Auto Market Update: Analyzing Wholesale Prices Trends

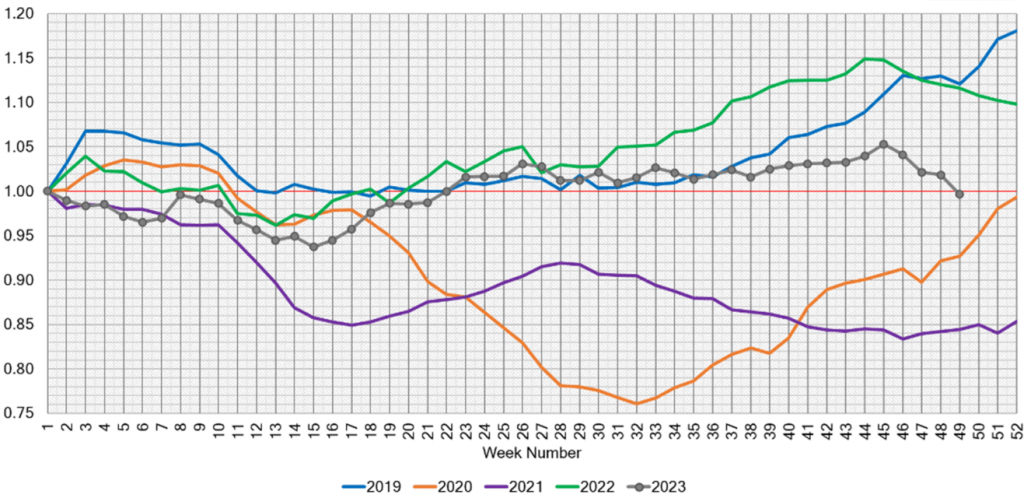

In this week’s Auto Market Update, we delve into the dynamics of the automotive market, focusing on the wholesale prices for the week ending December 9th.

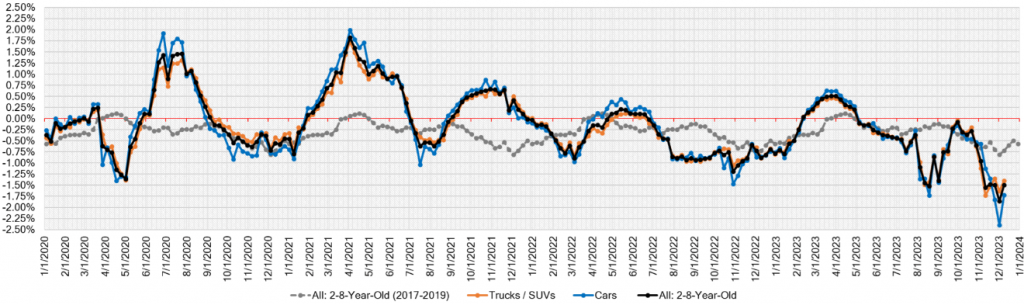

The industry continues to witness substantial declines, although there are noteworthy signs of moderation in the overall rate of decrease, with a market-wide decline of -1.49% compared to the previous week’s -1.86%.

Sellers appear more willing to adjust their price floors, anticipating that larger-than-traditional seasonal declines will persist until the year’s end.

Auto Market Update Week Ending Dec 09, 2023 (PDF)

Market Overview

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.72% | -2.40% | -0.82% |

| Truck & SUV segments | -1.40% | -1.64% | -0.66% |

| Market | -1.49% | -1.86% | -0.72% |

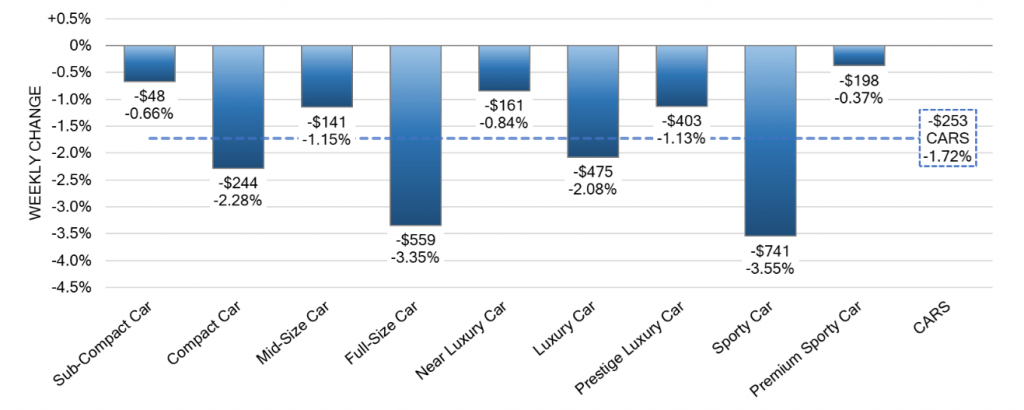

Car Segments

On a volume-weighted basis, the Car segment experienced a -1.72% decrease, showing a slight improvement from the previous week’s -2.40% decline. Delving into the specific age categories, 0-to-2-year-old Car segments saw a decline of -1.36%, while 8-to-16-year-old Cars declined by -2.15%.

Notably, all nine Car segments recorded decreases, with Sporty (-3.55%) and Full-Size (-3.35%) Cars showing the most substantial declines. Compact Cars continued their downward trend but at a slower rate of -2.28%, compared to the previous two weeks.

Premium Sporty Cars, however, defied the trend, experiencing only a -0.37% decline, which is typical for this time of year.

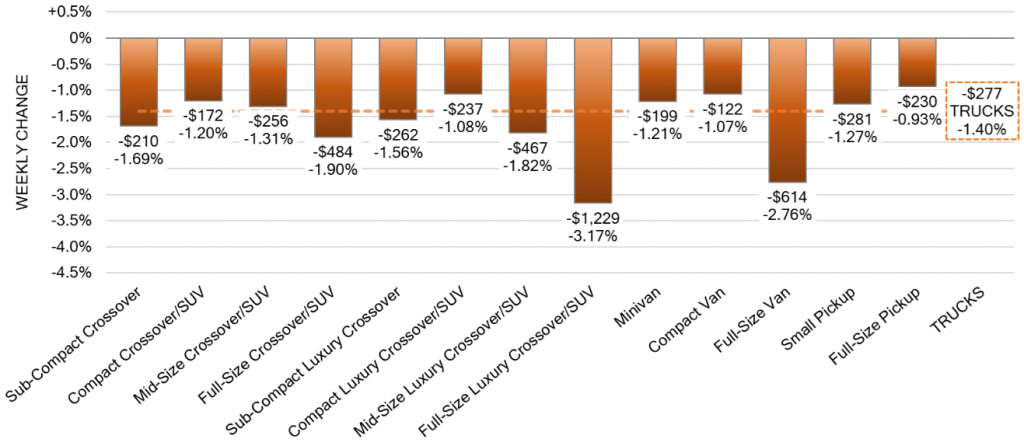

Truck / SUV Segments

The overall Truck segment, on a volume-weighted basis, decreased by -1.40%, a slight improvement from the previous week’s -1.64% decline. Both 0-to-2-year-old models (-1.18% on average) and 8-to-16-year-olds (-1.32% on average) saw decreases.

All thirteen Truck segments reported declines, with Full-Size Luxury Crossover/SUVs (-3.17%) marking a third consecutive week of significant depreciation. Notably, Compact Vans experienced the smallest single-week depreciation in the last six weeks, with a decline of -1.07%.

Used Retail

The Used Retail Active Listing Volume Index stands at 1.00 points, indicating stability. The Used Retail Days-to-Turn estimate is approximately 58 days.

Wholesale Trends

As we conclude the first full week of December, wholesale prices continue their downward trajectory across all reporting segments. A notable observation at auctions this week is the increased preference among buyers for vehicles with clean histories, lower mileage, and higher condition grades, reflecting a reluctance to invest more in preparing vehicles for the front line.

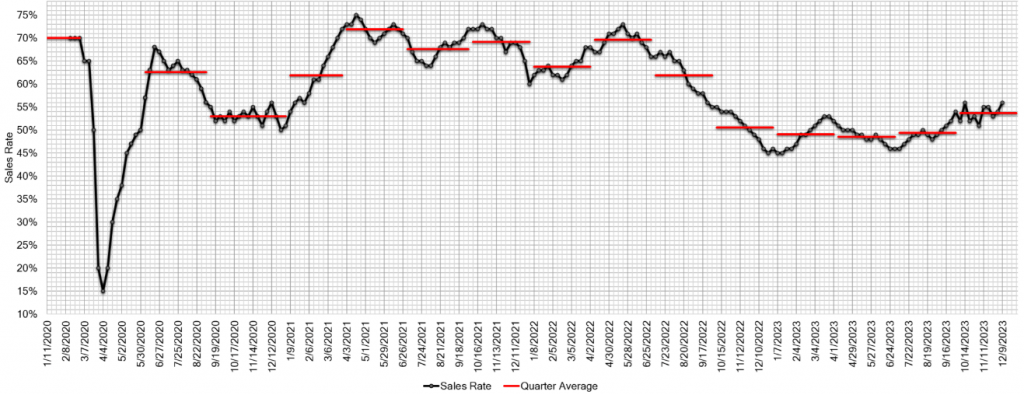

A positive outcome from this shift in buyer behavior is the overall increase in auction conversion rates. The estimated Average Weekly Sales Rate rose to 56% last week, signaling a potential market adjustment and increased demand for well-maintained vehicles.