Auto Market Update Week Ending Jul 1, 2023 (PDF)

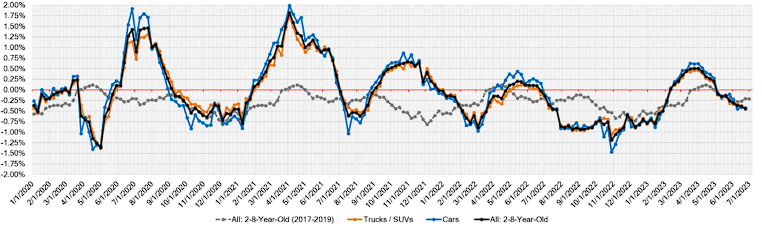

In the ever-evolving world of the automotive market, the past week witnessed a continuation of declines across all segments. The overall market rate of weekly depreciation showed a gradual increase, marking the ninth consecutive week of downturns. Both sellers and buyers remained cautious in the auction lanes, resulting in an abundance of no sales as sellers held firm on pricing floors.

Let’s delve into the specific numbers for this week, comparing them to the previous week:

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.42% | -0.44% | -0.28% |

| Truck & SUV segments | -0.45% | -0.41% | -0.15% |

| Market | -0.44% | -0.42% | -0.20% |

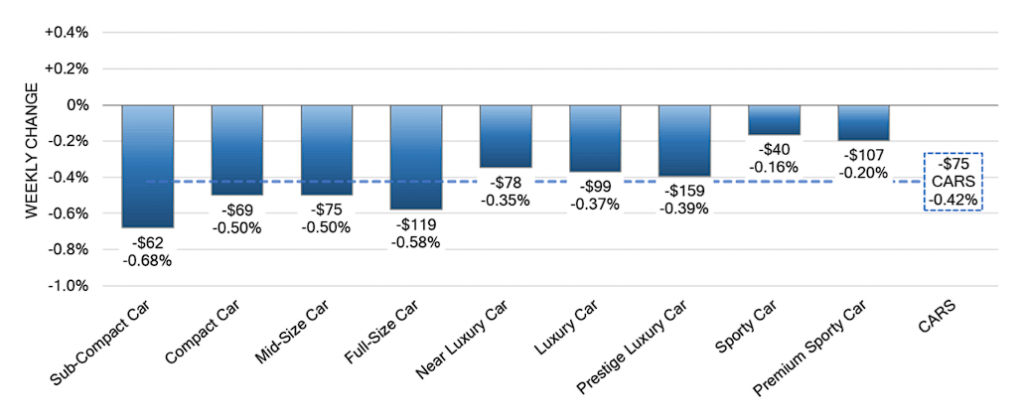

Car Segments

On a volume-weighted basis, the Car segment experienced a decline of -0.42% this week, slightly less than the -0.44% drop observed in the previous week. Within the Car segment, the 0-to-2-year-old units exhibited a similar trend, decreasing by -0.32%, while the 8-to-16-year-old Cars saw a decline of -0.37%.

All nine Car segments reported decreases this week. The Sub-Compact Car segment recorded the largest decline at -0.68%, continuing its nine-week streak of downturns with an average weekly change of -0.52%. The Sporty Car segment, which has shown fluctuations in recent weeks, experienced a decline of -0.18%. Interestingly, the Sporty Car segment began reporting declines around the beginning of June, prior to the impact of COVID.

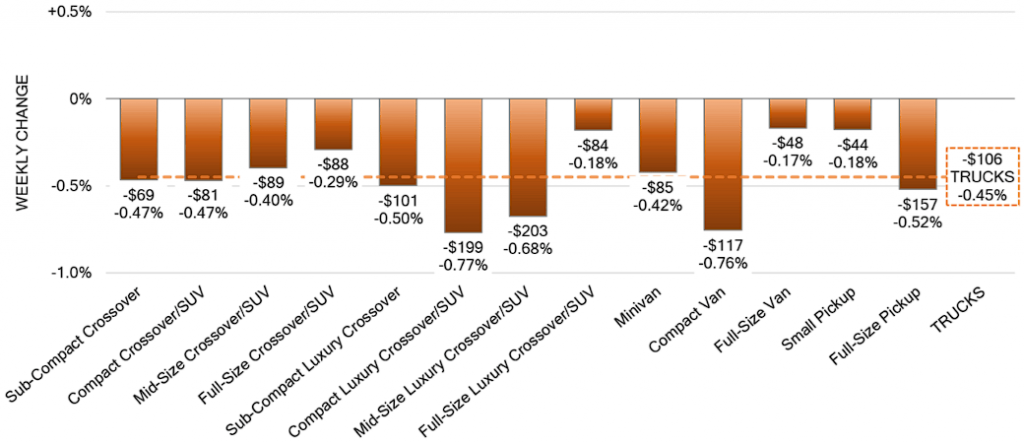

Truck/SUV Segments

The overall Truck segment, on a volume-weighted basis, declined by -0.41% this week, maintaining consistency with the -0.37% decrease seen in the previous week. In terms of age, both the 0-to-2-year-old and 8-to-16-year-old Truck segments reported smaller declines of -0.40% and -0.33%, respectively.

All thirteen Truck segments witnessed a decrease this week. Among them, Compact luxury Crossovers and Compact Vans experienced the largest declines, falling by -0.77% and -0.76%, respectively. Both segments exhibited an increase in depreciation compared to the previous week, with Crossovers down by -0.42% and Vans down by -0.35%. On the other hand, Full-Size Vans saw the smallest decline, dropping only -0.1 7%, which represents the smallest weekly change for the segment since the first week of May.

Used Retail

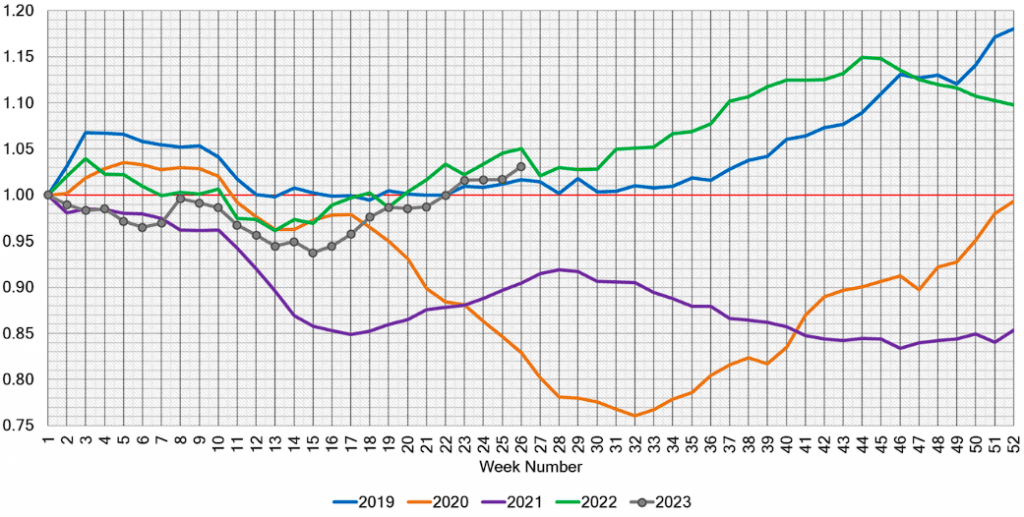

The Used Retail Active Listing Volume Index, which reverted back to one at the start of 2023, currently sits at 1.01 points. This indicates a slight increase from the dips observed at the beginning of the year and marks the first time this year that the index has surpassed the 1.00 mark. These figures suggest a positive trend in the used retail market.

Wholesale

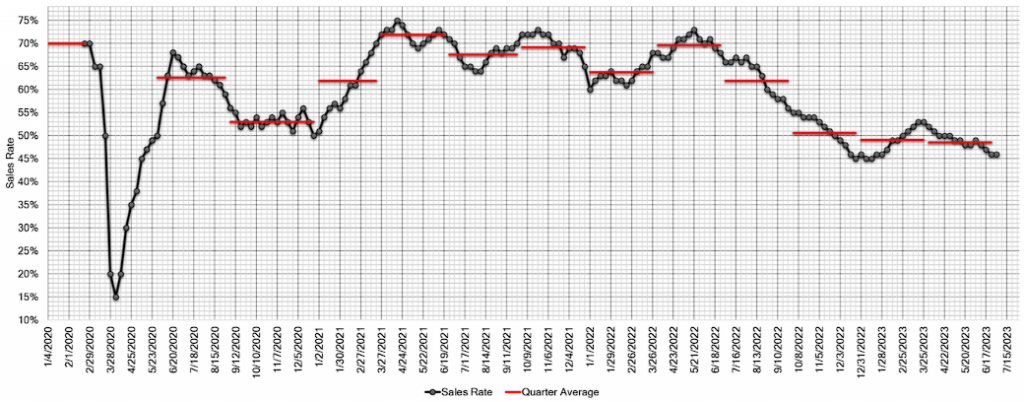

As the month of June came to a close, auction conversion rates and prices continued to decline. With July commencing alongside a long weekend for many, it remains intriguing to observe what the wholesale market has in store for the upcoming month.

Keeping a vigilant eye on the market, we will monitor developing trends and provide valuable insights. The Estimated Average Weekly Sales Rate remained unchanged at 46% throughout the previous week, showcasing stability in the market.

In conclusion, the auto market experienced another week of declines across all segments, with the overall rate of depreciation gradually increasing. Sellers held firm on pricing floors while buyers remained cautious, resulting in a significant number of no sales in the auction lanes. As we navigate the dynamic automotive landscape, it becomes increasingly vital to stay informed about the evolving trends that shape the industry.