Auto Market Update Week Ending Jul 15, 2023 (PDF)

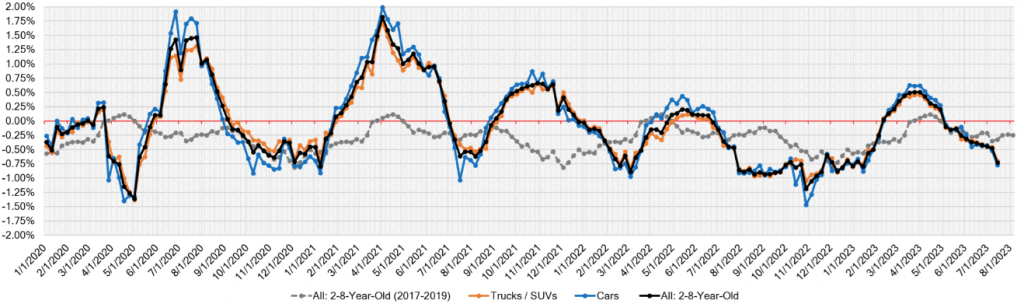

The automotive market witnessed significant shifts during the week ending July 15, 2023, as sellers adjusted their pricing strategies to adapt to changing conditions. These adjustments were reflected in the wholesale price trends, which experienced the most substantial single-week drop since mid-January. Leading up to the July 4th holiday, the market had been on a downward trajectory, although cautious buyers and sellers reluctant to compromise on prices resulted in low sales rates.

However, as we entered the first full week after the holiday, sellers became more open to negotiations. Despite the attractive price drops, buyers remained cautious and only sought out “good deals.” As a result, dealerships saw a growth in inventory levels, and the average time it takes to sell vehicles increased, indicating the preference for appealing offers.

Here is a breakdown of the price trends for different segments in comparison to the previous week and the average from 2017 to 2019:

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.77% | -0.52% | -0.39% |

| Truck & SUV segments | -0.70% | -0.45% | -0.28% |

| Market | -0.73% | -0.47% | -0.33% |

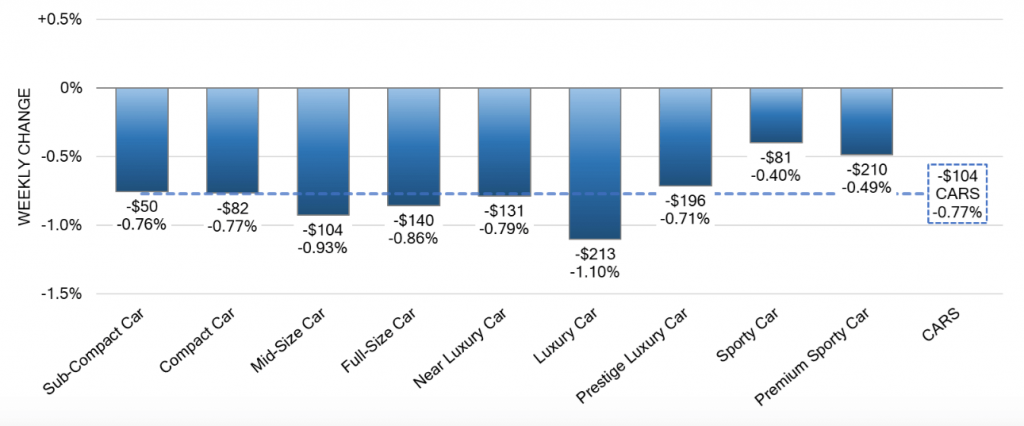

Car Segments

In the Car segments, the volume-weighted average showed a decline of -0.77% this week, compared to -0.52% in the previous week. Both 0-to-2-year-old and 8-to-16-year-old Car segments experienced decreases, with declines of -0.53% and -0.63%, respectively. Across all nine Car segments, depreciation was observed. Notably, the Luxury Car segment had the most significant decline, with a drop of -1.10%, marking the largest single-week depreciation since the final week of 2022. The Sporty Car segment had the smallest decline at -0.40%, but it still represented the segment’s largest depreciation since New Year’s week.

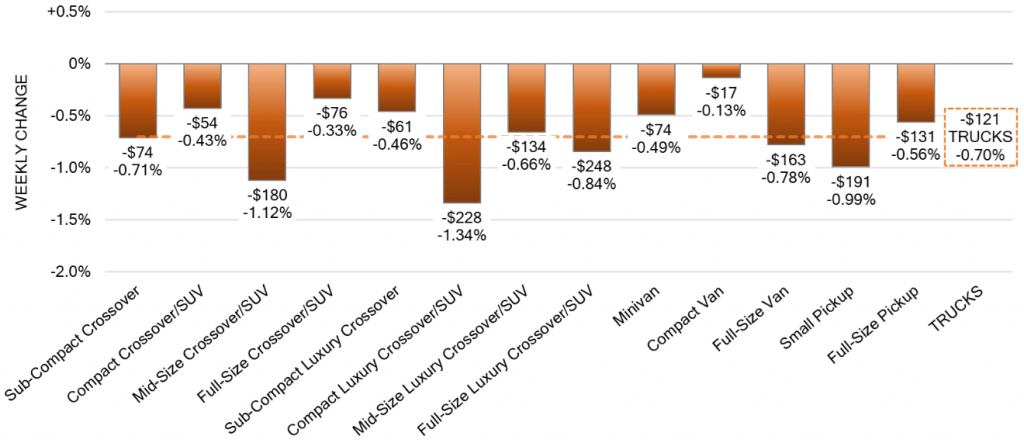

Truck / SUV Segments

Within the Truck & SUV segments, the volume-weighted average exhibited a decline of -0.70% this week, consistent with the -0.45% decline in the previous week. Similar to the Car segments, both 0-to-2-year-old and 8-to-16-year-old Truck segments experienced declines of -0.49% and -0.52%, respectively. All thirteen Truck segments reported decreases during the week. The Mid-Size and Compact Luxury Crossovers experienced the most significant declines within the Truck segment, with drops of -1.12% and -1.34%, respectively. Furthermore, Small Pickups saw a notable increase in the rate of depreciation, declining by -0.99% compared to -0.45% in the previous week.

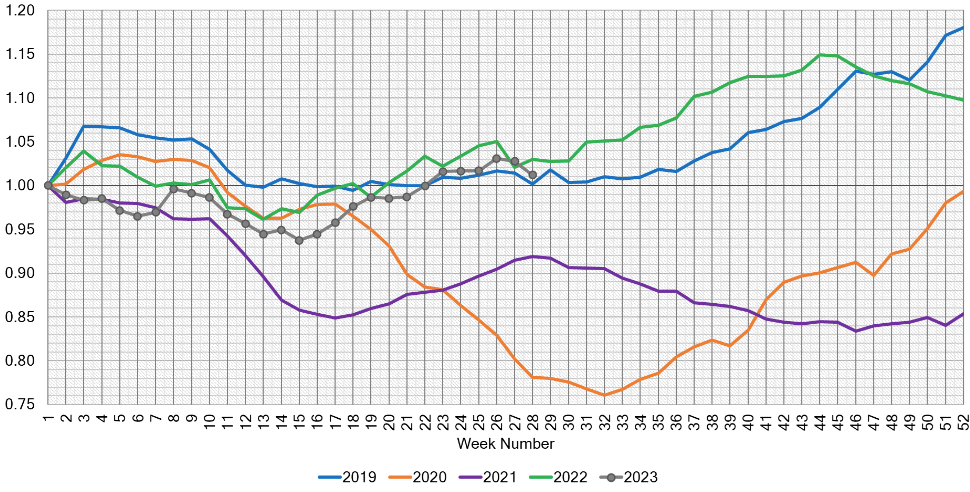

Used Retail

Shifting our focus to the realm of Used Retail, it’s worth noting that the Used Retail Active Listing Volume Index reset to a value of one at the start of 2023. As of now, this index stands at 1.01 points, reflecting the current state of active listings in the used vehicle market.

Wholesale

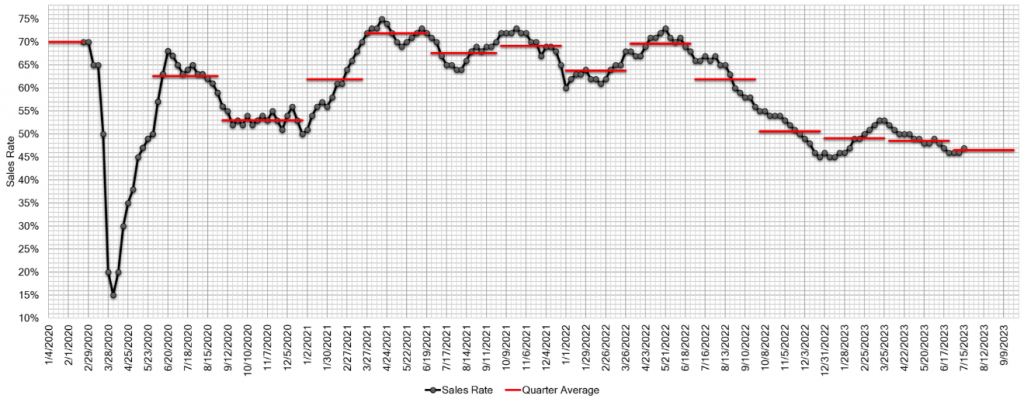

In the wholesale market, prices continued to decline across all segments as sellers started to adjust their pricing floors. Last week, buyers showed increased willingness to make purchases, but they remained cautious, seeking out “good deals.” As a result of the lowered pricing floors, there was a slight improvement in the sales rate. The estimated Average Weekly Sales Rate increased slightly to 47% last week.

These updates highlight the dynamic nature of the automotive market, with sellers making necessary adjustments while buyers remain cautious. As the industry continues to evolve, it is crucial for both buyers and sellers to closely monitor market trends and seize opportunities for favorable transactions. Stay tuned for more comprehensive updates on the automotive market as we track its ongoing developments.