What is Diminished Value?

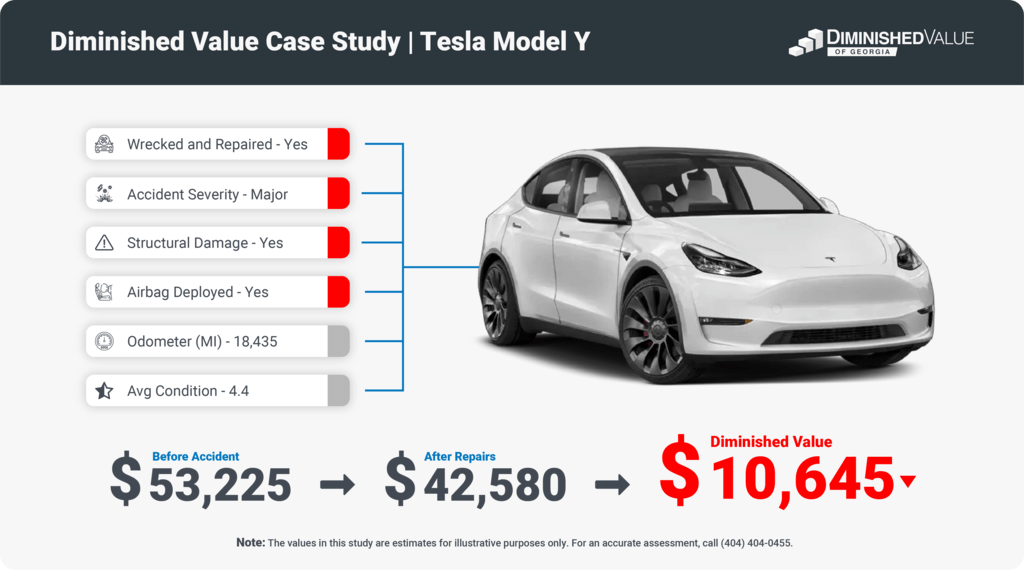

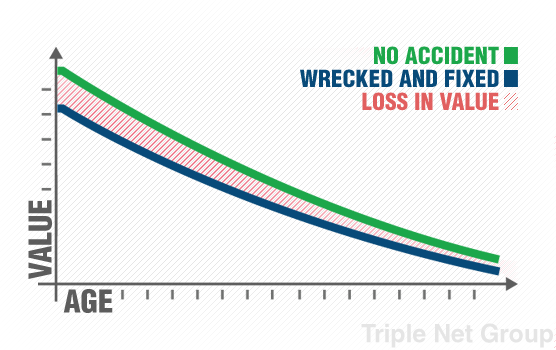

Diminished value is the reduction in your vehicle’s resale value after it has been involved in an accident and repaired.

This loss in value can affect what you might receive if you decide to sell or trade in the vehicle later on since consumers tend to pay less for a car with a damage history.

Filing a diminished value claim can help you recover the financial difference between what your car was worth before the accident and its value after repairs.

Many people aren’t aware that they might be entitled to this type of compensation, as insurance companies may not bring it up unless you do.

Even when they do, 80% of the time, it’s a lowball offer due to an inaccurate valuation or because insurers know that policyholders are often unaware of their rights, allowing them to profit from this lack of knowledge.

Knowing about diminished value can empower you to seek fair compensation for the loss in your car’s market value.

How Diminished Value Impacts Your Car’s Resale Price

When it comes time to sell or trade-in your car, the accident history can weigh heavily on its resale price.

Buyers and dealerships alike often factor in any past damage, assuming that a vehicle with an accident record may have lingering issues, even if it’s been expertly repaired.

This perception can lead to lower offers, as potential buyers expect a discount for taking on the added risk.

In fact, cars with a history of accidents can sell for as much as 20-30% less than similar cars with clean records.

This reduction reflects how diminished value can impact your wallet, regardless of how well the car was repaired.

Filing a diminished value claim is one way to offset this loss, ensuring that you’re compensated for the decrease in market value that results from an accident.

Types of Diminished Value

Three main types of diminished value can affect your vehicle after an accident. Understanding these types helps you determine the right approach when filing a claim and negotiating with insurance.

- Inherent Diminished Value: This is the most common type and refers to the depreciation in value simply because the vehicle has a documented accident history.

- Immediate Diminished Value: This type happens right after the accident but before any repairs are made. It reflects the visible damage to the vehicle.

- Repair-Related Diminished Value: This occurs when the repairs made to the vehicle are not up to standard, leaving behind imperfections or unresolved issues.

How to File a Diminished Value Claim

Filing a diminished value claim can help you recover the loss in your vehicle’s market value after an accident. Follow these steps to maximize your chances of a successful claim:

1. Determine Fault in the Accident

The first step is to establish who was at fault. Diminished value claims are generally only possible if the other party is 100% responsible for the accident.

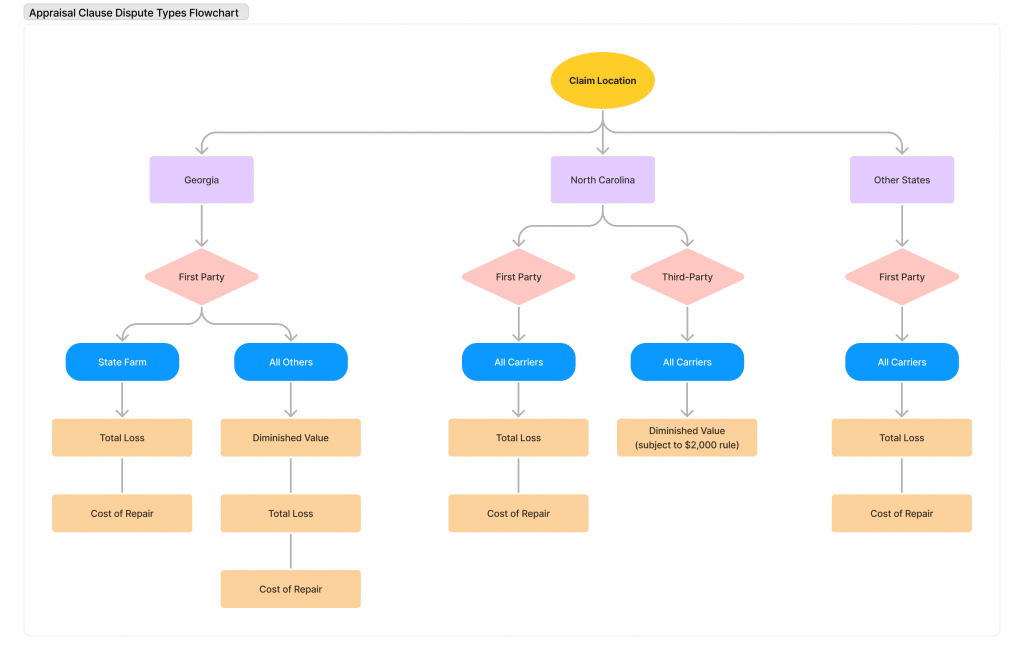

Outside of Georgia, you can only file a diminished value claim against the at-fault driver’s insurance, as there is no law that allows first-party (comprehensive) diminished value claims.

However, in Georgia, you have the unique advantage of being able to file a claim against your own insurance carrier, even if you are at fault.

2. Check Your Eligibility for Filing a Claim

Before filing, make sure your vehicle qualifies. Generally, vehicles that are less than 10 years old, have not had prior accidents, and do not have a salvage title are eligible for diminished value claims. Your insurance policy may also influence eligibility, so it’s worth reviewing the details.

This list includes several circumstances which may disqualify you from making a diminished value claim for your car:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

To learn more about the Diminished Value qualification process, click here.

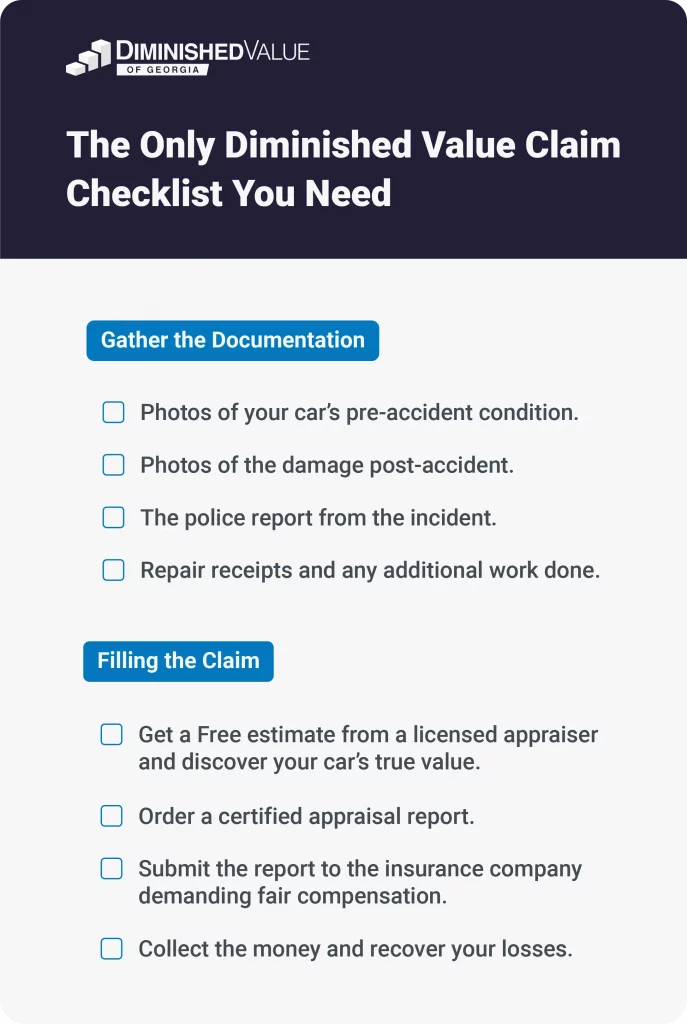

3. Gather Necessary Documentation

Collect all relevant documents, including the police report, repair receipts, photographs of the damage, and any estimates of repair costs.

Having thorough documentation can strengthen your claim and make it harder for the insurance company to offer a low settlement.

4. Calculate Your Vehicle’s Diminished Value

This is one of the most important steps you can take. Instead of relying on insurance company appraisers, who may have a conflict of interest, consider hiring an independent appraiser. A professional appraiser will provide a fair estimate of your car’s true diminished value.

Independent appraisers aren’t tied to the insurance company, so their evaluation is more likely to reflect the actual loss in your vehicle’s worth. For a quick estimate, you can also use our Diminished Value Calculator.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

5. Understand Your Policy and State Laws

In Georgia, you’re able to file both first-party and third-party diminished value claims, which makes it easier to recover the full loss in value. However, this varies by state. Some states only allow third-party claims, meaning you can only file against the at-fault driver’s insurance.

Knowing the specifics of your state’s laws and your insurance policy is essential for maximizing your claim. Review your policy and consult state guidelines to ensure you’re on the right track.

6. Submit the Claim and Negotiate with Insurers

Once you’ve gathered the necessary information and calculated the diminished value, file the claim with the at-fault driver’s insurance company.

Be prepared to negotiate, as insurers often offer low settlements initially. You may need to provide additional documentation or seek legal advice if negotiations stall.

Hiring a professional appraiser can give you the full support you need, faster, cheaper, and more effective than a lawyer. With their experience in dealing with insurers, they can advocate for a fair settlement and make sure you’re not taken advantage of in the process.

How to Calculate Diminished Value

Accurately calculating diminished value is essential for fair compensation. Several methods exist for estimating the loss in your car’s market value after an accident, but not all are equally reliable.

Method 1: The 17c Formula

The 17c formula is a commonly used but often unfair method that insurance companies rely on to calculate diminished value. While it’s simple to apply, this formula tends to yield lower estimates that may not accurately reflect the actual loss in value. It involves these steps:

- Start with your vehicle’s pre-accident value, obtained from resources like Kelley Blue Book or NADA.

- Apply a 10% cap, as insurers typically limit diminished value claims to 10% of the car’s value.

- Use a damage multiplier, ranging from 0.00 to 1.00, to reflect the severity of the damage.

| Multiplier | Damage |

|---|---|

| 1.00 | Severe structural damage |

| 0.75 | Major damage to structure and panels |

| 0.50 | Moderate damage to structure and panels |

| 0.25 | Minor damage to structure and panels |

| 0.00 | No structural damage |

4. Apply a mileage multiplier, which further adjusts the diminished value based on the car’s mileage.

| Multiplier | Damage |

|---|---|

| 1.00 | 0-19,999 miles |

| 0.80 | 20,000-39,999 miles |

| 0.60 | 40,000-59,999 miles |

| 0.40 | 60,000-79,999 miles |

| 0.20 | 80,000-99,999 miles |

| 0.00 | 100,000+ miles |

Despite its widespread use, the 17c formula has several inaccuracies that often lead to undervaluing the diminished value:

- Geographical Data: The formula does not account for regional variations in resale prices, meaning that vehicles may be undervalued based on location-specific market trends.

- Arbitrary Base Loss of Value: The assumed 10% loss of value is arbitrary and does not consider different depreciation rates for various vehicle types.

- Simplistic Damage Modifier: The formula’s generic damage multiplier is based mainly on structural damage, often underestimating the actual loss in value.

- Redundant Mileage Modifier: The base retail value already considers mileage, so adding a separate mileage multiplier tends to artificially lower the diminished value, eliminating recovery for vehicles with over 100,000 miles.

Due to these limitations, it’s often best to explore other methods to get a more accurate estimate of your vehicle’s diminished value.

Method 2: Using Online Calculators

Online diminished value calculators offer a quick way to estimate your claim amount. While these tools can provide a general idea, they may not account for specific details about your vehicle. For a more accurate result, use them as a preliminary step before consulting a professional appraiser.

We have our own calculator, that you can use by clicking here.

Method 3: Hiring an Independent Appraiser

To ensure an unbiased and thorough evaluation, hiring an independent appraiser is often the best option. Unlike insurance company appraisers, independent appraisers are unbiased, meaning their only interest is in accurately assessing a vehicle and providing an expert opinion.

Their primary goal is to help you recover your investment by ensuring you receive fair compensation for your car’s diminished value.

This assessment can also serve as strong evidence when negotiating with insurers. Most appraisers like us offer a free claim review to ensure our assistance may be needed firsthand.

GET MORE MONEY FROM THE INSURER

Don’t leave money on the table! Order a FREE Claim Review and discover your car’s true value.

Each of these methods has its pros and cons, so consider your specific situation when choosing how to calculate your vehicle’s diminished value.

The Appraisal Clause and Its Impact on Diminished Value Claims

The appraisal clause is an often overlooked aspect of insurance policies that can significantly impact your diminished value claim.

This clause provides a mechanism for resolving disputes between you and your insurance company over the value of your claim. Understanding how it works can give you a strategic advantage when negotiating with insurers.

What is the Appraisal Clause?

The appraisal clause allows you and your insurer to each hire an independent appraiser to determine the fair market value of your diminished value claim. If the two appraisers cannot agree, they typically appoint an impartial third party, known as an umpire, to make the final decision. This process helps ensure that your claim is not undervalued and provides a path to reach a fair settlement without resorting to litigation.

When to Invoke the Appraisal Clause

The appraisal clause is most useful when you and your insurer cannot agree on the amount of compensation for diminished value. If you feel the insurer’s offer is too low and negotiations stall, invoking the appraisal clause can be an effective next step.

This approach signals to the insurance company that you’re serious about pursuing fair compensation and willing to bring in experts to support your claim. However, be sure to check your policy, as some insurance companies, like State Farm, have removed the appraisal clause from their auto policies in certain states.

Common Challenges in Filling Diminished Value Claims

Filing a diminished value claim isn’t always straightforward, and you may encounter several challenges along the way.

Insurance Company Pushback

Insurance companies often downplay or deny diminished value claims, especially if they know the policyholder may not be familiar with the process.

They might argue that repairs restore the vehicle’s full value or offer a low settlement. Being prepared with solid documentation and an independent appraisal can strengthen your case and reduce the likelihood of pushback.

Low Settlement Offers

Even if an insurance company accepts your claim, the initial offer is likely to be lower than what you deserve. Many insurers rely on methods like the 17c formula, which can undervalue your car’s diminished value. Don’t hesitate to negotiate;

Navigating the Appeals Process

If your claim is denied or you receive an unsatisfactory settlement, you may need to go through an appeals process. This can be time-consuming and may require you to present additional documentation or seek legal advice.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

Conclusion

Filing a diminished value claim after a car accident can be a critical step in recovering the financial loss caused by the decrease in your vehicle’s market value. By understanding the types of diminished value, the steps involved in filing a claim, and the common challenges you may face, you can navigate this process with confidence. Remember, insurance companies may not readily offer diminished value compensation, so being informed and prepared to negotiate is essential.

Whether you choose to use an online calculator, hire an independent appraiser, or invoke the appraisal clause, taking action can help ensure you’re fairly compensated. With the right approach and resources, you can maximize your claim and protect your investment. If you’re facing a diminished value situation, are you ready to take the next steps to get the compensation you deserve?