Auto Market Update Week Ending September 13, 2023 (PDF)

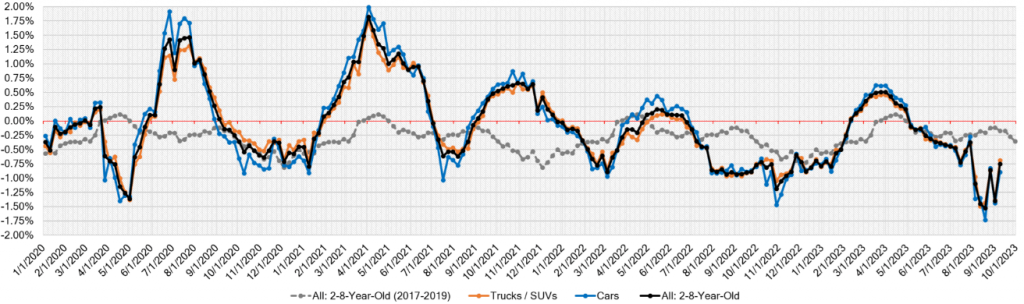

This week in the auto market has been one filled with anticipation and uncertainty as the industry awaits news of a possible UAW strike and its potential impact. The market’s depreciation rate, which had been on a rapid decline, showed signs of slowing last week as everyone held their breath, waiting for the strike’s outcome.

Auction conversion rates also saw an increase as buyers prepared for a potential drop in inventory in the wake of the strike. However, despite the depreciation rate slowing compared to the previous week, it still remains significantly above the typical seasonal movements.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.89% | -1.44% | -0.22% |

| Truck & SUV segments | -0.69% | -1.38% | -0.14% |

| Market | -0.75% | -1.40% | -0.18% |

Depreciation Trends

Let’s dive deeper into the depreciation trends for this week, comparing them to the previous week and the 2017-2019 average for the same week:

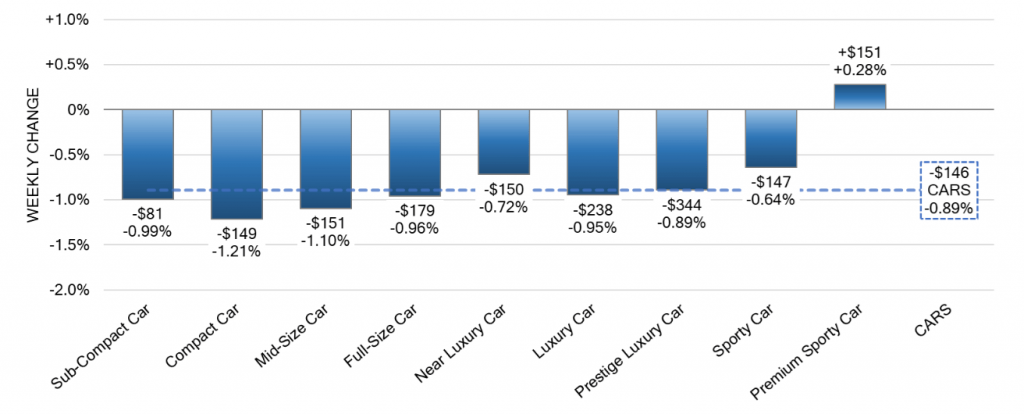

Car Segment Insights

The Car segment took center stage this week, offering a distinctive story of resilience. It showed remarkable strength with a modest decrease of just -0.89%, a notable improvement compared to the -1.44% dip in the previous week. When we delve deeper into the segment, we observe a nuanced picture: the 0-to-2-year-old cars displayed a relatively minor slide of -0.54%, while their more seasoned counterparts, the 8-to-16-year-old cars, experienced a slightly deeper decline at -1.09%. What’s particularly intriguing is that, within the Car segment, eight out of the nine segments witnessed a downward trend, with Compact Car (-1.21%) and Mid-Size Car (-1.10%) leading the charge into the realm of depreciation.

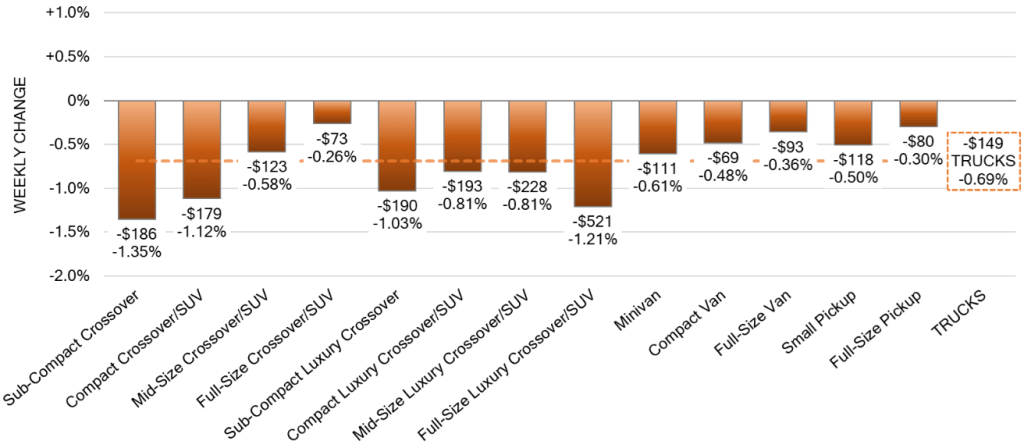

Truck & SUV Segments

The Truck segment saw a decrease of -0.69% this week, which is notably less severe than the -1.38% depreciation in the previous week. Similar to Car segments, all thirteen Truck segments declined this week, with Sub-Compact Crossover (-1.35%) registering the most substantial decline. However, there is a bright spot in the Full-Size Truck category, which saw depreciation slow down significantly to -0.30% compared to the previous week’s -1.12%.

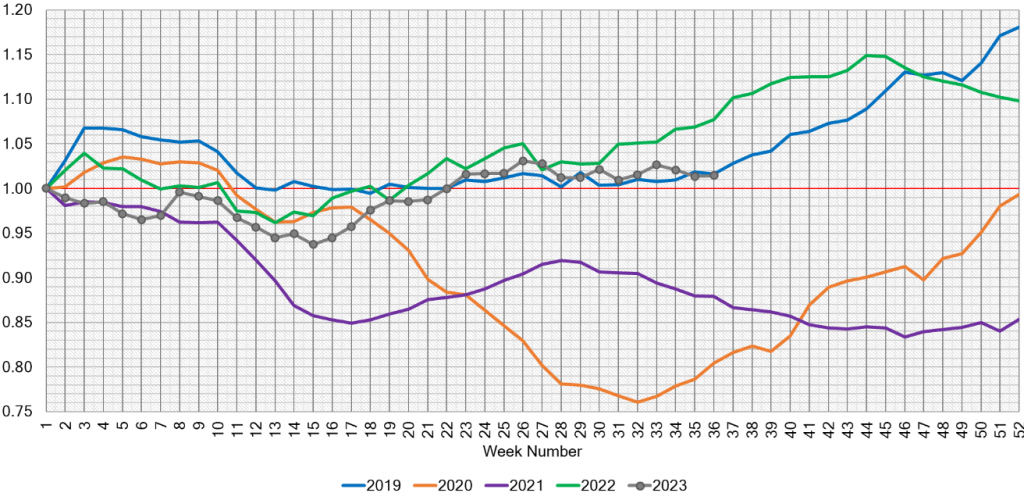

Used Retail and Wholesale Market

In the domain of Used Retail, we find a market exuding stability, with the Active Listing Volume Index firmly planted at 1.01 points. Yet, the true narrative unfolds when we examine the Days-to-Turn estimate, which has undergone a remarkable shift. August witnessed the languid pace of around 50 days, but September paints a different picture, boasting a brisk 44-day turnaround. This dramatic reduction is a testament to the heightened efficiency in selling used vehicles, transforming September into a month of bustling activity and swift used car sales.

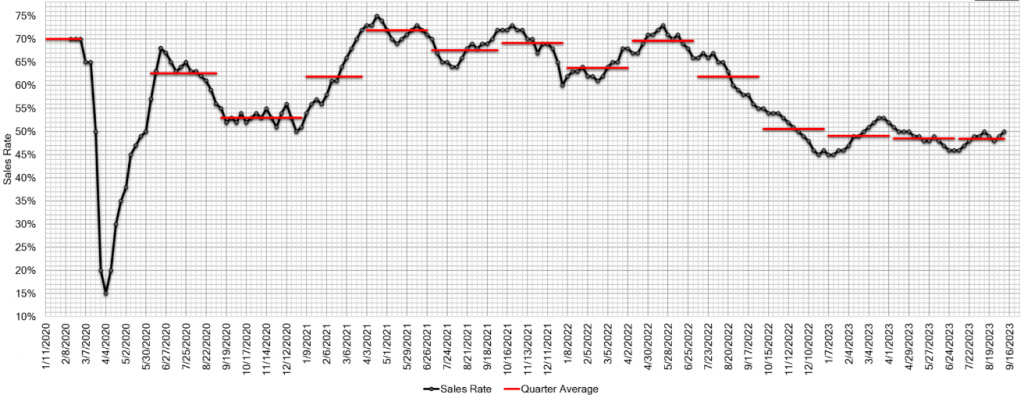

Now, casting our gaze upon the Wholesale market, we encounter an industry poised on the precipice of change as the current UAW contract expires on September 14th. Despite observing more moderate declines in both car and truck segments last week, prices maintained their downward trajectory. Interestingly, auction conversion rates have seen two consecutive weeks of growth, while auction inventory has reached a level of equilibrium, with inventory levels no longer escalating at their previous pace. In the event that the UAW strike materializes this week, our anticipation centers on a rapid surge in wholesale prices driven by the scarcity of inventory entering the auctions. Notably, the estimated Average Weekly Sales Rate has already surged to 50%, signaling the potential for a dynamic shift in market dynamics.

What Lies Ahead in the Auto Market

As we approach the week’s end, the automotive industry remains on edge, awaiting news of the UAW strike’s outcome. The repercussions of this event will undoubtedly ripple throughout the market, and we’ll be here to provide you with the latest updates and insights as events unfold. Stay tuned for a dynamic week ahead in the world of automobiles.