A Closer Look at Wholesale Prices During the Festive Season

As we approach the end of December, the automotive auction scene has notably quieted, a common trend during the holiday season. Dealers are now poised for what’s colloquially known as the ’13th month’ – that crucial final week of the year.

The outcomes of this week’s retail sales will be instrumental in shaping the industry’s momentum as we step into the new year.

Auto Market Update Week Ending Dec 23, 2023 (PDF)

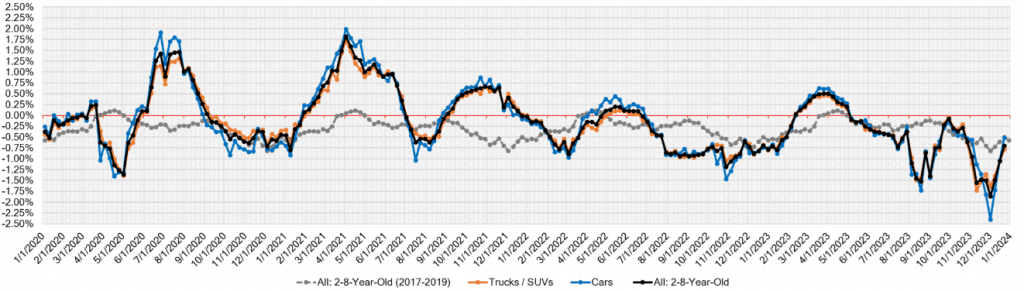

Comparative Analysis: This Week vs. Historical Trends

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.51% | -1.03% | -0.58% |

| Truck & SUV segments | -0.78% | -1.06% | -0.44% |

| Market | -0.70% | -1.05% | -0.50% |

Detailed Breakdown by Segment

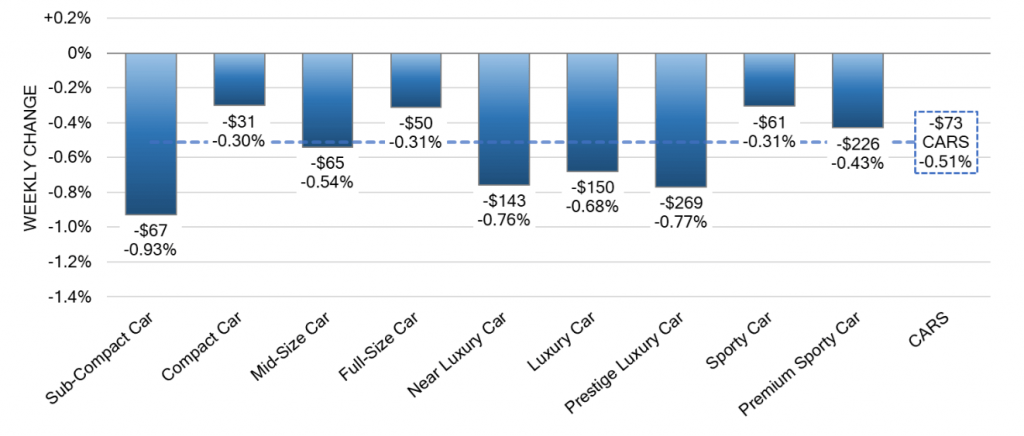

Car Segments:

This week, car segments witnessed a volume-weighted decrease of 0.51%, showing a slower rate of depreciation compared to the previous week’s 1.03% decline. Notably, cars in the 0-2 year range dipped by 0.52%, while those in the 8-16 year range saw a 0.91% drop.

Interestingly, all nine car segments experienced a decrease, yet none surpassed the 1% depreciation mark – a first in the past six weeks. The Sub-Compact Car segment led the decline at 0.93%, while the Compact Car segment recorded a notable slowdown in depreciation at just 0.30%.

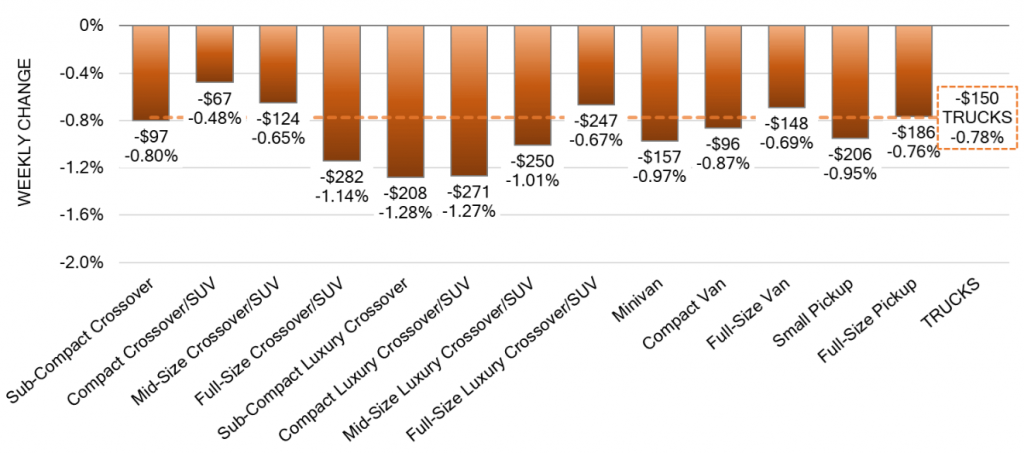

Truck / SUV Segments:

Trucks and SUVs followed a similar trend, with a volume-weighted decrease of 0.78%. Younger models (0-2 years) fell by 0.73%, while older models (8-16 years) saw a 0.85% decline. Despite all thirteen segments showing a decrease, only four exceeded the 1% depreciation threshold.

The Compact Crossover/SUV segment fared the best, with only a 0.48% drop, while the Sub-Compact Luxury Crossover/SUV segment faced the steepest decline at 1.28%.

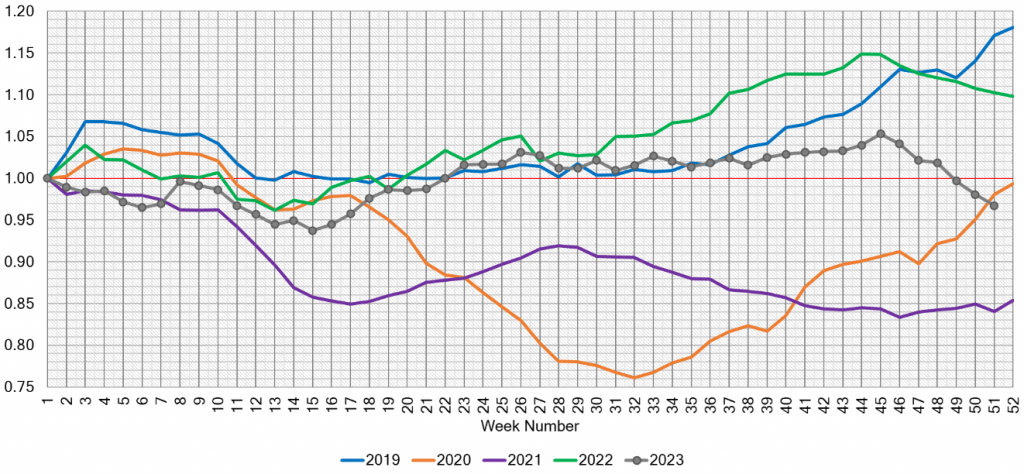

Retail and Wholesale Market Insights

Used Retail: The Used Retail Active Listing Volume Index has now dipped below the year’s starting point, with the Days-to-Turn estimate hovering around 62 days.

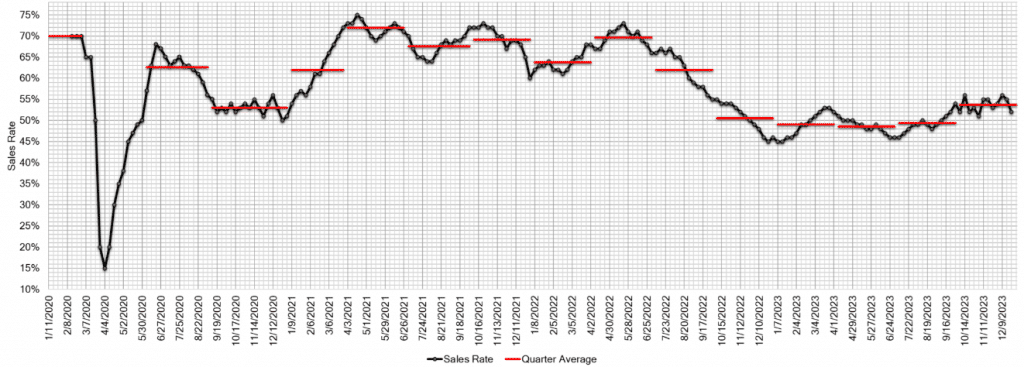

Wholesale Perspective: The holiday season has led to a noticeable slowdown in the market, with lower auction conversion rates. The average weekly sales rate has declined to 52%, reflecting the impact of the festive season, higher interest rates, and the recent downward trend in used vehicle prices.

The performance in the last week of the year will be crucial in determining the market’s direction as we enter the new year.