First-Half U.S. Auto Sales Rankings: Automakers and Trends (PDF)

As we reach the halfway mark of 2023, the U.S. automotive industry is witnessing a shift in sales dynamics. Overcoming the lingering challenges of supply shortages, the first half of the year saw an overall increase in sales across various vehicle segments. In this article, we dive into the highlights of the first-half U.S. sales rankings, exploring the performance of leading automakers, analyzing top brands, and identifying the most popular nameplates and segments.

General Motors and Ford Take the Lead

For the second consecutive year, General Motors has outperformed Toyota, solidifying its dominance in the market. Ford, on the other hand, is on track to claim the top brand position for the first time in three years. The gradual recovery from supply constraints has contributed to these achievements, as volume gains have been observed in nearly every vehicle segment.

Shifting Rankings and New Players

The first half of 2023 witnessed some notable changes in the automaker rankings. Hyundai-Kia surpassed Stellantis, securing the fourth position. Meanwhile, Tesla, although not officially reporting U.S. results, climbed to the eighth spot. Tesla continues to lead the electric vehicle market with three of the four most popular electric vehicles, but competitors are gradually gaining market share each quarter.

Pickup Supremacy and Pony Car Battles

A gripping battle for dominance in the pickup truck segment is unfolding between two automotive giants, Ford Motor Co. and General Motors. While Ford secured the top spot in the second quarter, GM continues to maintain a narrow lead year-to-date.

Notably, GM’s immensely profitable large SUVs have outperformed both Stellantis and Ford combined, solidifying their position as a force to be reckoned with. Meanwhile, the Ford Mustang is mounting a determined effort to reclaim its throne as the ultimate best-selling gasoline-powered pony car, posing a formidable challenge to the Dodge Challenger, which has held the runner-up position for the past two years.

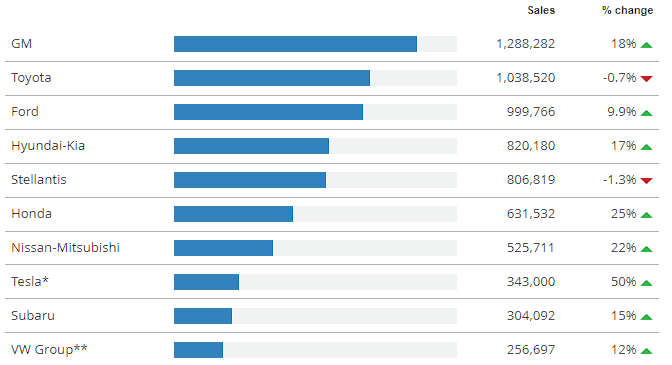

Top Automakers

The sales rankings for the first half of 2023 reveal the following performance by automakers:

- General Motors – 1,288,282 units (18% increase)

- Toyota – 1,038,520 units (-0.7% decrease)

- Ford – 999,766 units (9.9% increase)

- Hyundai-Kia – 820,180 units (17% increase)

- Stellantis – 806,819 units (-1.3% decrease)Honda – 631,532 units (25% increase)

- Nissan-Mitsubishi – 525,711 units (22% increase)

- Tesla* – 343,000 units (50% increase)

- Subaru – 304,092 units (15% increase)

- VW Group** – 256,697 units (12% increase)

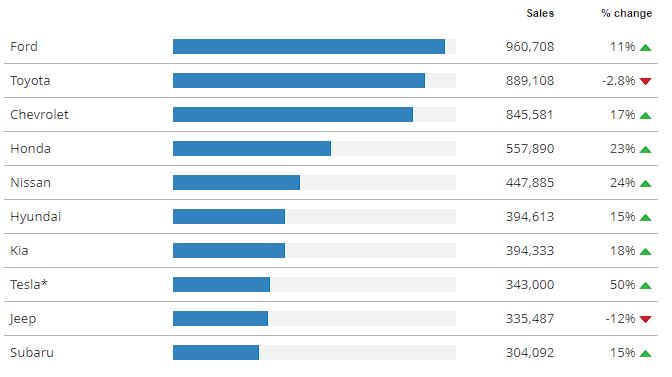

Top Brands

The first-half sales rankings also highlight the performance of leading brands:

- Ford – 960,708 units (11% increase)

- Toyota – 889,108 units (-2.8% decrease)

- Chevrolet – 845,581 units (17% increase)

- Honda – 557,890 units (23% increase)

- Nissan – 447,885 units (24% increase)

- Hyundai – 394,613 units (15% increase)

- Kia – 394,333 units (18% increase)

- Tesla* – 343,000 units (50% increase)

- Jeep – 335,487 units (-12% decrease)

- Subaru – 304,092 units (15% increase)

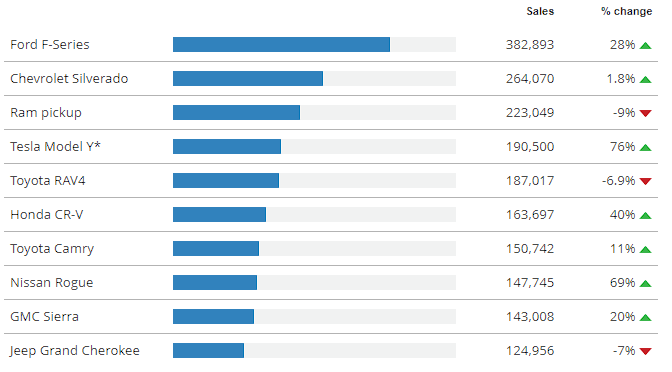

Top Nameplates

The best-selling nameplates in the first half of 2023 were:

- Ford F-Series – 382,893 units (28% increase)

- Chevrolet Silverado – 264,070 units (1.8% increase)

- Ram pickup – 223,049 units (-9% decrease)

- Tesla Model Y* – 190,500 units (76% increase)

- Toyota RAV4 – 187,017 units (-6.9% decrease)

- Honda CR-V – 163,697 units (40% increase)

- Toyota Camry – 150,742 units (11% increase)

- Nissan Rogue – 147,745 units (69% increase)

- GMC Sierra – 143,008 units (20% increase)

- Jeep Grand Cherokee – 124,956 units (-7% decrease)

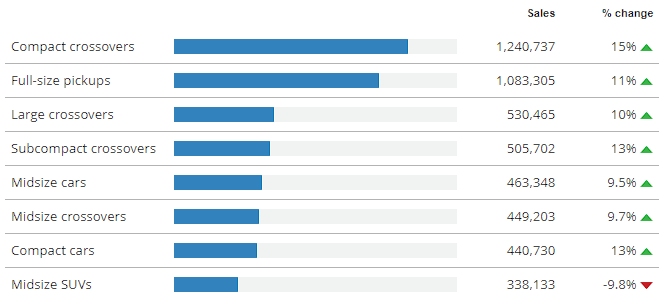

Emerging Trends in Segment Sales

Here are the largest vehicle segments based on sales performance in the first half of 2023:

- Compact crossovers – 1,240,737 units (15% increase)

- Full-size pickups – 1,083,305 units (11% increase)

- Large crossovers – 530,465 units (10% increase)

- Subcompact crossovers – 505,702 units (13% increase)

- Midsize cars – 463,348 units (9.5% increase)

- Midsize crossovers – 449,203 units (9.7% increase)

- Compact cars – 440,730 units (13% increase)

- Midsize SUVs – 338,133 units (-9.8% decrease)

Future Prospects: Implications of First-Half U.S. Auto Sales Rankings

The first-half U.S. sales rankings paint a dynamic picture of the automotive landscape, with General Motors and Ford leading the pack. As supply shortages ease, sales across various segments are on the rise. Emerging trends indicate a competitive pickup truck market and a battle for supremacy among gasoline-powered pony cars. As the year progresses, it will be intriguing to see how automakers strategize to maintain their positions and respond to evolving consumer preferences.