As we unpack the intricacies of the auto market for the week ending March 23, 2024, we find ourselves at the intersection of past trends and future possibilities. This period has unveiled a tapestry of market dynamics, woven with subtle yet significant shifts that hint at the evolving landscape of the automotive industry.

This update aims to provide a detailed exploration of these developments, offering insights that transcend the ordinary. Join us as we navigate through the nuances of this week’s market performance, charting the course of change and continuity.

Auto Market Update Week Ending March 23, 2024 (PDF)

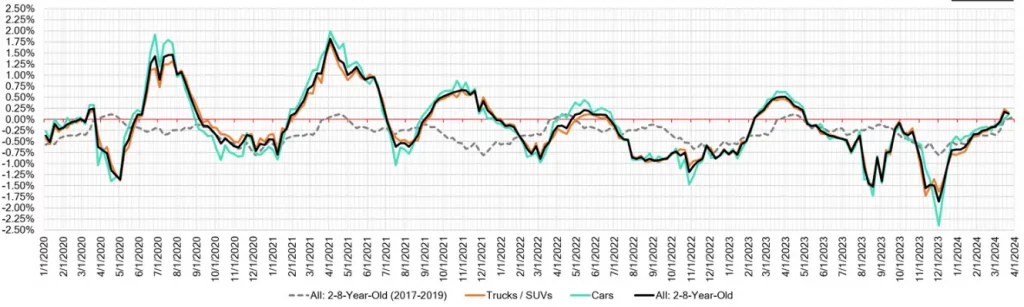

Overview of Wholesale Prices

The market has experienced a positive trajectory this week, marked by a 0.13% increase in wholesale prices. This increment represents the second consecutive week of gains, signaling a return to traditional market patterns.

Notably, this uplift is observed across all vehicle age groups, with the most recent models (0-to-2 years) and older vehicles (8-to-16 years) witnessing growth rates of 0.05% and 0.15% respectively.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.10% | +0.02% | +0.16% |

| Truck & SUV segments | +0.15% | +0.24% | -0.10% |

| Market | +0.13% | +0.17% | +0.01% |

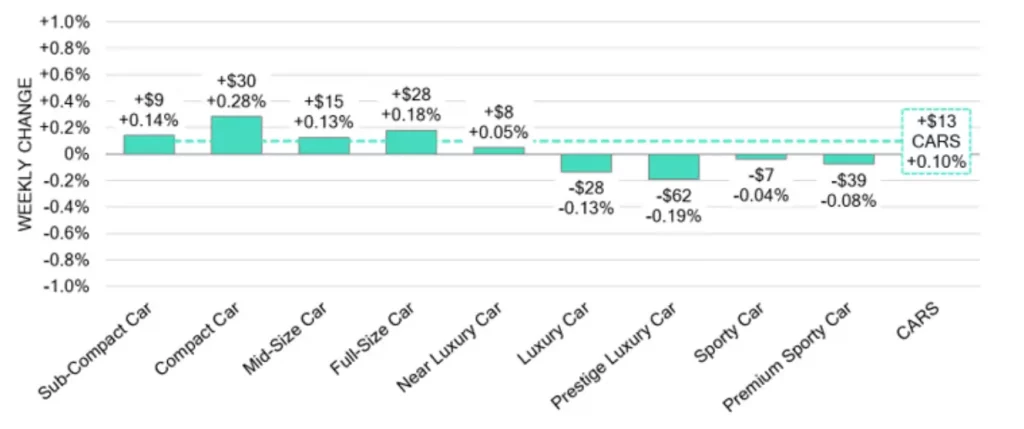

Car Segment Performance

The car segments have shown a modest but steady improvement, with an overall increase of 0.10% on a volume-weighted basis. The Compact Car segment, in particular, has demonstrated remarkable resilience, posting a growth of 0.28% this week — a continuation of an eleven-week growth streak.

Despite this positive trend, it’s important to note that not all segments fared as well, with Prestige Luxury, Luxury, and Premium Sporty Car segments experiencing slight declines.

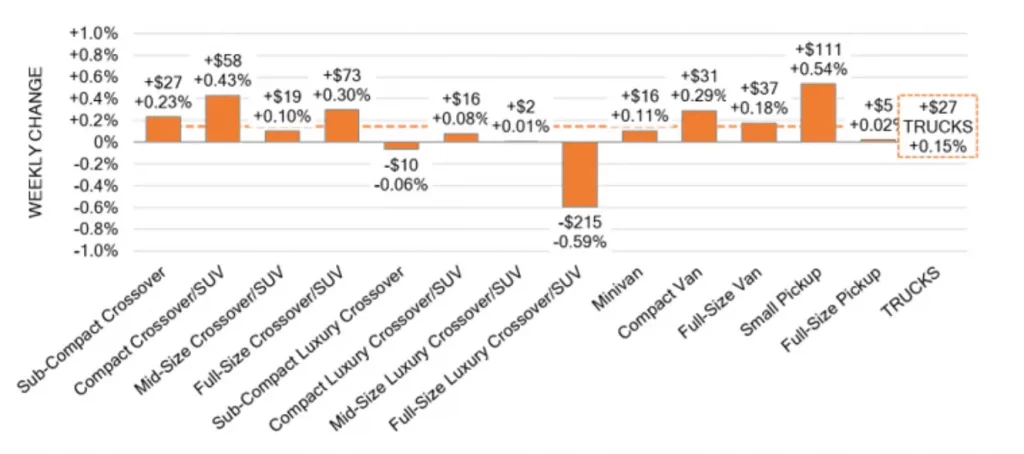

Truck and SUV Segment Trends

The truck and SUV segments have recorded a 0.15% increase, with notable variations across different categories. While the Full-Size Luxury Crossover/SUV segment has seen a decrease in value, the Full-Size non-luxury Crossover and Small Pickup categories have reported consistent growth, highlighting the diverse nature of consumer demand within these segments.

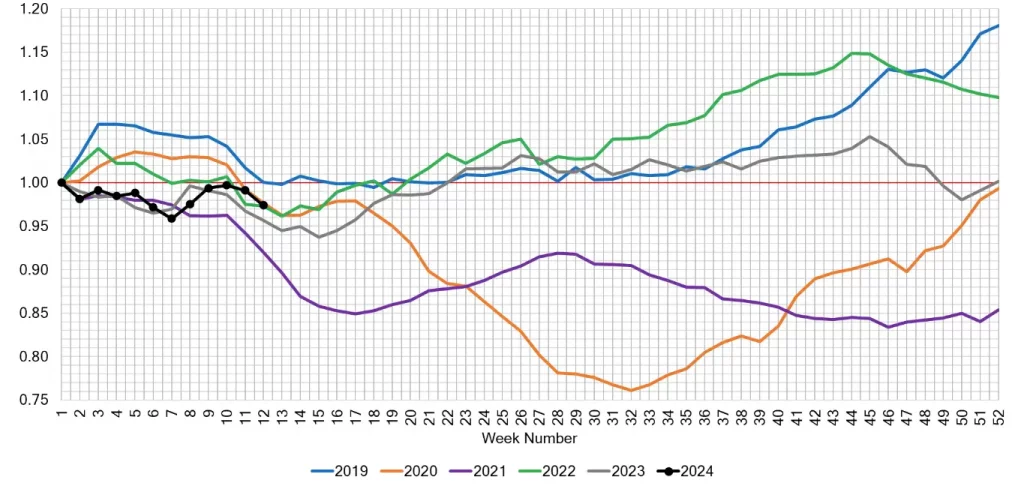

Insights into Used Retail and Wholesale Markets

The Used Retail Active Listing Volume Index remains stable, providing insights into inventory levels across independent and franchised dealerships.

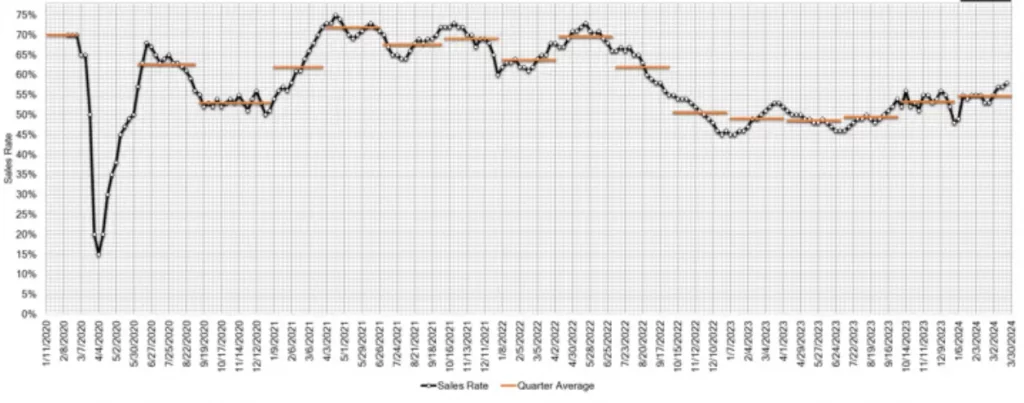

On the wholesale front, the auction market is showing signs of vitality with improved conversion rates and a slight increase in auction inventory, indicating a healthy demand and supply balance.

Conclusion

This week’s auto market update reflects a market that, while facing certain challenges, is generally on a path of positive growth. Key trends such as the sustained increase in compact car values and the varied performance across truck and SUV segments offer valuable insights for stakeholders.

As we continue to monitor these developments, it prompts us to consider what the coming weeks will hold. Will the market maintain its current trajectory, or are there new trends on the horizon?