The Georgia office of Commissioner of Insurance is beginning to allow insurance carriers to sell policies in Georgia where Diminished Value is excluded.

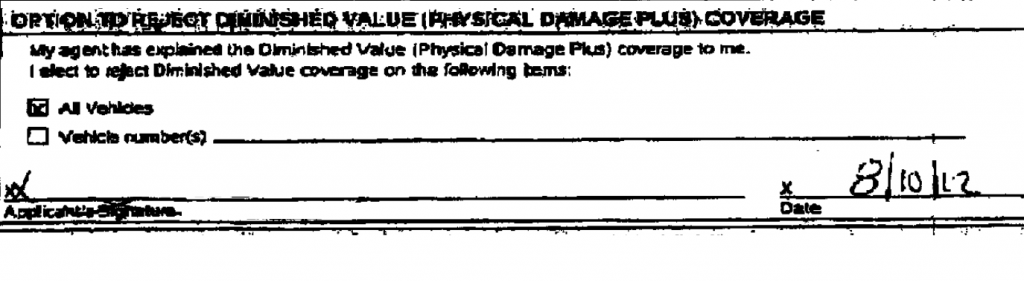

Above you can see a snapshot of a policy application that gives the policy purchaser the option to opt-out of diminished value coverage.

The individual who purchased this policy was actually involved in an accident where Diminished Value was $5,000 and they were not able to claim it.

Different carriers will write the application differently, this one was from Auto Owners Insurance, it states:

| OPTION TO REJECT DIMINISHED VALUE (PHYSICAL DAMAGE PLUS) COVERAGE |

| My agent has explained the Diminished Value (Physical Damage Plus) coverage to me. I elect to reject Diminished Value coverage on the following items:

|

As you can see, no written explanation was given as to the nature of Diminished Value, it leaves the explanation to the insurance agent who may or may not understand what Diminished Value is. The opt-out request normally occurs when you’re renewing or purchasing a new policy.

Obviously, there is nothing illegal about a carrier not offering a certain coverage or offering a small discount to opt-out, but is Diminished Value coverage properly explained? we think not!

It’s been our experience that 90% of claimants have no idea what diminished value is, we believe that a separate sheet properly describing diminished value should be included in the application, this way consumers are fully informed of their rights.

If your carrier is offering you a discount to reject Diminished Value coverage, say NO! the loss-in-value you would suffer when your vehicle is wrecked and repaired is far greater than the $10 you save by opting out. On average, our diminished value appraisals are about $3,000, you do the math!

This applies if you’re requesting Diminished Value from your own carrier, if you were not at fault, this does not affect you.

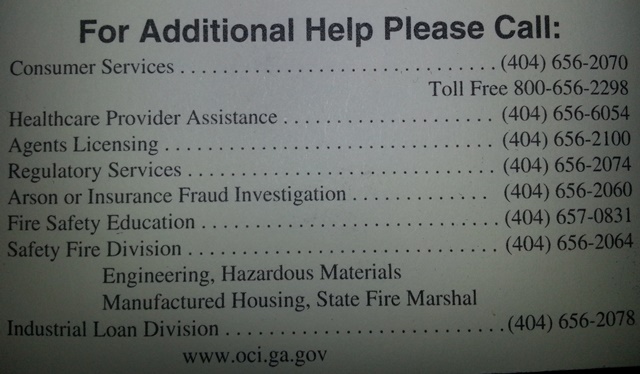

If you have any complaints about the sale tactics of insurance agents, feel free to contact the Georgia Insurance commissioner’s office at the numbers below or file a GA Insurance Commissioner Complaint.