Auto Market Update Week Ending Jul 29, 2023 (PDF)

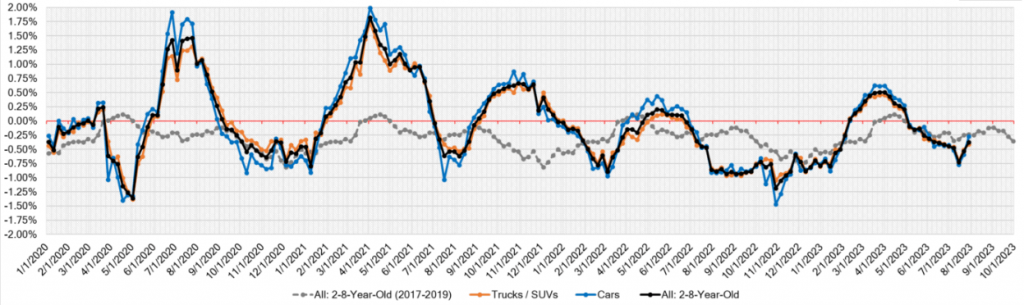

After several weeks of significant declines, the automotive market seems to be finding its footing, with certain segments showing signs of stabilization. Let’s take a closer look at the key highlights from this week’s wholesale price update.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.27% | -0.59% | -0.31% |

| Truck & SUV segments | -0.41% | -0.50% | -0.19% |

| Market | -0.37% | -0.53% | -0.24% |

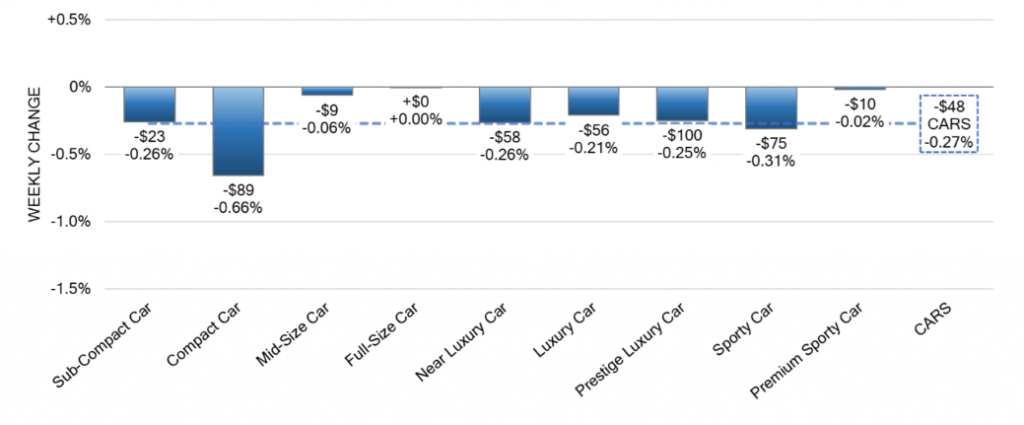

Car Segments

Based on volume-weighted metrics, the Car segment witnessed a marginal decline of -0.27%, showing slight progress compared to the -0.59% decrease in the preceding week. This decline was influenced by the 0-to-2-year-old cars, which experienced a decrease of -0.23%, while the 8-to-16-year-old cars faced a more significant decline of -0.40%.

Notably, all nine Car segments reported decreases this week. However, there were some positive signs within specific segments. The Full-Size, Sporty, and Mid-Size Car segments exhibited stability, with minimal declines of -0.001%, -0.02%, and -0.06% respectively. On the other hand, the Compact Car segment faced the largest decline at -0.66%, although it was an improvement from the prior week’s -0.94% decline.

Luxury segments also showed signs of improvement, with Premium Sporty declining only by -0.02%, compared to -0.24% the previous week, and Near Luxury Car declining by -0.26%, compared to -0.58% in the prior week.

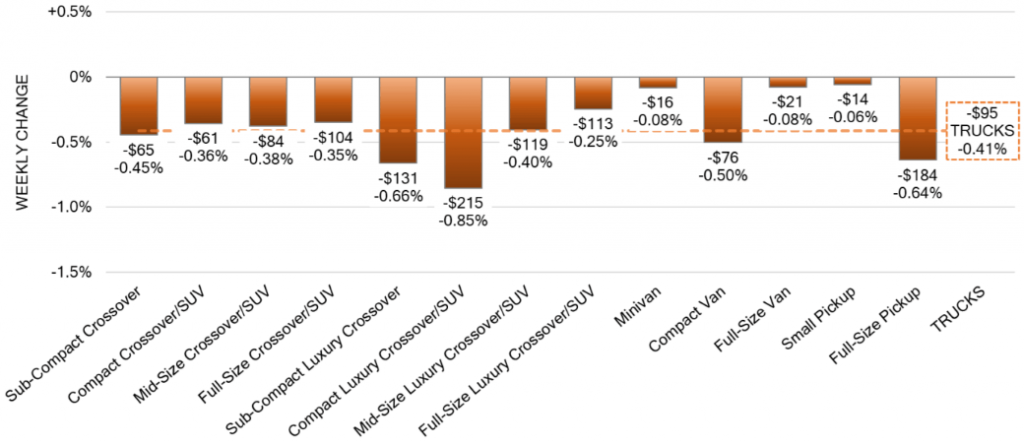

Truck & SUV Segments

The overall Truck segment experienced a decline of -0.41%, a slight improvement from the previous week’s decline of -0.50%. However, there were differing trends among different age groups within the Truck segments. The 0-to-2-year-old Truck segments showed a smaller decline of -0.36%, while the 8-to-16-year-olds faced a more significant depreciation of -0.46%.

During the week, every one of the thirteen Truck segments experienced declines. Particularly noteworthy was the Compact Luxury Crossovers segment, which suffered the largest decline at -0.85%, marking its ninth consecutive week of decline with an average weekly change of -0.74%. Additionally, the Full-Size Pickups segment faced a significant single-week decline of -0.64%, the most substantial since December 2022. Over the past eight weeks, the Full-Size Pickups segment has consistently averaged a weekly decline of -0.36%.

Used Retail

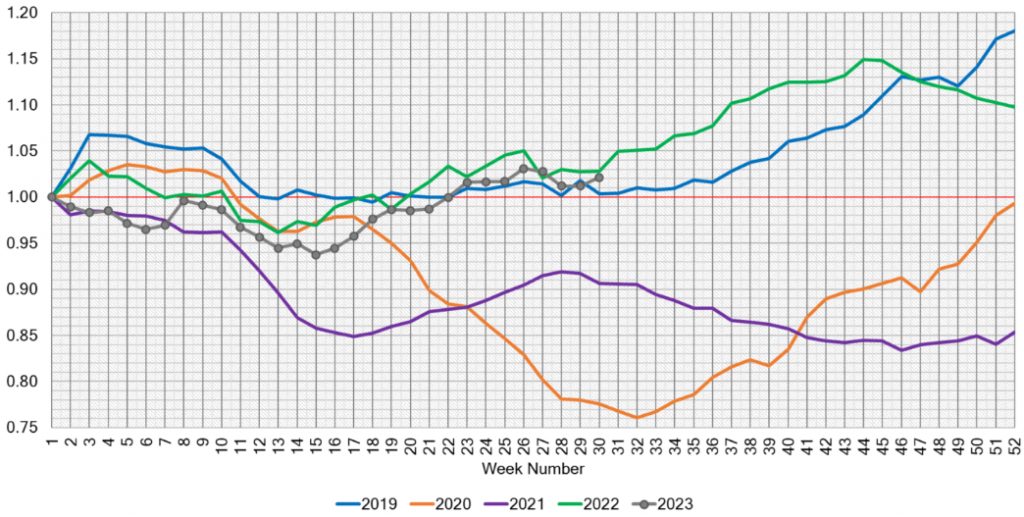

The Used Retail Active Listing Volume Index has maintained a steady reading of 1.02 points, indicating a relatively stable inventory level.

Wholesale Auctions

In the auction lanes, there was increased demand for some Car segments with lower supply. Manufacturers’ shift away from producing sedans has resulted in higher demand at auction for these vehicles compared to some SUV segments that are experiencing more significant depreciation rates.

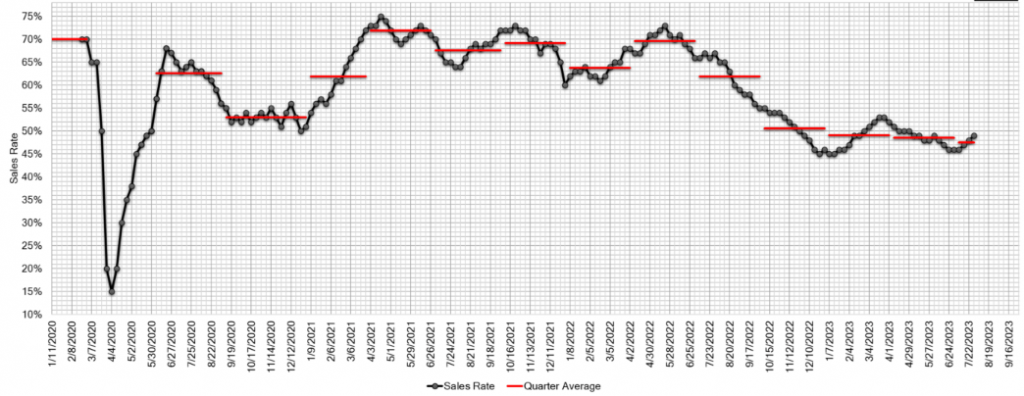

Despite dealers’ days-to-turn remaining in the range of 50+ days, conversion rates at auctions exhibited a notable improvement. However, buyers in search of retail-ready units encountered challenges arising from the condition of some vehicles. On a brighter note, the estimated Average Weekly Sales Rate experienced a boost, reaching 49% in the past week, indicating an encouraging positive trend in the market.

Overall, the automotive market is showing signs of stabilization after recent declines. While some segments are still experiencing depreciation, others are witnessing improvements, indicating a mixed landscape for buyers and sellers alike.

Please note that the data presented here is based on the weekly update ending July 29, 2023. As the market continues to evolve, it is essential to keep track of the latest trends and developments for accurate decision-making in the automotive industry.