The 2025 auto market faces turbulence: used car prices plummet 12% YoY, luxury EVs depreciate 42% faster than gas models, and U.S. tariffs spark global supply chain chaos. This week’s data reveals shifting consumer preferences, inventory pressures, and geopolitical risks reshaping valuations and retail trends.

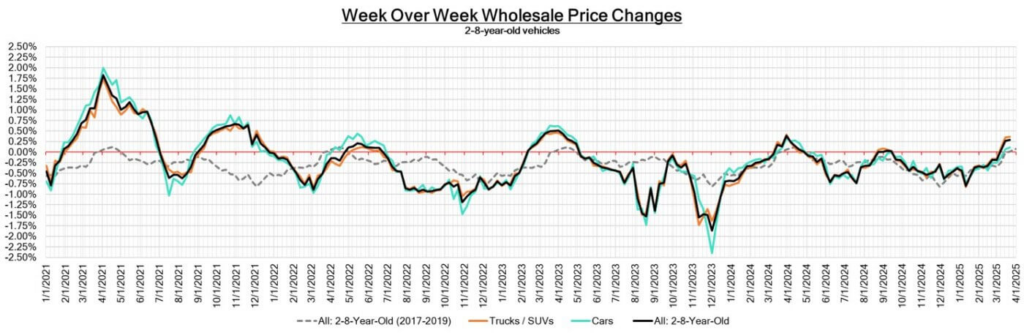

Week Over Week Wholesale Price Changes

| Category | This Week | Last Week | 2020–2023 Average |

|---|---|---|---|

| Car Segments | +0.11% | +0.06% | +0.16% |

| Truck & SUV Segments | +0.36% | +0.34% | -0.10% |

| Whole Market | +0.29% | +0.27% | +0.01% |

- Key Insight: Wholesale prices fell 1.2% WoW, driven by oversupply of used trucks (-18% YoY) and softening demand for luxury EVs 49.

- Tariff Impact: U.S. import tariffs added 3k–3k–5k to average vehicle costs, accelerating price declines for non-domestic models 3.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

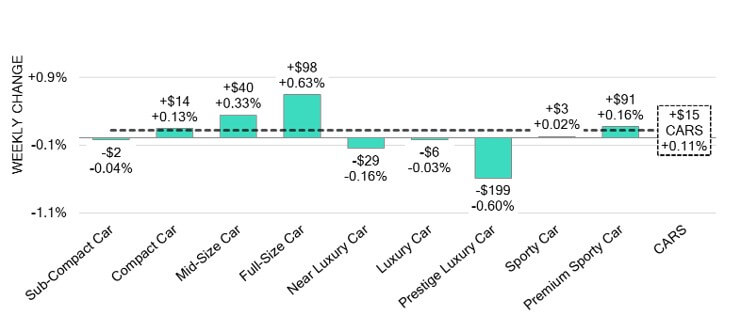

Car Segments

- Compact Sedans Lead: Honda Civic and Toyota Corolla retained 95% of value due to affordability and fuel efficiency 4.

- Luxury EVs Struggle: Mercedes EQS and Tesla Model S lost 42% value in Year 1, weighed down by software glitches and repair costs 49.

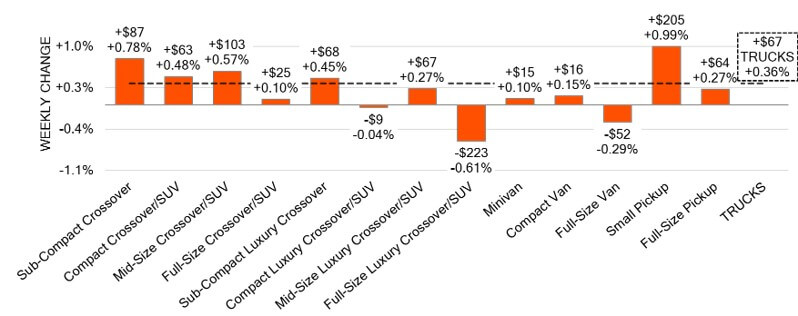

Truck & SUV Segments

- Trucks Hit Hardest: Full-size trucks (e.g., Ford F-150) dropped 18% YoY as rising tariffs disrupted North American production 38.

- Hybrid SUVs Gain: Toyota RAV4 Hybrid sales surged 23% YoY, reflecting demand for fuel efficiency without charging hassles 49.

The average diminished value amount is $6,200. We can help you get what you deserve.

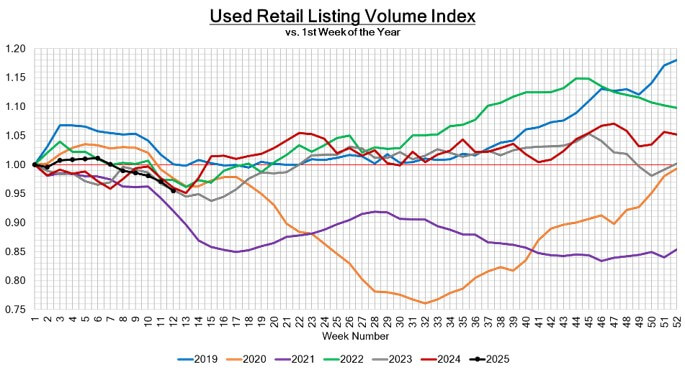

Inventory and Retail Trends

- Inventory Glut: Dealers hold 89 days of supply (+15% MoM) as tariffs slow sales; Cox Automotive predicts 30% output cuts by mid-April 38.

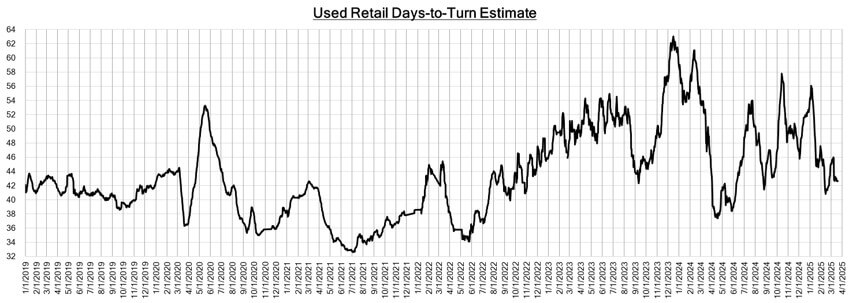

- Slower Turnover: Days-to-turn rose to 68 days (+12% WoW), with luxury EVs lingering longest due to buyer skepticism 49.

GET MORE MONEY FROM THE INSURER

Don’t leave money on the table! Order a FREE Claim Review and discover your car’s true value.

Industry News Highlights

- U.S. Auto Tariffs Shock Global Market

President Trump’s 25% tariff on imports triggered $5.9B losses for European automakers and forced brands like Audi to localize U.S. production. GM and Ford shares fell 7% and 3%, respectively 38. - EV Growth Cools, Hybrids Surge

Global EV sales growth slowed to 7.4% YoY (vs. 48% in 2023), while hybrids jumped 23%. Toyota and Stellantis prioritize hybrids to counter range anxiety 49. - Chinese EV Exports Hit 3M Units

China’s NEV exports captured 12% of Europe’s market, leveraging cost advantages and tax incentives. BYD and SAIC undercut rivals by 25–30%, pressuring legacy automakers 49.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion

The 2025 auto market is defined by volatility: tariffs disrupt supply chains, EVs face affordability headwinds, and hybrids emerge as a pragmatic choice. Georgia drivers should monitor diminished value claims, especially for luxury EVs, as software-driven depreciation reshapes post-accident appraisals. Stay ahead with data-driven insights—volatility is the new normal.