As the first rays of the March sun thaw the remnants of winter’s chill, the automotive market, much like the resilient early spring blooms, is showing signs of vigorous life and renewal.

Amidst this season of rejuvenation, the narrative of the week ending March 09, 2024, unfolds, revealing a tale of gradual recovery and optimistic momentum within the auto industry. The canvas of numbers and trends paints a picture not just of statistics, but of a market steadily steering towards a hopeful horizon.

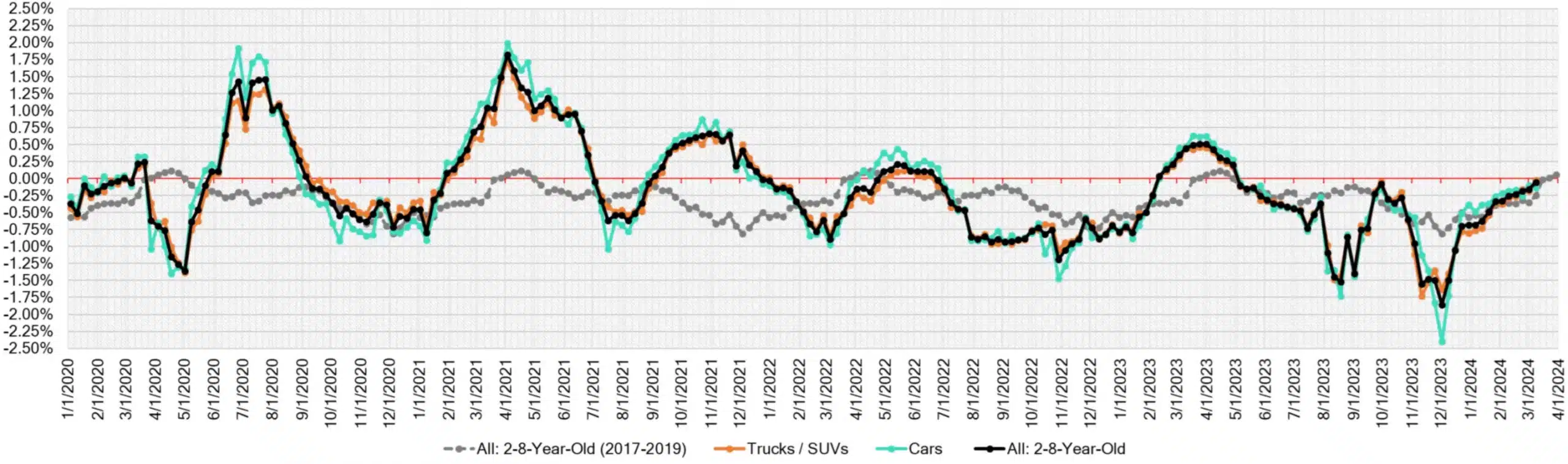

The “expected return to normalcy” for the automotive market is not just a forecast; it’s becoming a reality, as evident in the diminishing overall market depreciation. Last week, a notable upswing in auction prices emerged, painting strokes of optimism across the industry canvas.

A commendable 32% of the segments observed reported an uplift in wholesale values. The week showcased a subtle dance of numbers, with Car segments experiencing a slight decrease of -0.14%, an improvement from the -0.32% 2017-2019 average.

Truck & SUV segments presented an even smaller dip of -0.02%, showcasing resilience by outperforming the -0.34% average of yesteryear. Overall, the market depreciation slowed to -0.05%, signaling a steady stride toward stability.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.14% | -0.10% | -0.32% |

| Truck & SUV segments | -0.02% | -0.18% | -0.34% |

| Market | -0.05% | -0.16% | -0.25% |

Auto Market Update Week Ending March 09, 2024 (PDF)

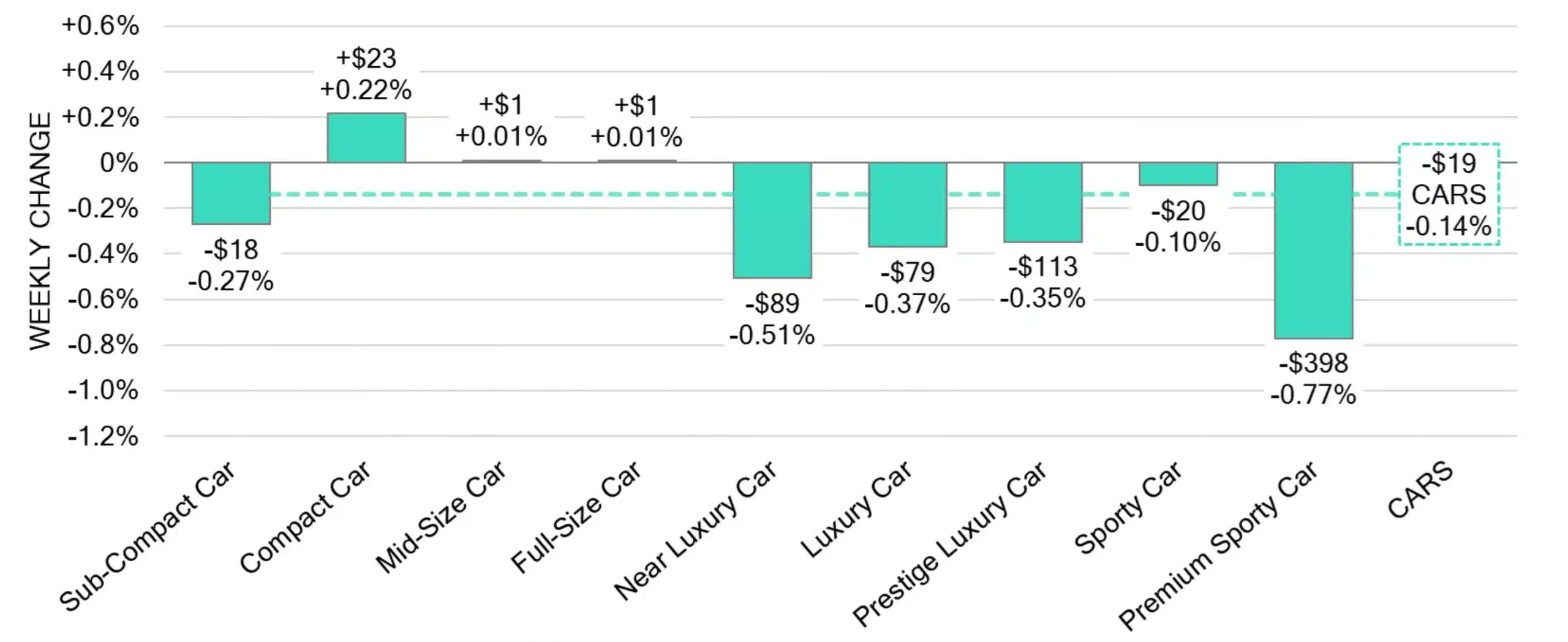

Diving Deeper into Car Segments

In the realm of Car segments, the narrative was one of nuanced shifts. The week ended with a -0.14% decline, marginally better than the previous week’s -0.10%. A closer look reveals the variegated landscape of this category:

- The younger 0-to-2-year-old Car segments dipped by -0.20%, while the elder, 8-to-16-year-old Cars, saw a modest decline of -0.13%.

- Amid these declines, three out of nine Car segments experienced growth, with the Compact Car segment leading the charge by marking a +0.22% increase, continuing its ascent for the ninth consecutive week.

- The Mid-Size and Full-Size Car segments also edged upward, each by a slight +0.01%.

- The Premium Sporty Car segment, however, faced the week’s steepest decline at -0.77%, accelerating from the previous week’s -0.32%.

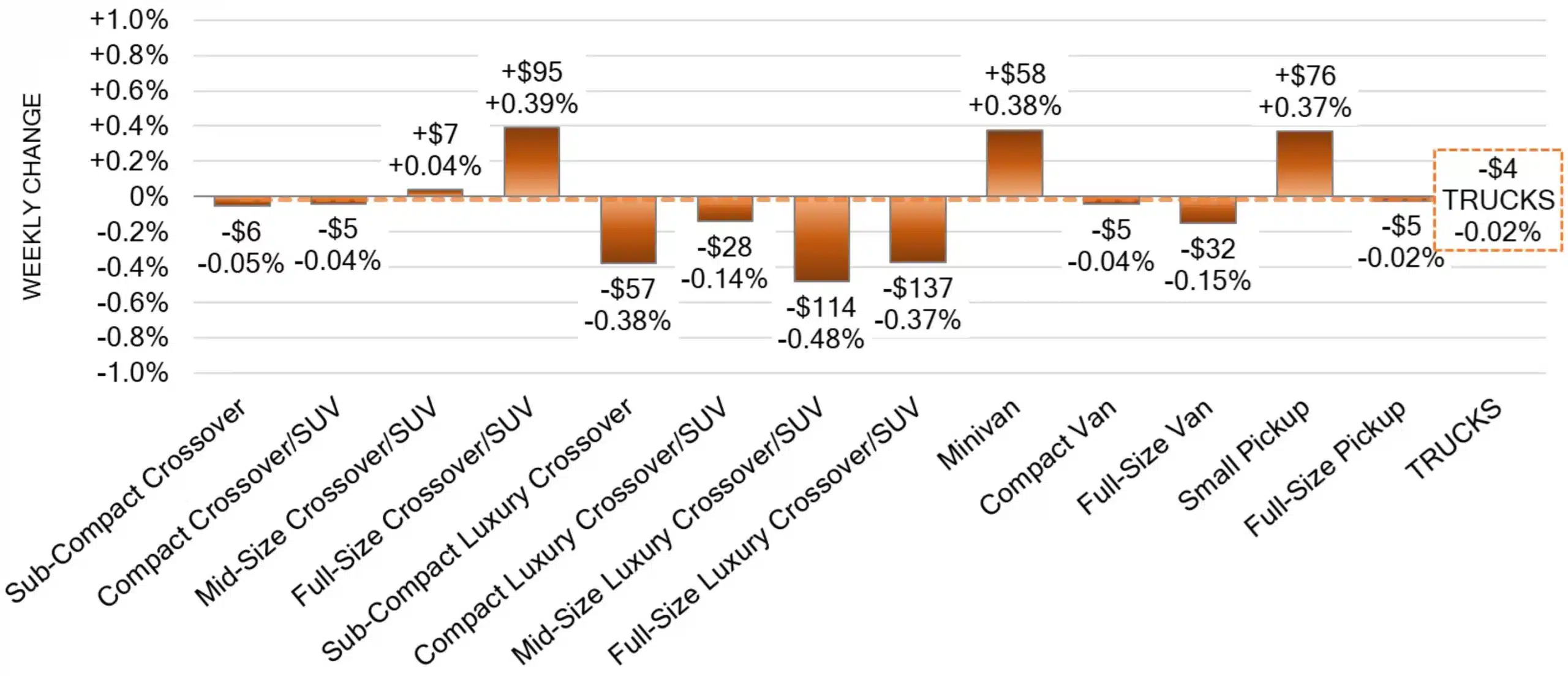

Truck / SUV Segments: Holding the Line

The Truck / SUV territory displayed its own tale of endurance:

- The overall Truck segment decreased marginally by -0.02%, showcasing a reduction in depreciation when compared to the previous week’s -0.18%.

- Within this broad category, the 0-to-2-year-old models saw a -0.14% decline, while the 8-to-16-year-olds experienced a minimal decrease of -0.02%.

- Growth was observed in four of the thirteen Truck segments, with Small Pickups and Minivans leading the way with increases of +0.37% and +0.38% respectively.

Used Retail and Wholesale Insights

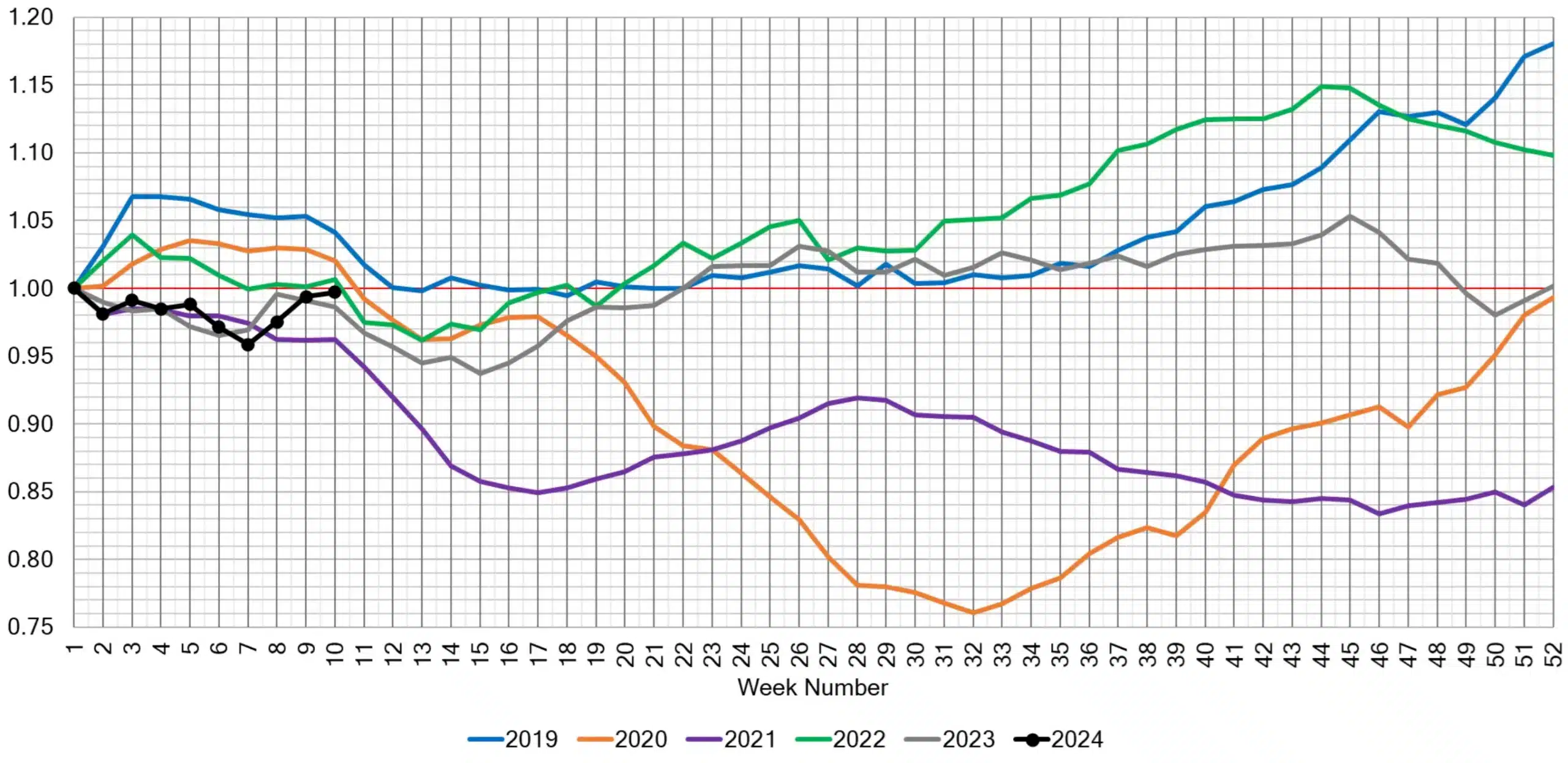

The Used Retail Active Listing Volume Index and the Used Retail Days-to-Turn estimate, now at 52 days, provide a lens into the market’s pulse, signaling the adaptive strategies of dealerships across the US.

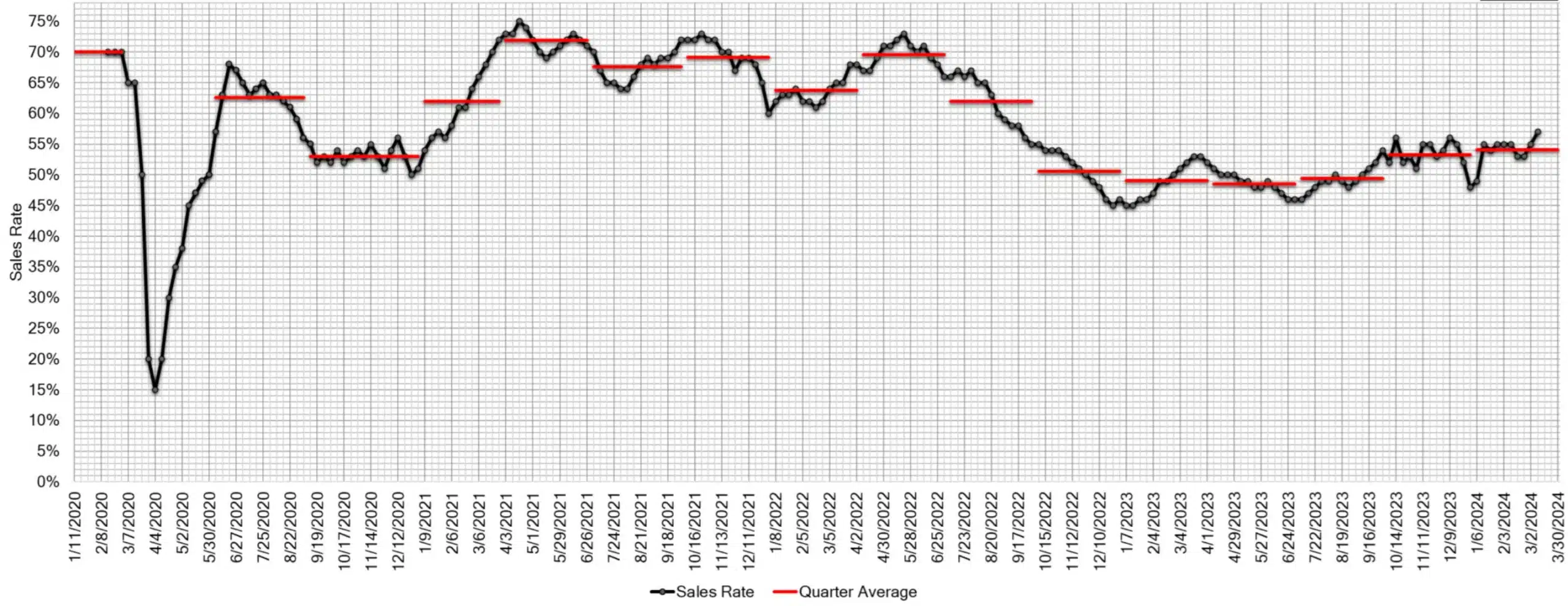

Meanwhile, the wholesale market beams with improvement, embracing the spring’s promise with positive movements in both truck and car segments. The auction lanes buzz with a 2% increase in conversion rates and a slight dip in inventory, fostering a climate of growing optimism.

Concluding Thoughts: On the Road to Optimism

As we navigate through the evolving landscape of the automotive market, this week’s update serves as a beacon of steady progress and cautious optimism. The industry’s resilience, mirrored in the stabilizing depreciation rates and the vibrant auction scene, hints at a burgeoning spring market.

With analysts vigilantly monitoring these shifts, the narrative of recovery and growth continues to unfold.

As the market cruises down this road of recovery, one can’t help but wonder: what new milestones will next week bring?