When dealing with the aftermath of an auto accident, the time it takes for your insurance company to process a total loss claim is a critical concern.

While timelines vary, understanding the factors at play can help you navigate the process and avoid unnecessary delays.

This guide provides clear insights into the timeline, factors affecting payouts, and your rights as a policyholder.

Factors Affecting the Payout Timeline

The time it takes for an insurance company to process a total loss claim can range from a few weeks to several months. This depends on factors like the insurer’s processes, state regulations, and the complexity of your case. Being aware of these variables can help set realistic expectations and prepare you for any challenges that may arise.

Average Timeframes Across Different States

When it comes to total loss claims, some states have clear time frames for processing and payouts, while others rely on less specific guidelines. These differences can significantly impact how quickly you receive your settlement, making it important to understand the rules in your state.

| State | Claim Decision | Payout Timeline |

|---|---|---|

| Missouri | 15 days | No specific limit |

| California | 40 days | 30 days after settlement |

| Texas | 30 days | 5 days after settlement |

| North Carolina | 30 days | 10 days after settlement |

| Florida | “Reasonable time” | 20 days after settlement |

| New York | 30 days | 5 days after settlement |

| Pennsylvania | 15 days | “Promptly” |

In addition to state-specific timelines, individual insurance companies may have their own internal processes that impact the speed of payouts. Always verify the requirements and timelines with your insurer to avoid surprises.

Factors Influencing the Speed of Insurance Payout

You can speed up the total loss claims process by acting quickly and maintaining clear communication with your insurance adjuster.

Promptly submitting required documentation, responding to requests, and following up regularly can significantly reduce delays.

Below are some key factors that influence how fast your claim might be resolved:

- Claim Complexity: Multi-vehicle accidents or those involving serious injuries often take longer due to additional documentation and investigations. Such cases may require extensive communication between insurers, repair shops, and medical providers.

- State Regulations: Specific timelines for acknowledging and settling claims vary by state, influencing the overall process. Policyholders in states with stricter regulations may experience quicker resolutions compared to those in states with more lenient rules.

- Required Documentation: Delays in obtaining police reports, repair estimates, or other documents can extend the timeline. Ensuring you provide accurate and complete information upfront can help expedite the process.

- External Factors: Natural disasters or high claim volumes can slow down insurance company operations. In such cases, insurers may prioritize emergency claims over standard ones.

What Is a Total Loss Claim?

A total loss claim arises when the cost of repairing a vehicle exceeds its Actual Cash Value (ACV). In such cases, insurers opt to pay the ACV rather than cover repair costs. Understanding how insurers calculate and handle total loss claims is crucial for ensuring a fair settlement.

How Does the Insurance Company Determine if a Vehicle Is Totaled?

There are two methods when determining if your vehicle is to be totaled:

- Total Loss Formula (TLF):

- A vehicle is considered totaled if the cost of repairs plus salvage value exceeds the ACV.

- Total Loss Threshold (TLT):

- Some states set a damage-to-value percentage, typically 75%, as the threshold for declaring a total loss. Vehicles meeting or exceeding this percentage are automatically deemed total losses on this type of claim.

Understanding which method applies in your state can help you anticipate the outcome of your claim and prepare for discussions with your insurer.

→ Discover the Total Loss Threshold specific to your state here.

Understanding ACV (Actual Cash Value)

- Definition: Actual Cash Value (ACV) refers to the vehicle’s market value just before the loss occurred. It accounts for factors such as depreciation, wear and tear, overall condition, and local demand. Typically, this value is lower than the vehicle’s original purchase price.

- Determination: Insurers calculate ACV using data from trusted third-party sources like Kelley Blue Book or NADA. They also factor in specifics such as the vehicle’s history, local market conditions, and sales data for similar vehicles in your area.

- Disputes: If you believe the insurer’s valuation is inaccurate or unfair, you have the right to challenge it. You can invoke the appraisal clause in your policy and hire an independent appraiser to provide an alternative assessment. This process can lead to a more equitable settlement by offering an impartial evaluation of your vehicle’s worth.

The Claims Process Overview

The total loss claims process involves several stages, starting from initial filing to final settlement. Being proactive and informed can help you navigate each step efficiently.

Initial Claim Filing

Report the loss promptly to your insurance provider. Delays in reporting can result in longer processing times and may even jeopardize your claim.

Submit required documents such as police reports and photos of damage. Providing clear and comprehensive documentation can help prevent unnecessary back-and-forth with your insurer.

State regulations often mandate insurers to acknowledge claims within specific timeframes, typically within a few days. Familiarizing yourself with these deadlines can help you hold your insurer accountable.

Review the Initial Offer

Examine the insurer’s offer carefully, focusing on the ACV calculation and comparable vehicle listings. Ensure the valuation aligns with the condition and market value of your vehicle.

If the offer seems unfair, negotiate or seek an independent appraisal to challenge the valuation. Be prepared to present evidence, such as recent maintenance records or comparable sales data.

Get a Free Insurance Claim Review

Before committing to further action, you can submit your information for a free claim review. This step allows a licensed appraiser to evaluate your case and determine if the insurance company’s offer is fair.

The appraiser will analyze your claim and provide feedback on whether you have grounds to dispute the offer. It’s worth noting that 90% of the time, the insurance company’s first offer is a lowball and may not accurately reflect your vehicle’s true value.

If the claim review reveals that the insurance company’s offer undervalues your vehicle, hiring a licensed appraiser is the next step. A professional appraiser will issue a certified report that provides an unbiased, accurate valuation of your vehicle’s Actual Cash Value (ACV). This report is a critical piece of evidence that proves the true value of your car.

Do you need a second opinion? Get a Free Total Loss claim review from our experts!

Factors That Could Delay the Insurance Payout Process

Delays in the claims process can result from several factors. Being aware of these potential obstacles can help you address them proactively.

- Complex Cases: Multi-vehicle accidents or severe property damage require extensive investigation. Insurers may need additional time to determine fault and assess the extent of damages.

- Incomplete Documentation: Missing reports or other required information can halt progress. Double-check your submissions to ensure all necessary details are included.

- Natural Disasters: Insurers may experience backlogs during catastrophic events. In such cases, patience and consistent follow-ups are essential to keep your claim moving forward.

Rights of Policyholders

As a policyholder, you have specific rights to ensure your claim is handled fairly and efficiently. Familiarizing yourself with these rights can empower you during the claims process.

Understanding Your Coverage

- Collision or comprehensive coverage is usually required for total loss payouts. Review your policy to confirm you have the necessary coverage.

- For financed vehicles, payouts may go directly to the lender, with any excess given to you. This can impact how much you receive directly from the insurer.

What to do if You Disagree with the Payout Amount

- If the payout seems unfair, you can submit a counteroffer with supporting evidence, such as an independent appraisal. Provide detailed documentation to strengthen your case.

- For unresolved disputes, you may invoke the appraisal clause in your policy or consider legal action if delays are excessive. Consulting with an attorney can help you explore your options.

Can You Sue an Insurance Company for Taking Too Long?

You can sue your insurance company if it takes your insurance claim too long to settle. Insurers face steep consequences for unnecessarily delaying claims, which could result in penalties if delays extend beyond 60 days after all requested documentation has been received.

If you suspect your insurer is acting in bad faith due to a delay, you may file a claim for damages, potentially recovering the full value of your claim along with interest and attorney costs.

State laws require insurance companies to inform you of the status of your claim, and some states mandate that a written explanation must be provided if a claim takes longer than 30 days to process.

Extensions for claim investigations may be granted by a governing board if the insurer can show good cause, allowing them up to 45 days to settle the claim.

Delays can arise from various factors, including the complexity of the accident, the investigation of fault, or circumstances beyond the insurer’s control, which may impact the timely processing of claims.

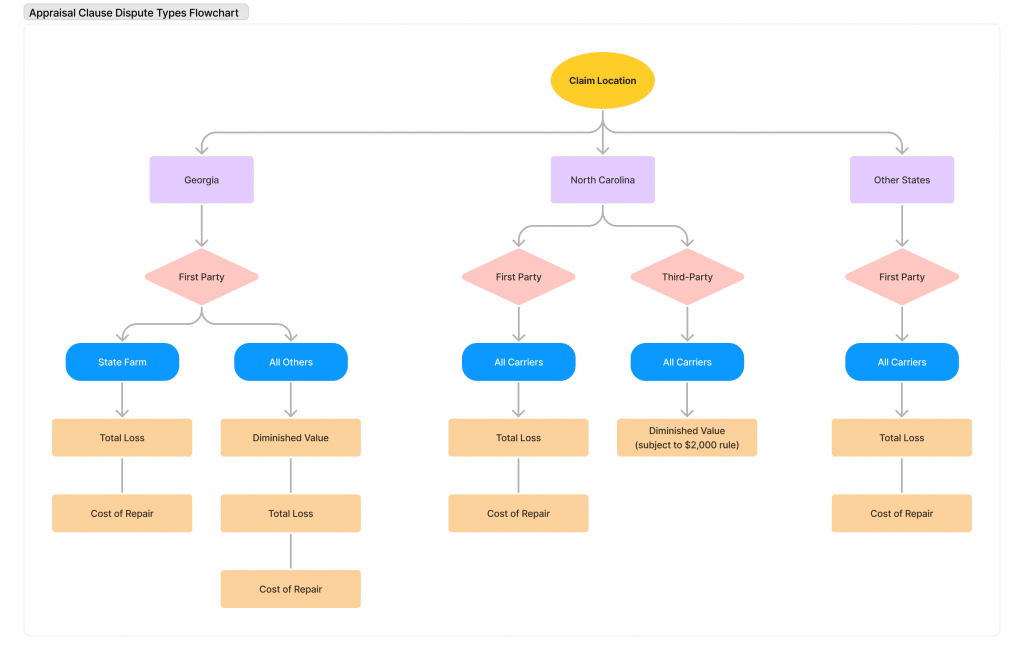

Understanding the Appraisal Clause in Your Policy

When negotiations with your insurance company fail to result in a fair settlement, the appraisal clause can be a valuable tool. This clause, found in many auto insurance policies, offers a structured way to resolve disputes about the value of your vehicle.

By invoking the appraisal clause, you can ensure that the process remains professional and unbiased, with a focus on determining the true market value of your car.

The appraisal clause is a dispute resolution tool included in many auto insurance policies. It serves as a mechanism to resolve disagreements between policyholders and their insurance companies over the value of a claim.

When there’s a dispute about how much the insurer should pay for a total loss, either party can invoke the appraisal clause. This process involves both sides selecting independent appraisers to determine the fair market value of the vehicle. If the appraisers disagree, an impartial umpire is appointed to make the final decision.

The appraisal clause provides a formal, binding resolution and ensures that you have an opportunity to obtain a fair settlement based on the evidence.

Conclusion: Being Informed and Prepared

The timeline for total loss payouts varies based on several factors, from state regulations to claim complexity. Knowing your rights and being proactive in providing documentation can help expedite the process.

If disagreements arise, consider hiring an appraiser or invoking the appraisal clause to ensure a fair settlement.

By staying informed, you can navigate the claims process with confidence and secure the payout you deserve. Remember, preparation and persistence are key to achieving a satisfactory resolution.