Auto Market Recap and Wholesale Price Trends – November 2023

In the wake of a resolved six-week auto workers’ strike, the auto market in November experienced a tumultuous ride, marked by significant wholesale price fluctuations.

This recap delves into the intricate details of the market’s movements, highlighting the key segments that witnessed noteworthy changes.

Auto Market Update November 2023 (PDF)

The Aftermath of the Strike

Following the resolution of the prolonged auto workers’ strike, November ushered in a series of wholesale price changes that reverberated throughout the industry. Initially, the Truck segments saw noticeable declines, setting the stage for a correction phase that resulted in substantial depreciation across various segments.

As the dust settles, industry insiders are left grappling with uncertainty, attempting to gauge the depth of these declines and pondering whether the market has hit its bottom.

Post-Thanksgiving Acceleration

The post-Thanksgiving period brought with it a continuation of significant weekly declines, adding momentum to the market’s depreciation. Despite robust auction attendance, ample inventory, and strong conversion rates, sellers are now recalibrating their strategies, revising reserve prices, and contributing to the ongoing challenge of establishing a new “normal” for the market.

Car Segment Overview

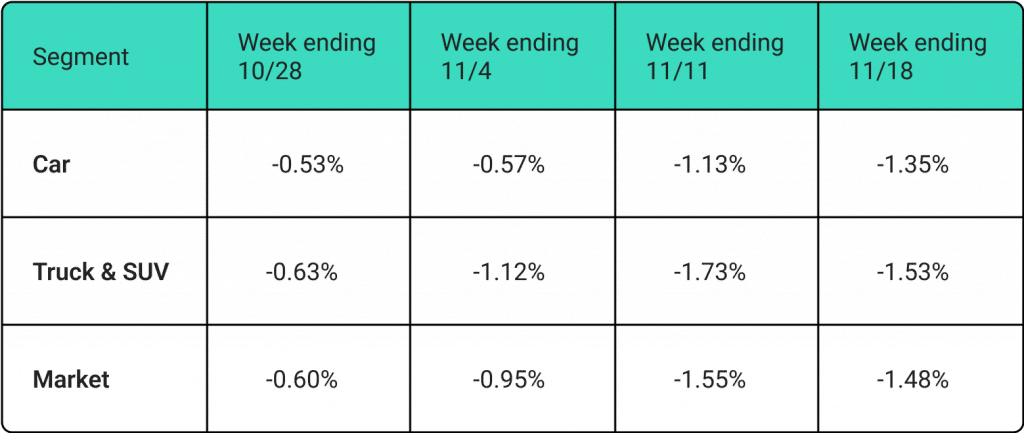

The Car segment witnessed a consistent decline in wholesale prices, ranging from -0.53% to -1.35%. Both the 0-to-2-year-old and 8-to-16-year-old Car segments experienced significant drops, ranging from -0.96% to -1.05%.

Across all nine Car segments, weekly declines were reported, with Full-Size Car and Sub-Compact Car segments experiencing the most significant depreciations at -2.33% and -2.12%, respectively.

In contrast, the Premium Sporty Car segment remained relatively stable, with a modest decline of -0.25% and an average weekly decline of -0.20% over the past six weeks.

Truck & SUV Segment Insights

The Truck/SUV segment encountered substantial wholesale price drops, ranging from -0.63% to -1.53%. Both newer and older models experienced declines between -1.36% and -1.77%. Among the thirteen segments, Compact Vans took the lead with a record-setting decline of -5.48%.

Full-Size Vans and Full-Size Pickups also recorded noteworthy declines at -3.64% and -2.79%, respectively. This highlights a pervasive and consistent depreciation trend in the Truck segment, particularly with Compact Vans setting records for steep declines.

Used Retail Landscape

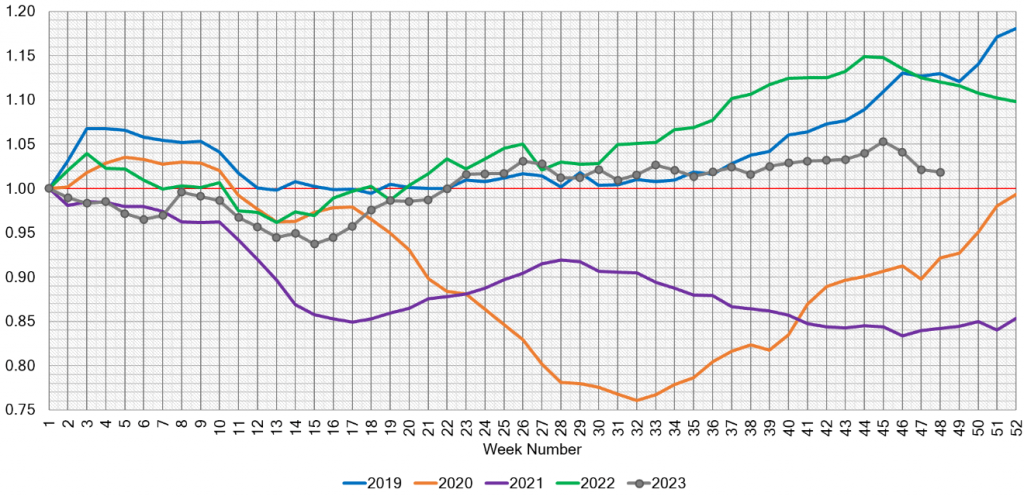

The Used Retail Active Listing Volume Index currently stands at 1.02 points, reflecting the dynamics of the used car market. This index serves as a valuable metric for understanding the trends in the used retail sector.

Wholesale Market Observations

Yet another week of heavy declines in both car and truck segments has been observed. Notably, the Full-Size Luxury SUV emerged as the truck with the largest decline, while Compact Car reported the most significant decline among all reporting segments.

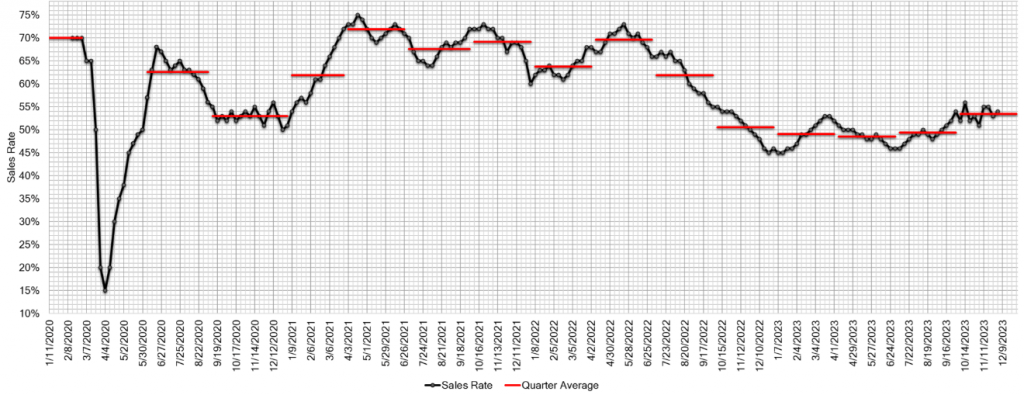

Despite the volatility, there was a slight uptick in auction conversion rates, indicating that sellers are willing to adapt to the market’s unpredictability, even if it means accepting lower prices to avoid more substantial losses in the future. The estimated Average Weekly Sales Rate increased to 54% last week, underscoring the dynamic nature of the wholesale market.

As we navigate the waves of uncertainty in the auto market, November’s recap sheds light on the complex dynamics of wholesale price changes. Stakeholders are now tasked with adapting to this new reality, where market resilience and strategic recalibration become paramount. The journey through November’s market fluctuations provides valuable insights for industry players, setting the stage for informed decision-making in the months ahead.