Auto Market Update Week Ending December 31st, 2022 (PDF)

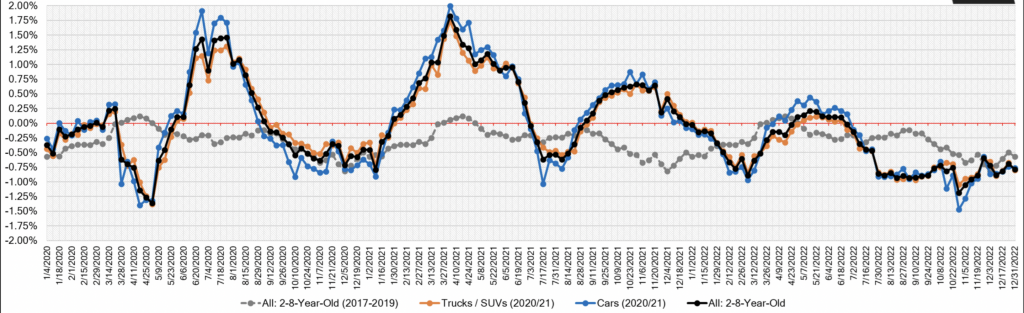

In a positive development, the overall conversion rate at the auctions improved slightly over last year. With depreciation exceeding the typical yearly rate, values are still well above pre-COVID levels.

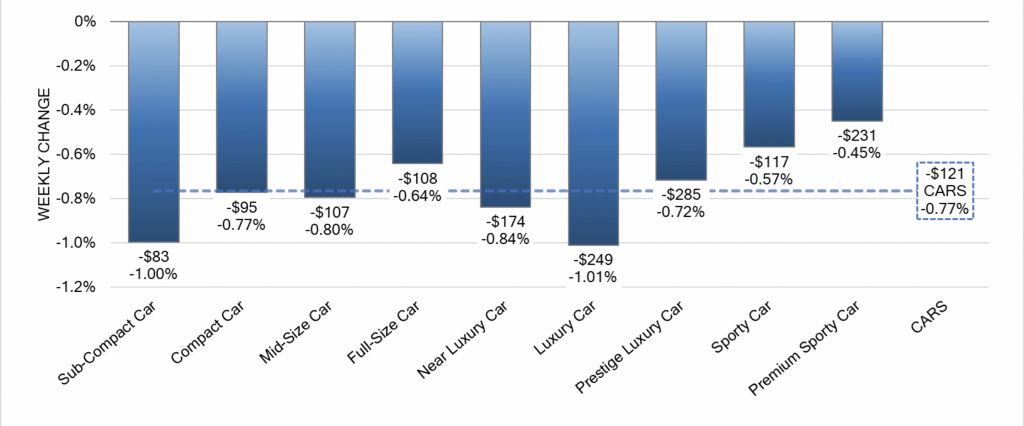

- For comparison, the previous week, cars decreased by -0.49% on a volume-weighted basis, while this week -0.77%.

- Two out of the nine Car segments experienced declines greater than 1% last week (Luxury Car, -1.01%; Sub-Compact Car, -1.00%).

- Over the last six weeks, Premium Sporty Cars have averaged a weekly decline rate of -0.49%.

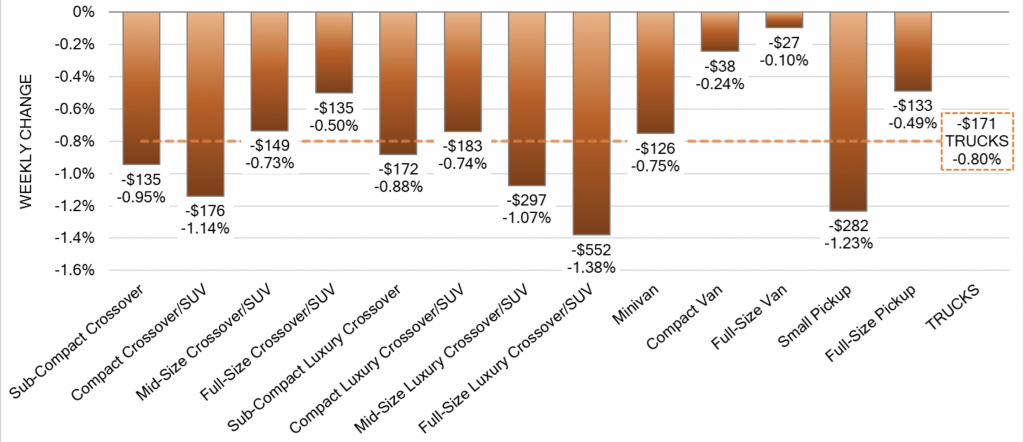

- Compared with the previous week’s decline of -0.34%, the volume-weighted, overall Truck segment declined by -0.80%.

- Four of the thirteen Truck segments reported declines last week (Full-Size Luxury Crossover/SUV, -1.38%; Small Pickup, -1.23%; Compact Crossover, -1.14%; Mid-Size Luxury Crossover/SUV, -0.07%).

- With another week of small declines, the full-size van segment now has an average weekly decline rate of -0.16% over the last 20 weeks; by comparison, the truck segment has an average weekly decline of -0.80%.

| This week | Last week |

2017-2019 Average(Same Week) |

|

| Car segments | -0.77% | -0.49% | -0.57% |

| Truck & SUV segments | -0.80% | -0.34% | -0.57% |

| Market | -0.79% | -0.39% | -0.57% |

Retail (Used and New) Insights

- Last week, Ford announced the horsepower and torque figures for the redesigned 2024 Mustang; 486 horsepower and 418 pound-feet torque, respectively in the 5.0L V8 engine. In comparison, the EcoBoost variant will deliver 315 horsepower and 350 pound-feet of torque, while the Dark Horse variant will deliver 500 horsepower and 418 pound-feet of torque.

- With plans to bring their electrolyte fuel-powered EV concept to the US, London-based NanoFlowcell has set up its headquarters in New York City.

- The First 2023 Audi Q8 E-Tron rolled off the assembly line last week and will offer at least a 30% increase in range over the original E-Tron released in 2018. Crossovers and Sportback Variants will be available in mid-2023.

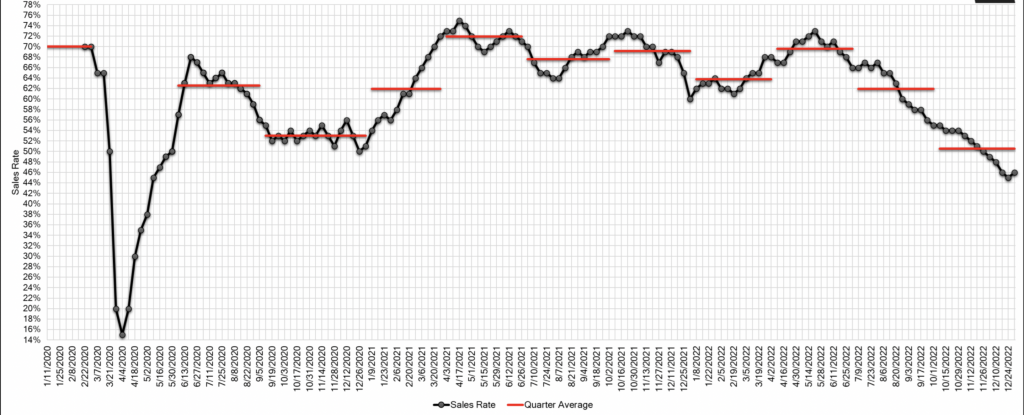

Wholesale

The week between Christmas and New Year’s is always a bit of a roll of the dice for market values. In prior years, used vehicle values were pushed lower because of strong incentives for new cars. On the other hand, some years saw higher demand from dealers as they geared up for the Spring market. This year, there are no high incentives for new vehicles, but consumer demand is low due to high-interest rates meaning that demand for used remains weak. There was one positive sign though – conversion rate inched up at the auction – but it should be noted that overall volume was lower than usual, which isn’t unexpected since many consignors are holding onto inventory until after the holidays.