Auto Market Update for the Week Ending November 4, 2023

Last week, the wholesale auto market saw higher-than-typical seasonal depreciation across various segments as the industry grappled with the impact of the recent labor strikes. The United Auto Workers (UAW) reached tentative agreements with major automakers, including Stellantis, Ford, and General Motors, effectively ending a six-week strike.

This development had ripple effects on depreciation rates, with some segments experiencing notable declines. Here’s a breakdown of the key trends in the market:

Auto Market Update Week Ending Nov 4, 2023 (PDF)

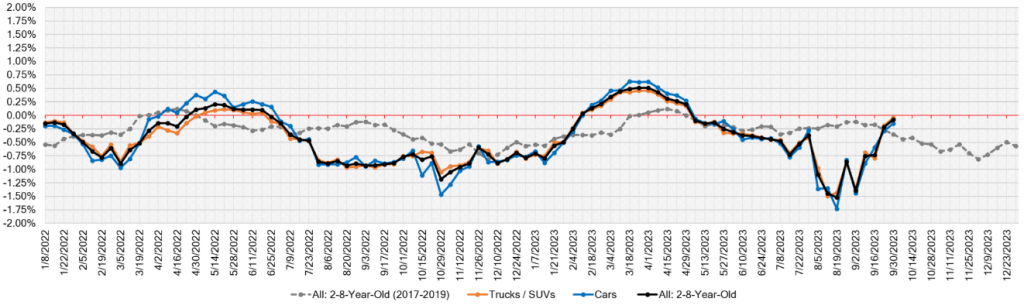

Depreciation Overview

The overall market witnessed a decline of -0.95% for the week ending November 4, 2023, compared to the previous week’s -0.60%. To put this into perspective, the 2017-2019 average for the same week was -0.67%. While cars and trucks/SUVs both experienced depreciation, the truck/SUV segment recorded the most significant decline.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.57% | -0.53% | -0.79% |

| Truck & SUV segments | -1.12% | -0.63% | -0.60% |

| Market | -0.95% | -0.60% | -0.67% |

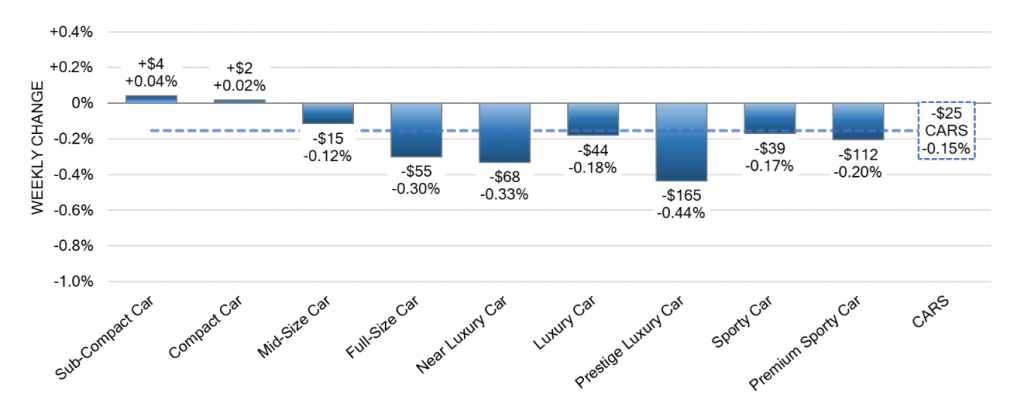

Car Segments

In the car segment, the volume-weighted depreciation rate was -0.57%, slightly higher than the previous week’s -0.53%. Notable trends in car depreciation include:

- 0-to-2-year-old cars decreased by -0.49%.

- 8-to-16-year-old cars declined by -0.53%.

- All nine car segments saw depreciation.

- Mid-size cars had the steepest decline, dropping by -0.99%.

- Sub-compact cars also depreciated significantly, with a -0.92% drop.

- Premium Sporty Cars, on the other hand, reported minimal depreciation, at -0.13%.

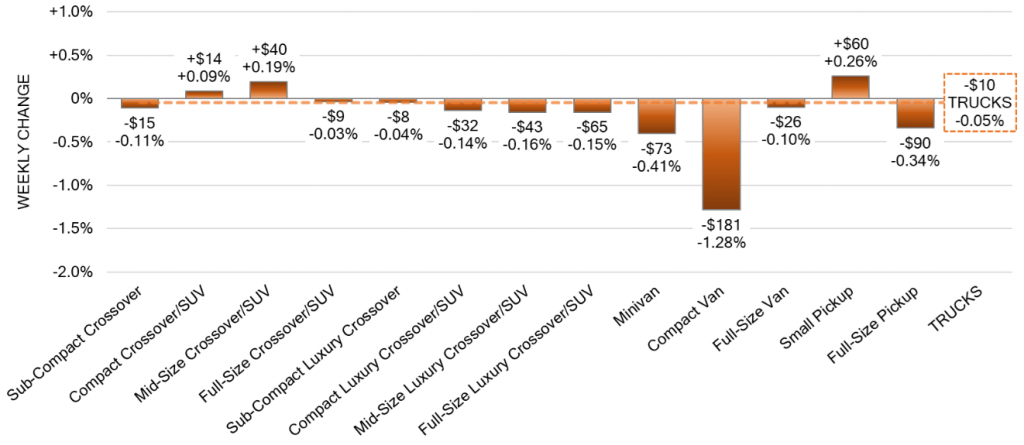

Truck / SUV Segments

The truck/SUV segment experienced a notable increase in depreciation, with a rate of -1.12% compared to -0.63% in the previous week. Key observations in this segment include:

- 0-to-2-year-old truck/SUV models declined by -0.86%.

- 8-to-16-year-old trucks/SUVs decreased by -1.18%.

- All thirteen truck/SUV segments reported depreciation.

- Compact and Full-Size Vans, which were highly sought after during the pandemic, are now experiencing consistent declines. Compact Vans depreciated by -2.01%.

- The Compact Crossover segment also saw a significant decline of -1.74%.

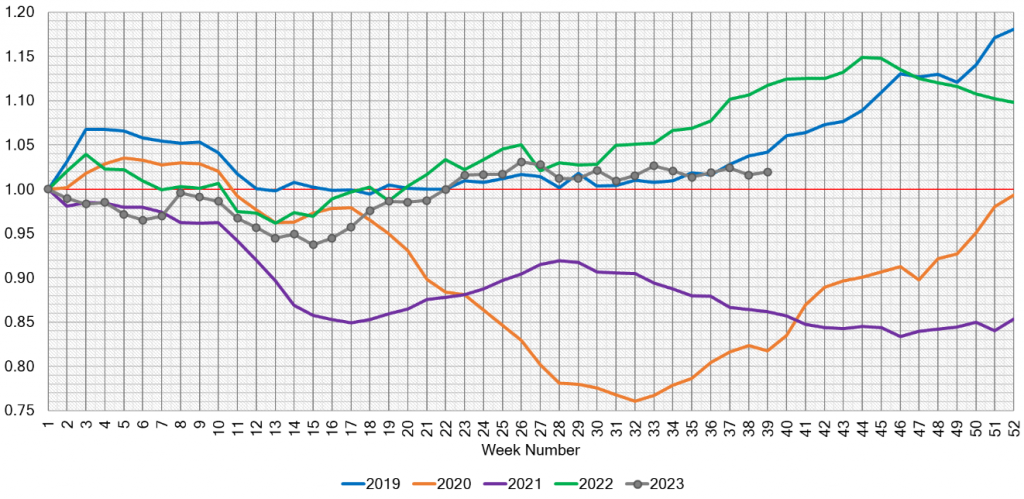

Used Retail

Within the realm of the Used Retail market, the Active Listing Volume Index maintains a steady presence at 1.04 points, underscoring the market’s resilience and equilibrium. Meanwhile, the Days-to-Turn estimate holds firm at approximately 50 days, emblematic of a deliberate and measured pace in sales activity.

Wholesale

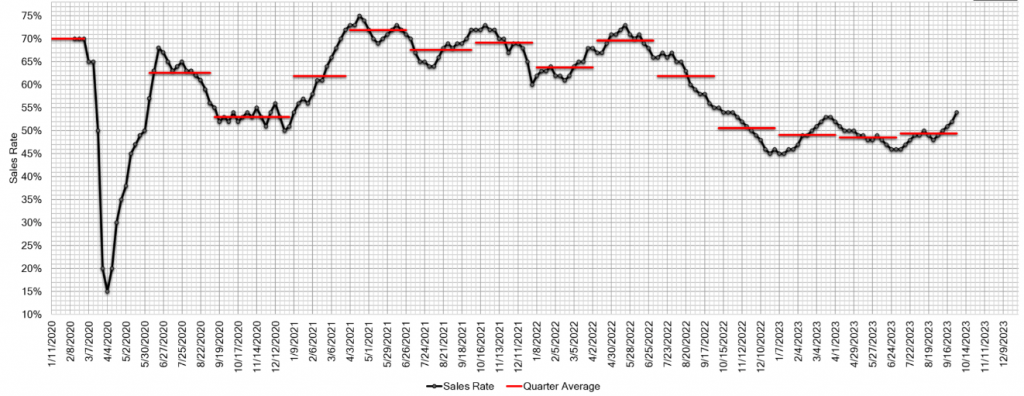

The wholesale market witnessed declines across all reporting segments, reflecting the broader market trends. Auctions across the country are starting to experience more ‘Ifs’ (unsuccessful sales) and no sales, which is reflected in the drop in auction conversion rates. Compact vans, in particular, saw the most substantial decline among truck segments.

The tentative agreement reached between the United Auto Workers (UAW) and major automakers (Ford, GM, and Stellantis) marks a pivotal development in the industry. The strike, which caused the shutdown of some plants for nearly two months, raises questions about the impact on new inventory in the coming months.

Lastly, the estimated Average Weekly Sales Rate declined to 51%, further highlighting the ongoing challenges and uncertainties in the wholesale auto market.

In conclusion, the auto market’s dynamics continue to evolve, influenced by labor strikes and shifting consumer preferences. Industry participants will need to closely monitor these developments to adapt to the changing landscape.