When making a Diminished Value claim, it is important to send the insurance company a written demand. The written demand needs to contain the following information:

- Loss Payee ( Name of person owning vehicle)

- At Fault driver’s Name

- Date of Loss (Date of Accident)

- Claim Number

- Description of your Vehicle

- Damage or Loss Amount (Cost of Repair)

- Diminished Value Amount

In addition to claim details, you must date and sign the demand letter. The demand must also contain a deadline for answering it.

It is always recommended to send this demand via US Certified mail, however, email or fax is generally acceptable.

In some states, to argue bad faith, you must show that you:

1- Sent a written demand with USPS delivery confirmation to insurance and their insured

2- Notified the department of insurance

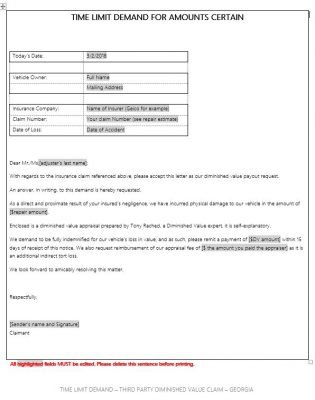

Diminished Value Demand Letter

Below is a sample demand letter.

| TIME LIMIT DEMAND FOR AMOUNTS CERTAIN

Dear Mr./Ms.[adjuster’s last name]; With regards to the insurance claim referenced above, please accept this letter as our diminished value payout request. An answer, in writing, to this demand is hereby requested. As a direct and proximate result of your insured’s negligence, we have incurred physical damage to our vehicle in the amount of [$repair amount]. Enclosed is a diminished value appraisal prepared by Tony Rached, a Diminished Value expert, it is self-explanatory. We demand to be fully indemnified for our vehicle’s loss in value, and as such, please remit a payment of [$DV amount] within 15 days of receipt of this notice. We also request reimbursement of our appraisal fee of [$ the amount you paid the appraiser] as it is an additional indirect tort loss. We look forward to amicably resolving this matter.

Respectfully,

[Sender’s name and Signature] |