Once upon a time, in a bustling market filled with the hum of eager buyers and the competitive calls of sellers, a week stood out, marked by a subtle yet significant shift. It was the week ending March 30th, 2024, a period that would be remembered for its nuanced changes in wholesale prices, akin to the early blooms of spring signaling a season of growth and renewal.

This wasn’t just another week in the financial records; it was a narrative of market momentum, a story of highs and lows, bustling auction activity and the curious case of the underperforming used electric vehicle sector.

Auto Market Update Week Ending March 30, 2024 (PDF)

A Snapshot of the Market’s Pulse

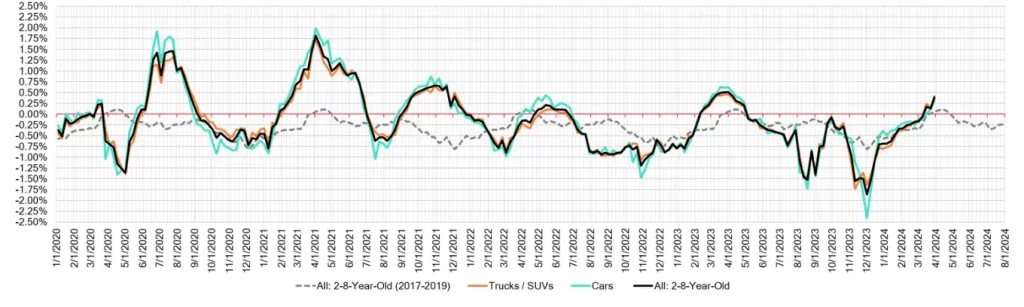

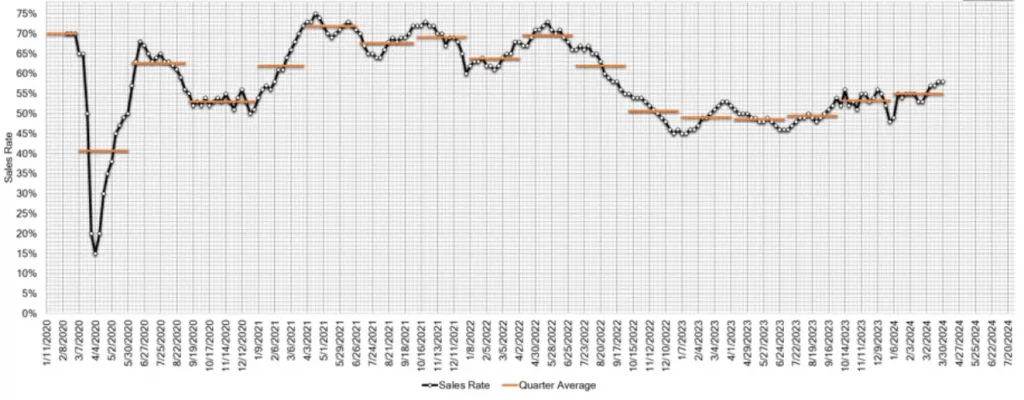

The market’s heartbeat quickened, evidenced by a +0.39% uplift in values from the preceding week, a whisper of acceleration that spoke volumes to those attuned to its language. The stage was vibrant with auction activity, a testament to the robust conversion rates and the spirited participation of bidders. Yet, amidst this bustling marketplace, the used electric vehicle (EV) sector casts a shadow, trailing behind with high no-sale rates and a downtrend in values.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.33% | +0.10% | +0.21% |

| Truck & SUV segments | +0.41% | +0.15% | -0.06% |

| Market | +0.39% | +0.13% | +0.06% |

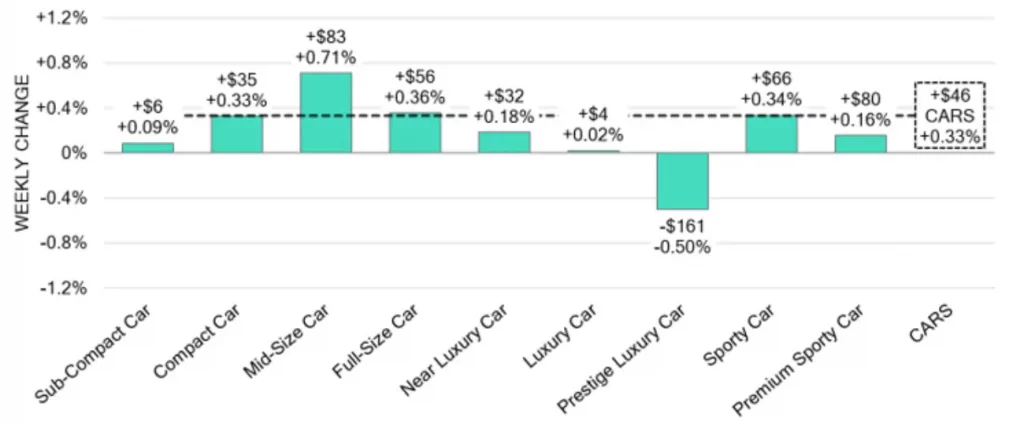

Car Segments

Cars experienced a gentle uplift, with a +0.33% increase. Notably, the 0-to-2-year-old car segments and 8-to-16-year-old cars both saw increases, with eight of the nine-car segments witnessing growth. However, the Prestige Luxury Car segment, particularly the Tesla Model S, faced depreciation.

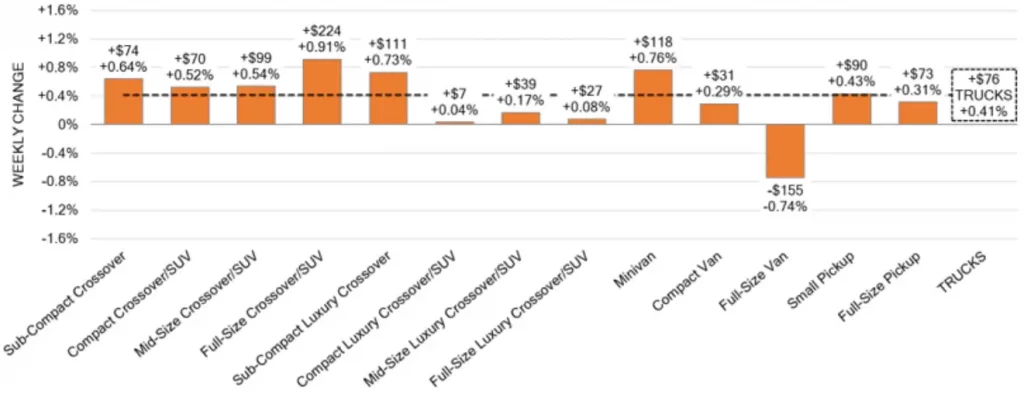

Truck & SUV Segments

Trucks and SUVs weren’t left behind, marking a +0.41% rise. From the 0-to-2-year-old models to the 8-to-16-year-olds, growth was evident across the board. The Full-Size Pickup and Full-Size Crossover/SUV categories, in particular, saw remarkable gains.

Used Retail & Wholesale Perspectives

The Used Retail Active Listing Volume Index offers a lens into dealership inventory dynamics, while the average days to turn a used retail estimate sits around 49 days, highlighting the market’s responsiveness.

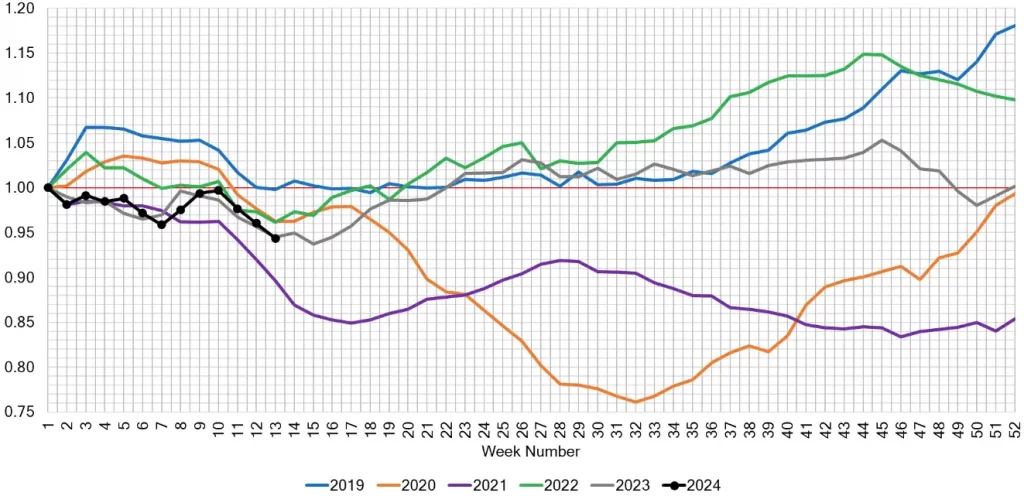

The Undercurrents Beneath the Electric Vehicle Sector’s Struggle

Diving deeper, the story behind the electric vehicle sector’s underperformance is not just a tale of numbers. It’s a narrative woven with various threads – from market saturation and shifting consumer preferences to the evolving landscape of government incentives. This multifaceted decline raises questions about sustainability, innovation, and the future trajectory of the EV market.

The Road Ahead: Analysis and Insights

As we stand at the crossroads of March 2024, witnessing the seasonal uplift and the contrasting trends within the EV sector, we’re reminded of the market’s complexity. The high auction conversion rates and slight inventory increase speak to robust demand, yet the EV sector’s challenges prompt a reflection on future directions and strategies.

Market analysts remain vigilant, their eyes on the horizon, deciphering trends, and gathering insights. They remind us that understanding the market’s ebb and flow is not just about the numbers but about seeing the stories behind the statistics, and the human experiences intertwined with economic dynamics.

As we wrap up our exploration of the wholesale prices for the week ending March 30th, 2024, we’re left with a rich tapestry of insights and questions. From the buoyancy in the auction market to the intrigue surrounding the used electric vehicle sector, each thread adds depth and color to our understanding. In this narrative of numbers and nuances, we find not just data, but directions for future inquiry and innovation.

In this journey through the market’s dynamics, we invite you, the reader, to ponder the forces at play. As we look ahead, let’s ask ourselves: What new stories will the next chapter of market trends tell?