In the serene twilight of an early March evening, the auto market, much like the fleeting cherry blossoms of spring, showed subtle yet significant signs of change. Amidst this picturesque backdrop, let’s delve into a narrative not just about numbers and trends, but about a journey through the labyrinth of the automotive industry for the week ending March 2, 2024.

It’s a tale that weaves together the persistence of Compact Cars, the resilience of Trucks, and the fluctuating fortunes of Luxury Crossovers, revealing a tapestry rich with insights and surprises.

Auto Market Update Week Ending March 02, 2024 (PDF)

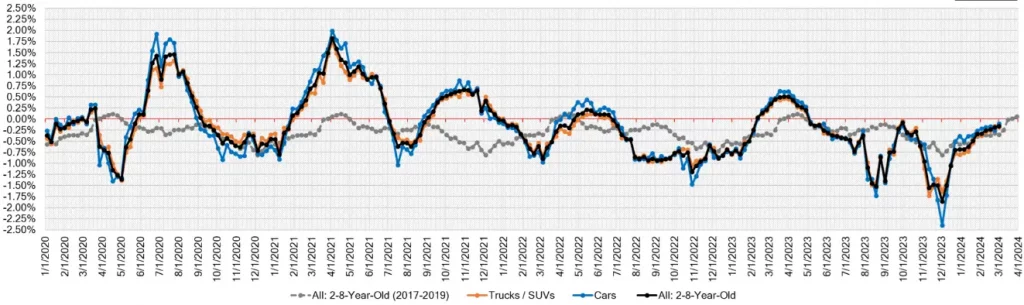

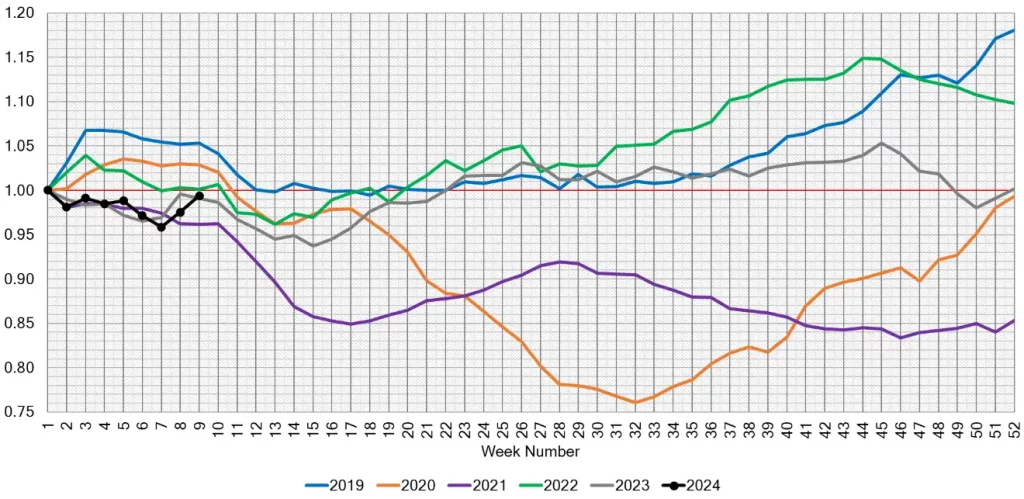

Wholesale Prices: A Closer Look

As the week concluded, the auto market whispered a story of gradual stabilization. With an overall depreciation of a mere -0.10%, the market’s heartbeat slowed compared to the previous week’s -0.25% decline. Among the chapters of this narrative, the Compact Car segment stood tall, boasting a +0.41% increase, its most significant leap since the blossoms of mid-April 2023.

The truck segment, though experiencing a slight increase in depreciation at -0.18%, had its own heroes. The Minivan category and the Small Pickup segment both defied the odds, with the former gaining momentum with a +0.30% rise and the latter marking a steady ascent with a +0.05% increase.

Meanwhile, the stage of Luxury was a tale of contrasts, with Compact Luxury Crossover/SUVs witnessing the most notable declines, painting a picture of mixed fortunes across the board.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.10% | -0.25% | -0.32% |

| Truck & SUV segments | -0.18% | -0.16% | -0.38% |

| Market | -0.16% | -0.19% | -0.35% |

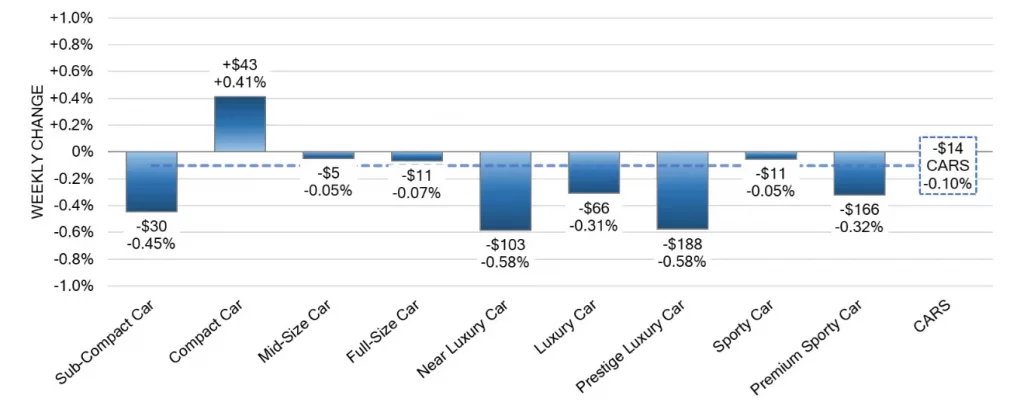

Car Segments: The Unsung Heroes

Diving deeper into the car segments, the narrative becomes even more intriguing. Despite an overall decrease of -0.10%, the Compact Car emerged as the protagonist, witnessing its value rise for the eighth consecutive week. This segment’s +0.41% increase is a testament to its resilience and appeal, marking the biggest one-week gain since the spring of the previous year.

However, not all was rosy in the realm of Cars. The Near-Luxury and Prestige Luxury Car segments faced the brunt of depreciation, each dwindling by -0.58%. Yet, amidst these tales of decline, the Sporty Car segment showed signs of a comeback, with its rate of depreciation slowing to a mere -0.05%.

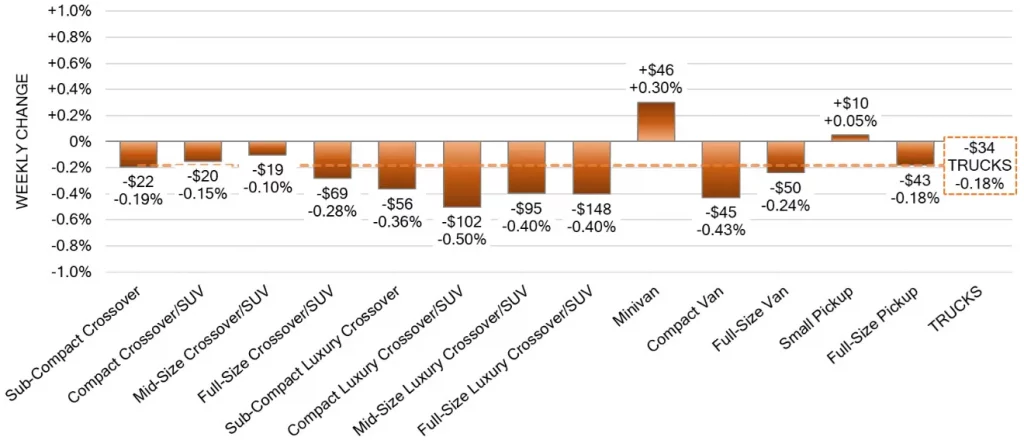

Truck/SUV Segments: The Battle of Resilience

The truck and SUV segments narrate a story of silent battles and quiet victories. With an overall depreciation of -0.18%, the market witnessed modest shifts. However, the Minivan and Small Pickup segments stood out, challenging the status quo with their positive performance. In contrast, the Full-Size Crossover/SUV segment encountered a downturn, reflecting the ever-changing dynamics of the auto market.

Used Retail and Wholesale: The Market’s Pulse

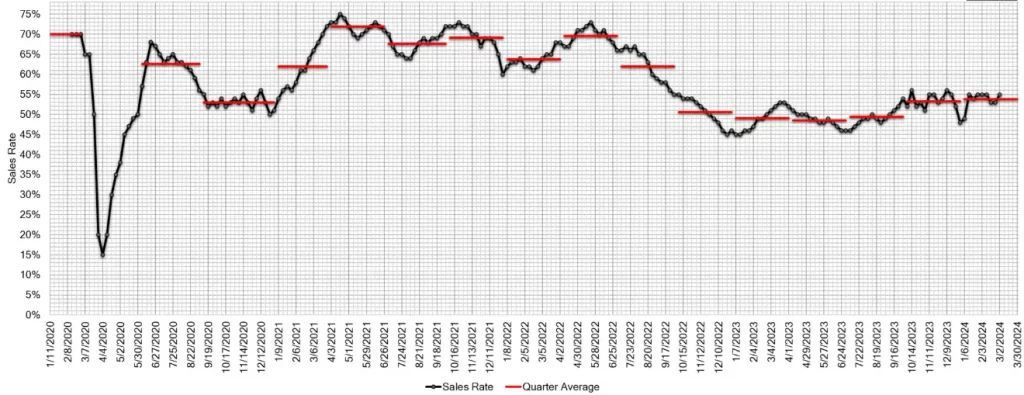

The Used Retail Active Listing Volume Index and the Used Retail Days-to-Turn estimate, sitting around 55 days at the month’s end, provide a pulse on the market’s health. February’s conclusion brought with it a robust performance, hinting at a blossoming optimism with a 2% boost in auction conversion rates and a decrease in auction inventory.

Adding to the drama, a Tesla Cybertruck auction saw a staggering bid exceeding its MSRP by over $100,000, embodying the unpredictability and excitement that define the auto industry. With an estimated Average Weekly Sales Rate improving to 55%, the market’s narrative is one of cautious optimism and spirited resilience.

Conclusion: The Road Ahead

As we put the finishing touches on this week’s auto market update, we’re reminded of the delicate balance between stability and volatility in the automotive world. The continued slowdown in depreciation, the surprising resilience of certain segments, and the robust performance at auctions paint a picture of an industry on the cusp of something new.

With analysts keeping a vigilant eye on developing trends, the journey through the auto market continues to be a source of fascination and intrigue. As the cherry blossoms prepare to bloom, one can’t help but wonder: What surprises will the next week bring?