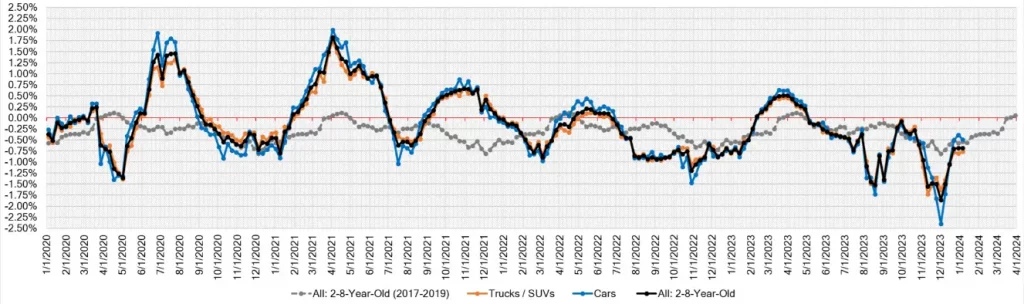

As the calendar page turns to 2024, the auto market tiptoes into the new year, much like a cautious explorer stepping into uncharted territory. Gone are the days of frenetic auction scenes that characterized the past, replaced now by a more measured tempo as January unfolds its first chapter.

This lull in the market’s heartbeat raises an intriguing prospect: the anticipation of a spring revival. Reflecting on the pre-COVID days of 2020, the market’s pulse had quickened noticeably by the third week of January, injecting a vibrant energy into the trade. Are we on the cusp of a similar awakening this year, or will 2024 chart a different course, rewriting the market’s seasonal playbook?

Auto Market Update Week Ending Jan 06, 2024 (PDF)

A Glimpse at the Numbers

Wholesale Prices (Week Ending January 6th, 2024)

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.49% | -0.39% | -0.60% |

| Truck & SUV segments | -0.77% | -0.80% | -0.50% |

| Market | -0.68% | -0.68% | -0.54% |

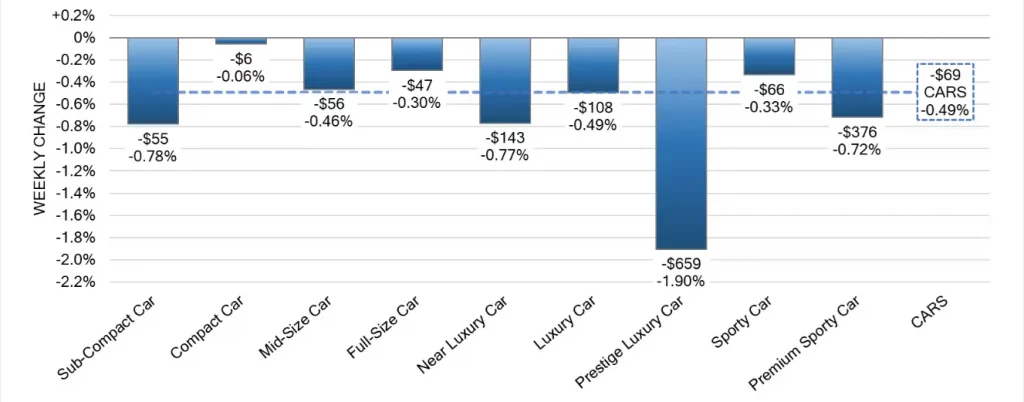

Insight into Car Segments

The car segments, on a volume-weighted basis, experienced a -0.49% dip. Notably, this is a subtle shift from the -0.39% decrease seen in the preceding week. The decline was more pronounced in the older car models (8-to-16-year-old), mirroring the younger segments (0-to-2-year-old) with a -0.41% fall.

The Compact Car segment, often prone to significant depreciation, showed remarkable resilience with just a -0.06% dip, a stark contrast to its previous steep declines.

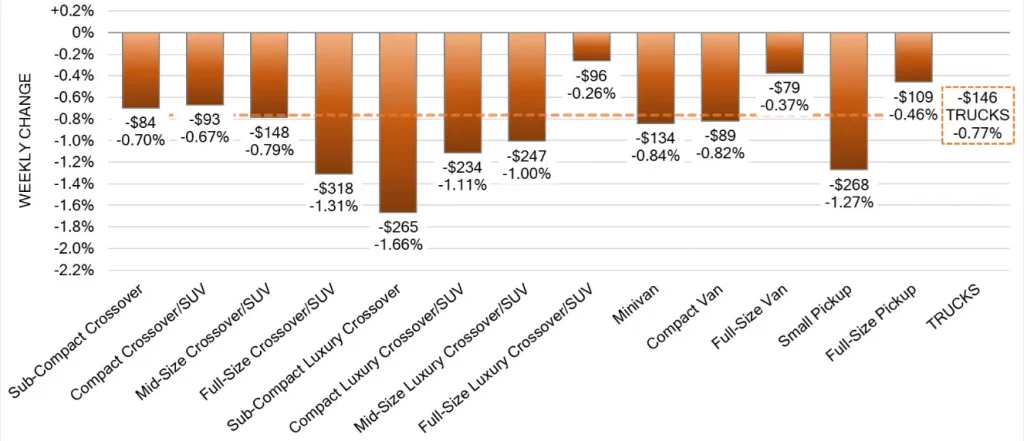

The Truck/SUV Landscape

Trucks and SUVs followed a similar downward trend with a -0.77% decrease. The depreciation rate, however, showed a slight improvement from the previous week’s -0.80%. The older models (8-to-16-year-old) were hit harder, depreciating by -0.81% on average.

Notably, the Sub-Compact Luxury Crossover segment suffered the most, marking its eighth consecutive week of decline exceeding 1%.

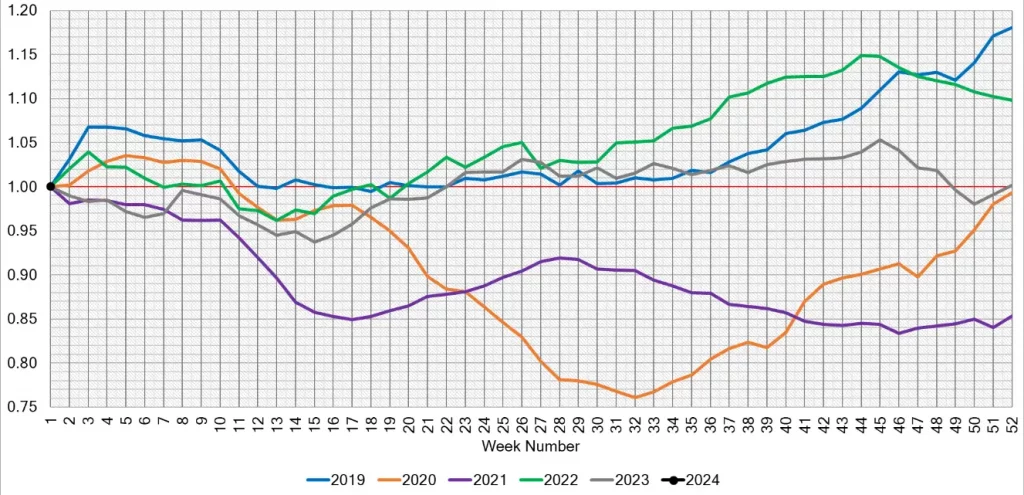

The Used Retail and Wholesale Picture

The Used Retail Active Listing Volume Index has now dipped below its starting point at the beginning of the year, with the Days-to-Turn estimate hovering around 59 days.

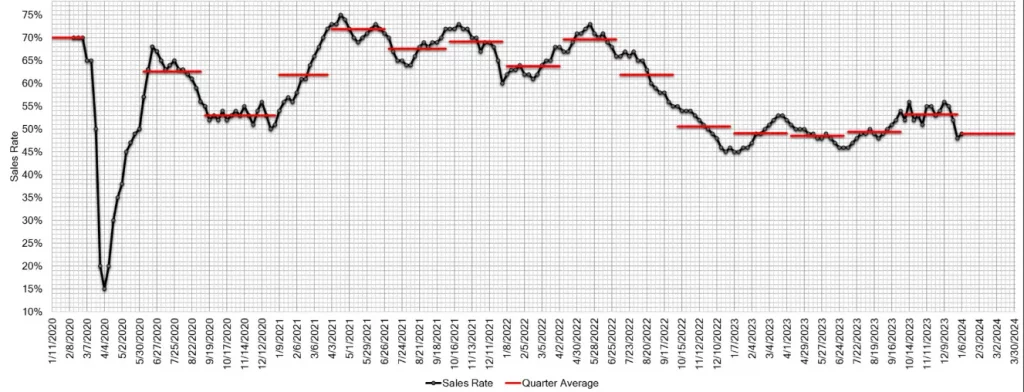

As for the wholesale aspect, the first week of 2024 mirrored the close of 2023, with a mix of optimism and uncertainty. Auction attendance picked up later in the week, but a sense of hesitancy was palpable, marked by mixed signals in wholesale prices and a moderate improvement in the auction conversion rate to 49%.

Concluding Thoughts

As 2024’s pages start to fill, the storyline of the auto market remains a tantalizing enigma. A central question hovers like a mirage on the horizon: Will the advent of spring breathe new life into the market’s sails, or are we sailing towards a continuation of the current calm?

The answer remains shrouded in the mists of time, a riddle waiting to be unraveled. In this ever-evolving narrative, one truth stands unwavering: the world of automobiles is a tapestry woven with unexpected twists and vibrant turns.

Keeping a keen eye on the ever-shifting landscape is more than a necessity; it’s an adventure in itself. Join us on this journey as we delve deeper into the market’s rhythms and currents, eager to uncover what 2024 has in store for the realm of autos.