Auto Market Update Week Ending May 13, 2023 (PDF)

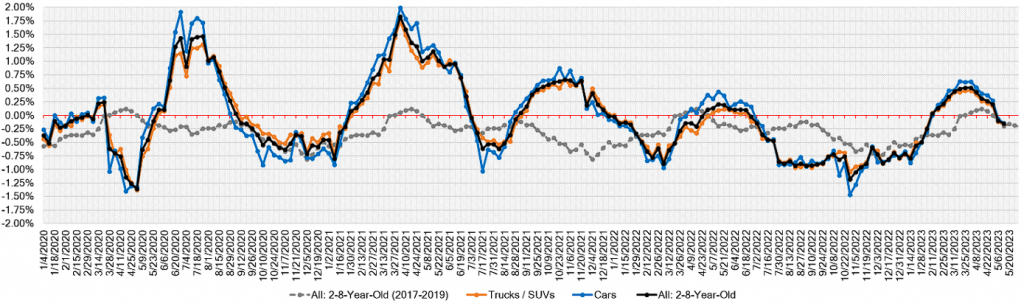

Auto Market declines continued this week, down -0.15%, not far from what we’d typically see at this time of year for seasonal declines. The pre-COVID market averaged a decline of -0.20%.

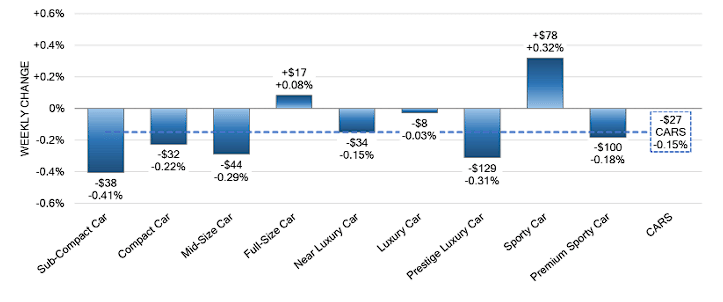

- Last week, only two of the nine Car segments increased.

- Volume-weighted, the overall Car segment decreased by -0.15%. The previous week, cars decreased by -0.16%.

- Last week, sporty cars reported the largest increase, but the rate of increases is slowing; the segment increased +0.32% last week, the smallest gain in eight weeks.

- The largest decline last week came from the Sub-Compact Car segment, at -0.41%. This was the largest decline for this segment since early February.

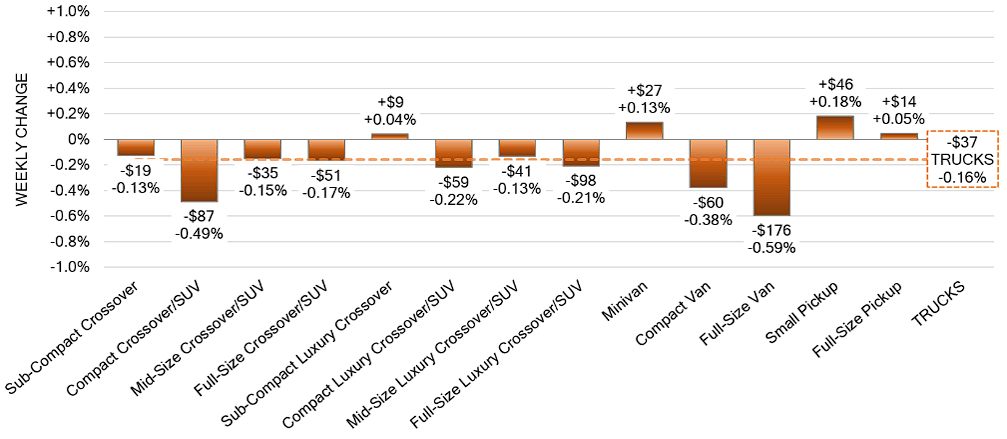

- Last week, four of the thirteen truck segments reported increases.

- In volume-weighted terms, the overall Truck segment decreased -0.16% compared to the prior week’s decrease of -0.12%.

- Pickup segments, Small and Full-Size, continue to grow, but their weekly gains are slower than earlier in the year.

- The Full-Size Van segment (-0.59) had its largest decline since July 2022 (-0.55%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.06% | -0.23% |

| Truck & SUV segments | -0.16% | -0.12% | -0.18% |

| Market | -0.15% | -0.10% | -0.20% |

Retail (Used and New) Insights

- Subaru plans to increase its EV offerings with four crossovers scheduled by 2026. By 2028, 400,000 all-electric vehicles will be built in Japan.

- The Ford Ranger is getting a redesign for 2024. In addition to getting a little larger, adding a larger touchscreen, and having some new engine options, the pickup is now also available in a Raptor trim. It is expected that the redesigned Ranger will be available in dealerships this summer.

- With the Ocean, Fisker’s all-electric crossover, they are falling behind in the race for manufacturers to get their EVs to market. They are experiencing delays because of software glitches. In addition to downgrading their production projections for this year, they are also delaying the launch of their next vehicle by one year, the Pear.

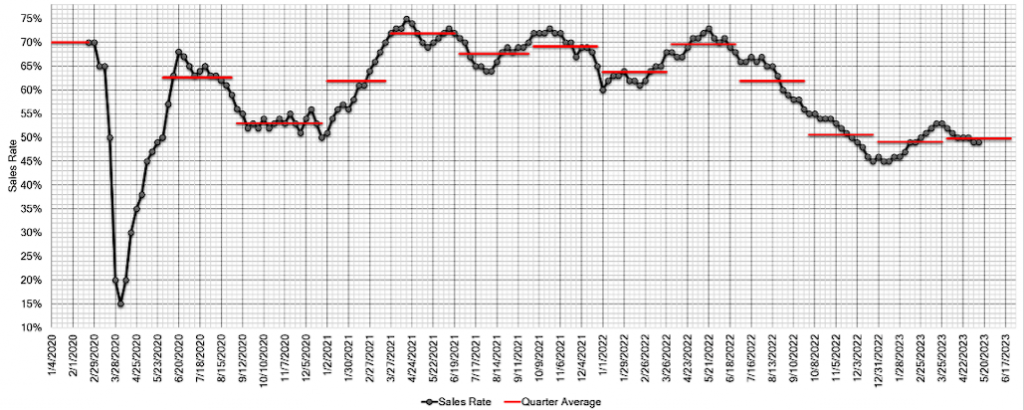

Wholesale

Auction conversion rates stayed steady last week, with the overall market leaning towards the negative. This brings us to the query of whether there will be any potential for a boost before Memorial Day. We see an array of changing prices across various auctions, based on locations in the US. Inventory is trending downward on a weekly basis, which is expected to help contain pricing. As usual, the Black Book team will stay alert and bring updates of any emerging trends. The Estimated Average Weekly Sales Rate sustained at 49% during this period.