the smaller the payout.

Each step in this formula chips away at the final amount. That’s why many car owners end up with offers far below the car’s actual loss in value.

What are the Steps to File a Diminished Value Claim

To file a successful diminished value claim with Erie Insurance, you need to follow a few important steps. The more prepared you are, the better your chances of getting a fair payout.

Here’s what to do:

- Start with a Free Claim Review: Before spending anything, contact a professional appraiser for a free claim review. This helps you find out if you qualify and whether your claim is worth pursuing.

- Order a Diminished Value Appraisal: If the review looks promising, get a formal appraisal. This report will estimate your vehicle’s loss in value and serve as the foundation of your claim.

- Open the Claim with Erie: Call or email Erie Insurance to start a diminished value claim. You’ll need your claim number, accident date, and repair documents.

- Submit the Appraisal and Demand Letter: Send Erie the diminished value appraisal along with a demand letter. This letter clearly states how much you’re requesting and includes the evidence to back it up. Most reputable appraisers will provide this for you.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

What is a Diminished Value Appraisal, and Why Should I Get One?

You can’t just pick a number and expect the insurance company to pay it. To file a diminished value claim, you need solid proof of how much your vehicle lost in value. That’s exactly what a professional appraisal provides.

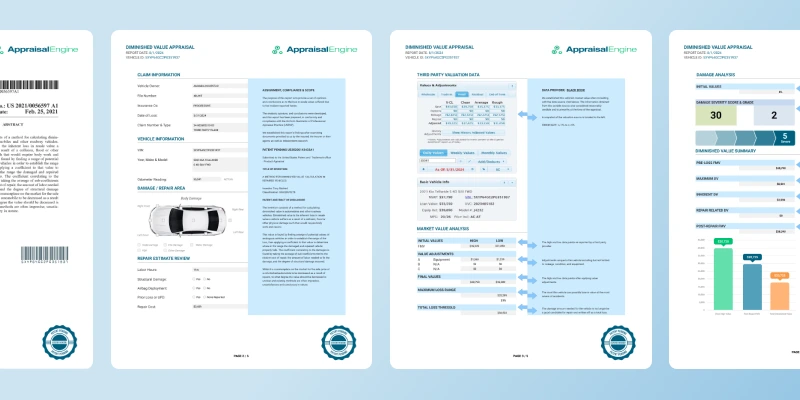

A diminished value appraisal is a detailed report that shows how much your car was worth before the accident, and how much less it’s worth now—based on real market data. It removes the guesswork and gives your claim legitimacy.

Erie Insurance—and every other insurer—is legally required to consider any reasonable proof of loss. That includes a third-party appraisal from a certified expert.

We offer USPAP-compliant appraisals and use a patent-pending methodology that goes beyond outdated formulas. Instead of using a percentage-based estimate like the 17c formula, we rely on real-world sales and current market data to give you a fair and accurate number.

This isn’t just helpful—it’s your strongest tool in getting paid what you truly deserve.

What if Erie Insurance Denies my Claim?

If Erie Insurance denies your diminished value claim, don’t walk away just yet. You still have options—and they can make a real difference.

Start by asking to speak with a supervisor. They may have broader settlement authority and be more willing to negotiate. Sometimes the initial adjuster simply doesn’t have the power to approve a higher payout.

If that doesn’t work, you can file a formal complaint with your state’s Department of Insurance. Each state has a process for reviewing unfair claim denials and putting pressure on insurance companies to act in good faith.

As a last resort, you can take legal action. In many cases, suing the at-fault driver directly in small claims court forces the insurance company to respond more seriously. Most states allow you to do this without hiring a lawyer.

Check the small claims court limit in your state.

Don’t assume a denial is the end of the road. With the right documentation and persistence, you can still recover what you’re owed.