Auto Market Update Week Ending Jun 24, 2023 (PDF)

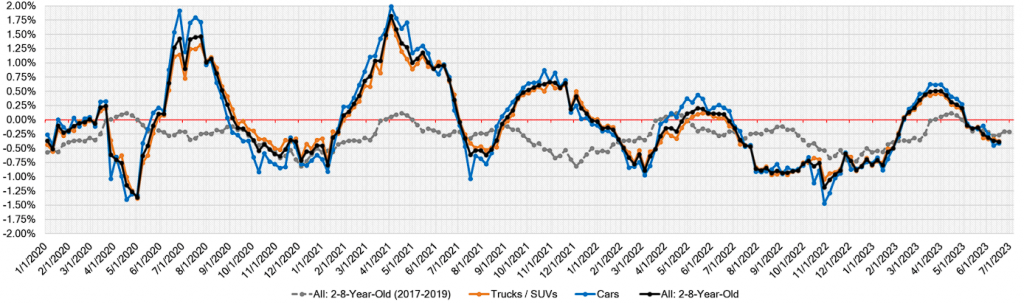

In the automotive market, dealers are exercising caution in their purchasing decisions, resulting in a gradual increase in days to turn and a downward trend in auction sales rates. While retail listing prices have yet to mirror the wholesale decline, it’s important to note that retail prices typically trail behind wholesale changes by six to eight weeks. Consequently, it is anticipated that the retail market will soon witness a decline in prices as well.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

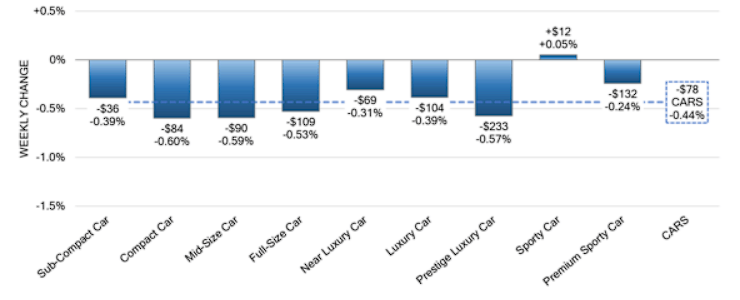

| Car segments | -0.44% | -0.41% | -0.12% |

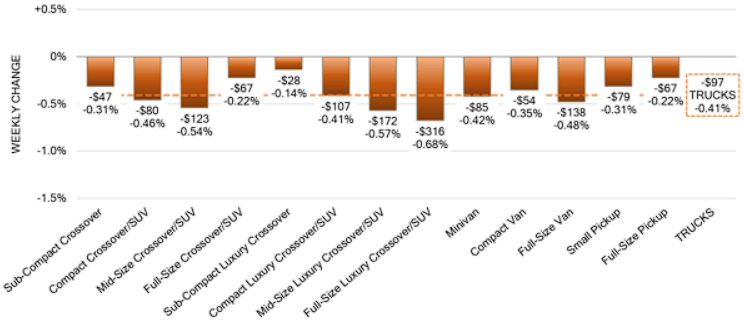

| Truck & SUV segments | -0.41% | -0.37% | -0.08% |

| Market | -0.42% | -0.38% | -0.10% |

Market Performance

During this week, the car segments experienced a volume-weighted decrease of -0.44%, following a decline of -0.41% the previous week. This trend was consistent across various age units, including 0-to-2-year-old and 8-to-16-year-old cars, which both declined by -0.41%. Among the nine-car segments, all but one reported a decrease. The Sporty Car segment demonstrated minimal growth at +0.05%, exhibiting overall stability with an average weekly change of +0.01% over the past month.

In the truck and SUV segments, the volume-weighted overall decline remained consistent with the prior week at -0.41%, mirroring the decrease of -0.37%. The 0-to-2-year-old truck segments experienced a smaller decline of -0.29%, while the 8-to-16-year-old trucks saw a decline of -0.24%. Across all thirteen truck segments, a decline was observed. Notably, the Full-Size Luxury Crossover/SUV segment recorded the largest decline of -0.68%, marking its most significant weekly decrease since mid-January.

Used Retail

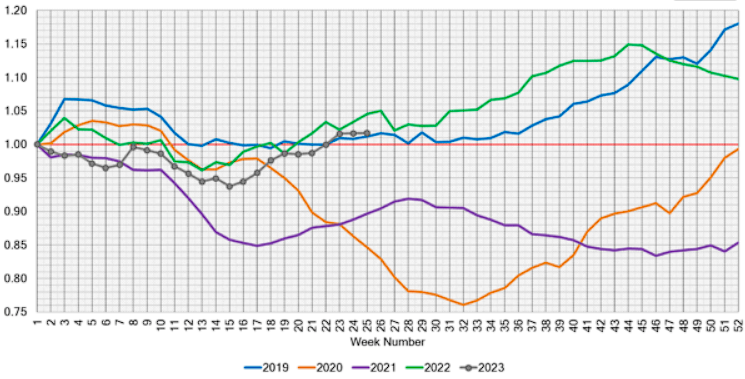

The Used Retail Active Listing Volume Index, which reset to one at the beginning of 2023, currently stands at 1.01 points. This indicates a slight increase from the minor dips witnessed earlier in the year and marks the first time this year that the index has surpassed the 1.00 mark.

Wholesale

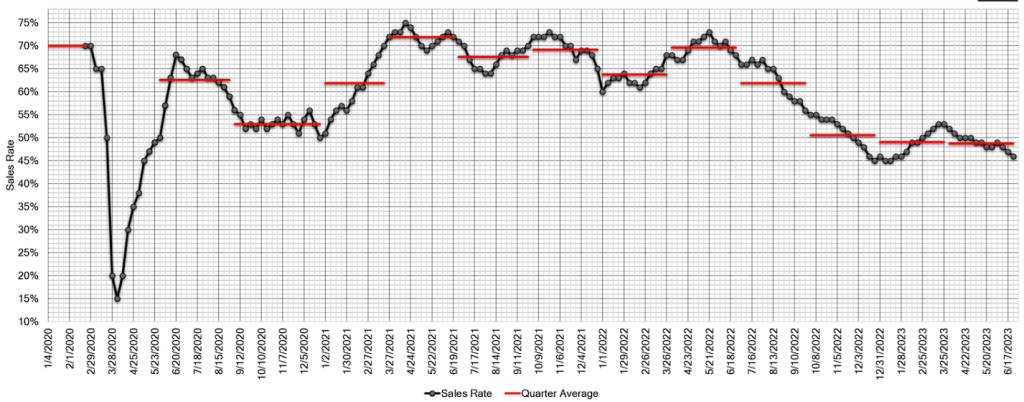

The past few weeks have seen lower conversion rates and increased no-sales, a recurring trend throughout the month of June. While most car segments experienced a decline last week, with the exception of the Sporty Car segment, all truck segments have witnessed a decline in the last two weeks. While larger wholesale sellers continue to perform well, smaller sellers are encountering challenges in moving vehicles at auction. The Estimated Average Weekly Sales Rate decreased to 46% last week, reflecting the market’s current state.

Navigating a Shifting Landscape in the Automotive Market

As dealers exercise caution and sales rates decline, the automotive market is witnessing shifts in both wholesale and retail sectors. While retail listing prices have yet to follow the downward trend observed in the wholesale market, it is expected that they will begin to decline in the coming weeks. As the industry continues to adapt and respond to changing market dynamics, it is crucial for dealers to stay informed and adjust their strategies accordingly.