Auto Market Specialty Insights December 2022 (PDF)

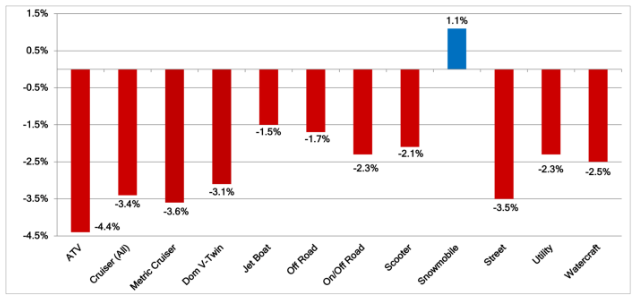

This month, the only segment to see an increase is snowmobiles. As we head into winter, all other segments are decreasing in value—most by 3.0% or more. The ATVs have taken the largest drop with a decline of 4.4%. Cruisers and Street Bikes have fallen by 3.5%. Other secondary segments decreased by an average of 2.0% when averaged together. Strangely enough, jet boats ha a good performer this month, declining only 1.5%. Both the Jet Boats and personal watercraft have been two of our stronger segments, even as we enter the colder months. Dealers have relayed to us that new production for these units is slow before there is enough inventory in stock to bring prices down to levels more in line with the rest of Powersport vehicles.

Street Bike Segment Performance

This year, street bike prices have been less volatile than last year. Since reaching a peak in July, they have been declining steadily. We were still seeing a sizeable monthly swing previous year, but the overall trend was still upward. Despite the fact that prices remain far from historical averages, we now see less volatility and a downward trend. The combination of increased supply and higher interest rates is helping to drive lower prices.

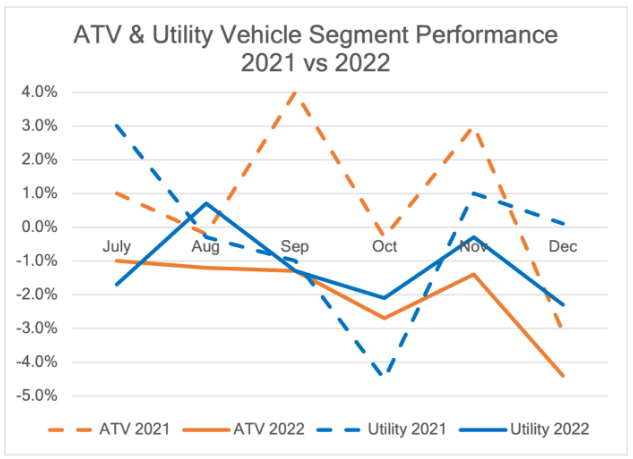

ATV & Utility Vehicle Segment Performance

The ATVs and Utility Vehicles, much like the street bikes to the left, have seen a much more normal 2022 than they saw in 2021. Prices for each segment are generally trending downward since late summer, and they have been for a while. As a result of the return to pre-pandemic trends for these segments, side-by-sides are once again outperforming ATVs. We expect this general pattern of falling prices overlayed with mild seasonality to continue well into 2023.

Motorhomes (including Class A, B, and C)

- There was an increase of $534 (0.7%) in the average selling price from the previous month of $69,157.

- In the past year, the average selling price was $51,574.

- There was a decline of 11.3% in auction volume from the previous month.

- 2010 was the average model year.

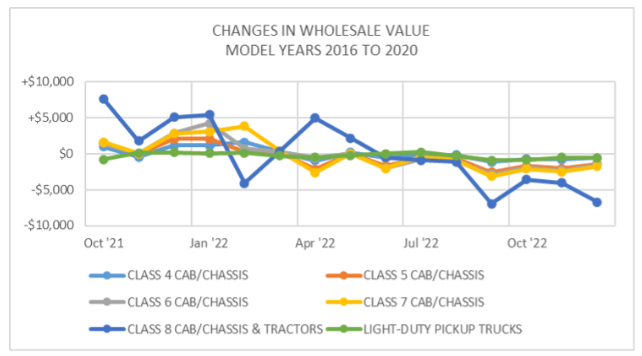

Medium And Heavy Duty Truck

- November saw a -3.0% drop in late model, Medium Duty truck values ($1,807).

- The overall value of medium-duty units increased by 39.6% from September 2020 to April 2022.

- In December, Construction/Vocational units dropped 2.8% ($3,667), Regional Tractions dropped 3.4% ($3,153), and Over Road Tractors dropped 3.4% ($3,498).

- Construction/Vocational units have fallen by -11.6% ($16,246), Regional Tractors by -25.7% ($27,209), and Over-the-Road Tractors by -24.5% ($28,031).

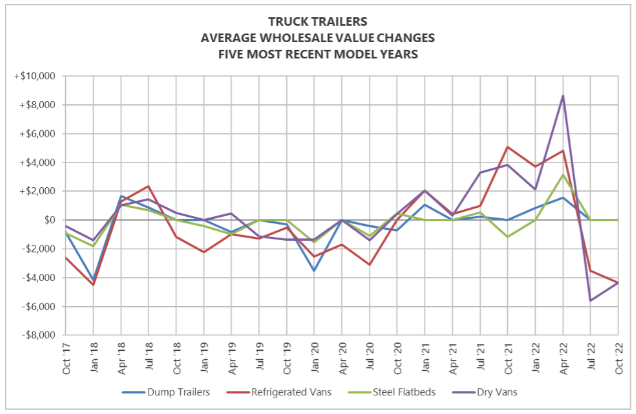

Commercial Trailer Market Update

- In the final quarter of 2022, the value of commercial trailers dropped.

- We expect to see continued depreciation in commercial trailers as more new and used inventory is available.