Car Sales in the US: Is the Tide Turning for Sedans? (PDF)

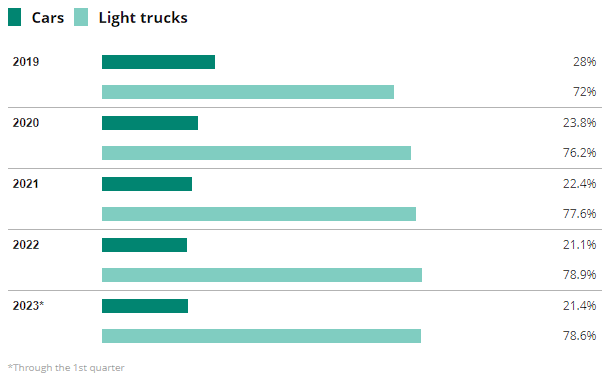

Has the share of cars sold in the US compared to light trucks finally bottomed out? The latest data from Q1 2023 shows that sedans and other types of cars made up 21.4% of the 3.6 million new vehicles sold, up from 19.6% in Q4 2021, marking a slight increase after years of decline. This shift is noteworthy since the share of cars has been on the decline in the US since 2002. The question remains whether this trend is temporary or lasting and what factors are driving it.

Theories behind the shift in consumer preferences

Toyota Motor North America predicts industrywide average vehicle transaction prices to reach $50,000 this year. Are consumers finally changing their behaviors and opting for cheaper sedans?

There are various theories among automakers to explain the recent shift in the declining trend of cars. Some attribute it to the affordability of sedans compared to similar crossover models, while others believe it stems from generational attitudes where younger generations prefer not to drive the same vehicles their parents did.

As American Honda’s crossover inventory dwindled, the Accord and Civic experienced a resurgence in demand, indicating a potential shift in consumer preferences. Meanwhile, Toyota doubled down on its car segments by introducing the high-performance GR Corolla hatch and integrating the iconic nameplate into its new subcompact crossover, the Corolla Cross. Despite this move, it remains to be seen if sedans can maintain their newfound momentum in the face of the crossover craze

The demand for sedans has revealed some surprising insights as a result of a worldwide shortage of microchips. Volkswagen introduced the Taos crossover last year, a similar-sized but more expensive Tiguan, for budget-conscious consumers. In addition to the Taos and Tiguan, Volkswagen also produces the compact sedan Jetta for the North American market, which starts at a lower price than both crossovers.

VW prioritized the production of the more profitable Taos and Tiguans, resulting in the sacrifice of Jetta production. As a result, 90% of VW’s 67,853 first-quarter sales in the US were crossovers. Despite having the Taos to cover the $25,000 price point, dealers are now desperate to get Jetta back on the showroom floor.

For customers who want to buy a sedan, their choices have shrunk considerably. Automakers have culled car segments in favor of crossovers, pickups, and SUVs over the last several years, leaving white space for European and Asian brands to strengthen their core sedan models.

Overall, while cars’ share has been declining in the US for almost two decades, Q1 2023 has seen a stabilization and growth in the sedan market. Although it’s hard to say if this is a temporary or lasting trend, consumers’ increasing aversion to high vehicle prices may be driving them back to more affordable sedans. The situation caused by the global microchip shortage also highlights that the consumer’s love for sedans has not waned. They may not have the same number of choices as before, but the demand is still there.