Revving Up the Weekly Auto Market Review: Ending October 21, 2023

Auto Market Update Week Ending Oct 21, 2023 (PDF)

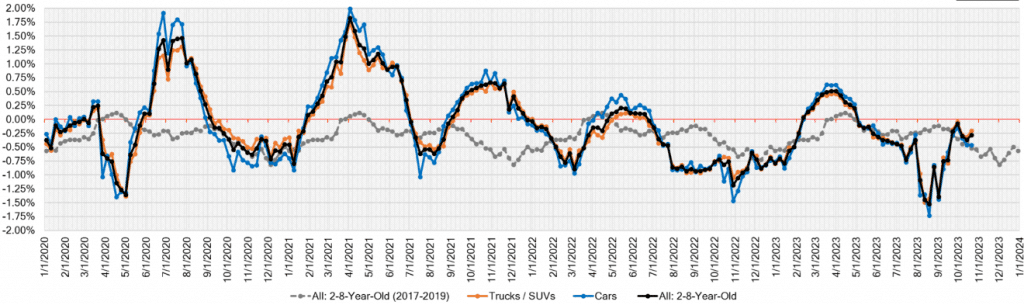

In a period of prolonged uncertainty driven by the United Auto Workers (UAW) strike, the auto market finds itself in a holding pattern, with industry players adopting a cautious “wait-and-see” attitude. While the market overall continues to depreciate, the rate of decline remains somewhat atypical for this time of year.

Last week, a surprising glimmer of optimism emerged as the 8-to-16-year-old truck segments witnessed a slight upswing of +0.14%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.46% | -0.47% | -0.57% |

| Truck & SUV segments | -0.20% | -0.32% | -0.48% |

| Market | -0.28% | -0.36% | -0.52% |

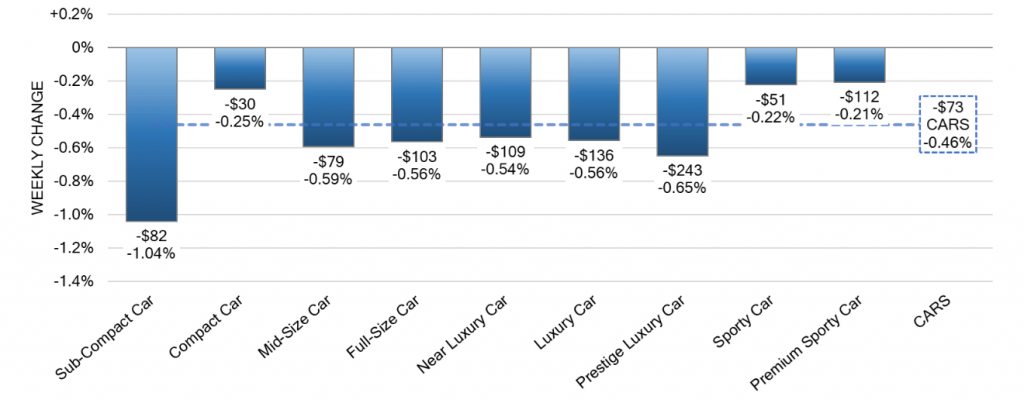

Car Segments

- On a volume-weighted basis, the comprehensive Car segment recorded a decline of -0.46%, displaying a marginal improvement compared to the preceding week’s -0.47% decrease.

- Last week, every one of the nine Car segments experienced a decline. Most notably, the Sub-Compact Car segment registered the steepest decrease at -1.04%, surpassing the previous week’s -0.61% dip.

- Remarkably, the Car segments comprising vehicles aged 0 to 2 years saw a reduction of -0.45%, whereas the 8-to-16-year-old Cars witnessed a decrease of -0.40%.

- The Premium Sporty Car segment, despite minimal declines, saw a decrease of -0.21%, slightly surpassing the previous week’s -0.20% dip.

- After two weeks of an upward trend, the Compact Car segment reverted to a decline. However, the rate of decline last week was milder at -0.25% compared to the previous week’s -0.53%.

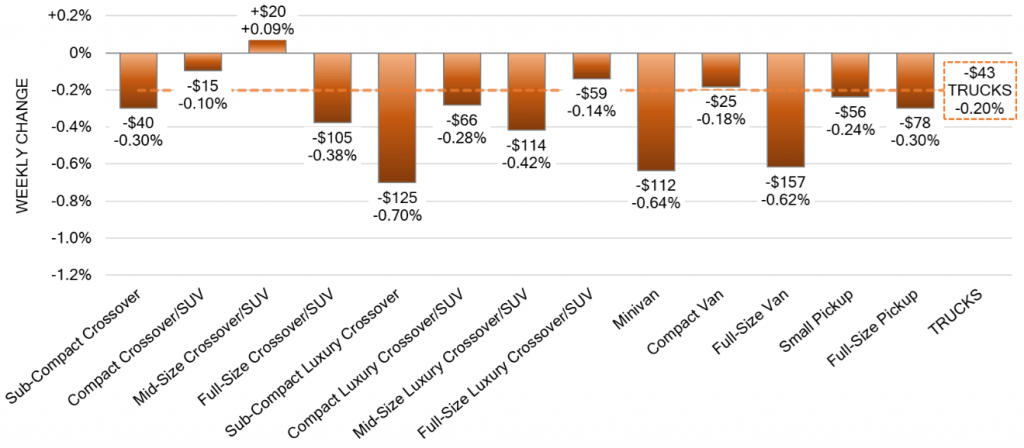

Truck and SUV Trends

- On a volume-weighted basis, the overall Truck segment decreased by -0.20%, reflecting an improvement from the previous week’s -0.32% decline.

- In a twist of expectations, vehicles in the 0-to-2-year-old category demonstrated an average decline of -0.26% last week, while their 8-to-16-year-old counterparts experienced an unforeseen increase of +0.14%.

- Out of the thirteen Truck segments, the Mid-Size Crossover segment stood out, recording a +0.09% increase. This marks its third increase in the last five weeks.

- Conversely, the Full-Size Crossover/SUV segment disclosed its most significant depreciation since the commencement of the UAW strike, with a decline of -0.38%, in stark contrast to the prior week’s -0.10% dip. For five consecutive weeks leading up to the strike, the segment had consistently documented declines surpassing 1% each week.

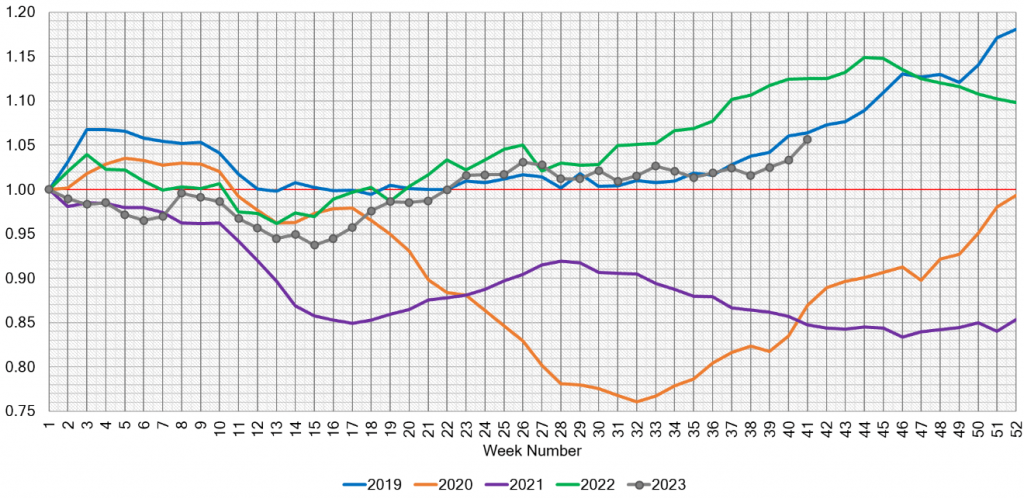

Used Retail Insights

There are currently 1.05 points in the Used Retail Active Listing Volume Index.

Wholesale Market Dynamics

- The UAW strike has entered its second month, and its resolution remains unclear, continuing to sow uncertainty in the market.

- Recent observations indicate that auction inventory has stabilized over the past two weeks, and the overall market’s rate of decline has decelerated. Could these developments foreshadow a more positive week ahead?

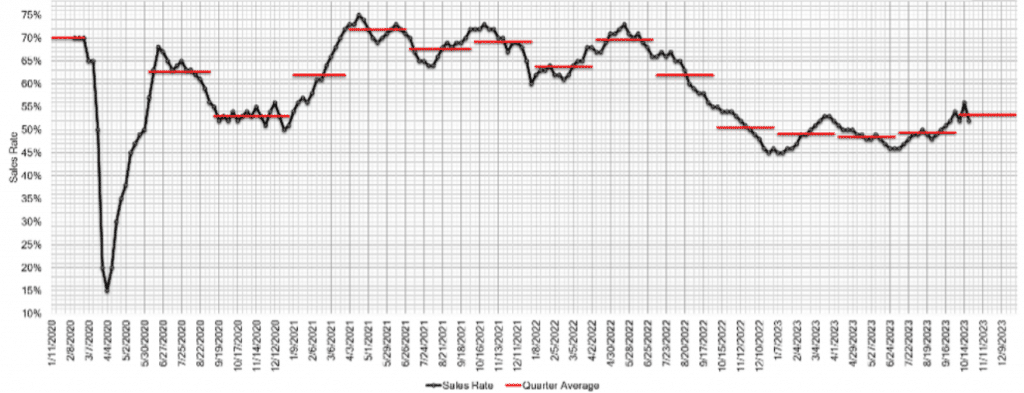

- The estimated Average Weekly Sales Rate retreated to 52% last week.

In summary, as the UAW strike exerts its influence on the auto market, we witness a complex interplay of trends. While some segments show signs of improvement and stabilization, the overall market’s trajectory remains uncertain. Industry experts and dealers are closely monitoring developments, hoping for a clearer path in the weeks to come.

Stay tuned for further insights and updates on the ever-evolving auto market. We remain committed to keeping you well-informed.